Global equity funds dominate 2017 fundraising

Among unlisted, closed-ended infrastructure funds reaching final close in 2017, strategies geared towards global equity investments have taken up a vast chunk of the total capital raised.

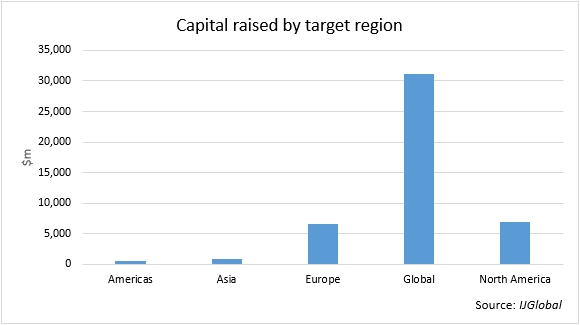

Out of the $45.9 billion raised from 1 January to 13 November, more than $31 billion has been raised by either global funds or funds targeting investments in more than one region, mostly Europe and North America.

One could argue that this trend - like many other fundraising trends this year - has been skewed by the gigantic GIP III, which closed at $15.8 billion in January. However, even taking out the amount raised by this fund, the amount of capital raised since the beginning of the year still stands at around $15.2 billion, almost three times higher than the amount raised for regional funds.

Interestingly, European and North American funds almost raised an equal amount of capital, with the former racking up roughly $6.5 billion and the latter topping that at $6.8 billion.

Among the funds reaching final close in 2017 with a global or multiple-regional target are:

- AMP Capital Infrastructure Debt Fund III

- Blackrock Global Renewable Power II

- Actis Energy 4

- Samsung-IFM Global Infra PEF Investment Trust

- Westbourne Infrastructure Debt Opportunities Fund

- QIC Global Infrastructure Fund

- EQT Infrastructure III

- GIP III

- iCON IV

Equity vs Debt

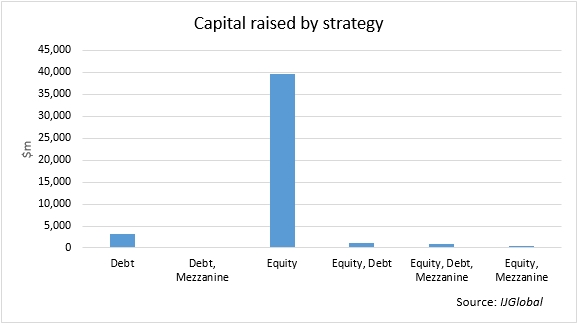

Unsurprisingly, equity strategies have massively surpassed debt funds in 2017 when it comes to fundraising. Pure-equity strategies have raised a total of $39.7 billion out of $45.9 billion, which excludes mixed strategies which collected some $6 billion among them.

Pure-debt funds instead have collectively closed on a total $3.4 billion throughout 2017. They include:

- AMP Capital Infrastructure Debt Fund III

- Samsung-IFM Global Infra PEF Investment Trust

- Schroders Loan Infrastructure Senior Europe

- Westbourne Infrastructure Debt Opportunities Fund

A great start, a less great ending

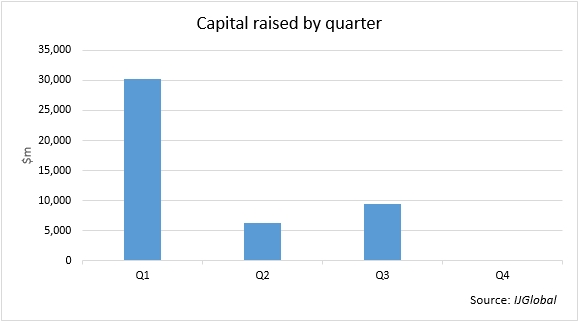

While infrastructure and energy fundraising had a strong start to the year, it cannot be said that the pace held up through the other quarters. And while, again, it can be noted that GIP III did half of the job in Q1, levels of capital raised at final close in other quarters were still considerably lower.

Even taking out the GIP III contribution, Q1 still saw a total $14.3 billion coming into funds. A huge bend followed in Q2, when funds reaching final close collected a total $6.2 billion. Q3 fundraising then rose a little to $9.5 billion.

To date, it looks like Q4 is going to be the weakest for funds reaching final close with only one fund - WRB Serra Partners Fund I - announcing final close at $46.5 million.

With just a month and a half left to the end of 2017, a number of funds are expected to reach final close, which will boost the Q4 total to a more respectable level. But how much extra capital will be brought into the market this year remains to be seen.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.