BlackRock Global Renewable Power II fund: The largest of its kind

BlackRock Real Assets recently raised the largest global renewables fund in the world by reaching final close on its Global Renewable Power II (GRP II) at $1.65 billion, confirming that the asset class has reached maturity among institutional investors.

Fundraising overview

Final documentation was signed off on 30 June, after roughly two years of fundraising. BlackRock was originally targeting $1 billion, but commitments from a total of 67 investors took it comfortably above target, confirming increasing interest among institutional investors in the asset class.

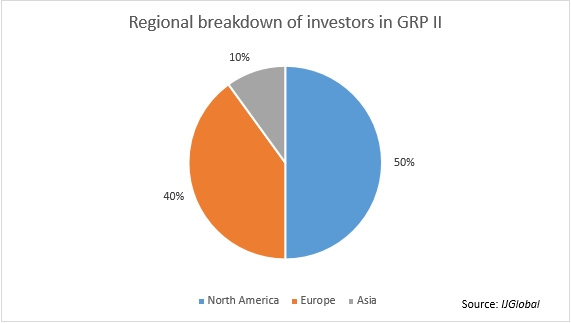

More specifically, commitments came from 16 countries across three continents. Roughly half of the investors are from North America, 40% from Europe and 10% from Asia.

Fundraising was launched in mid-2015 and a first close was achieved in November 2015, when the fund was registered as a limited partnership in the UK. It is an unlisted, closed-ended fund making equity investments in wind and solar projects globally.

Documents filed by BlackRock on UK's company database Companies House record 22 investors from Europe ranging from pension funds to insurance companies, funds of funds, asset managers and wealth managers including:

- Asga Infra Master

- Bord Na Mona General Employees Superannuation Scheme

- Gebaudeversicherung Bern

- Kingfisher Pension

- Allgemeine Rentenanstalt Pensionkasse

- Caisse de Pension de la Societe Suisse de Pharmacie

- Golding Infrastructure 2016 SICAV

- Velux Fonden

- Velux Stiftung

- Villum Fonden

- Wide Invest

- Wurttembergische Versicherung

- Wustenrot & Wurttembergische

- FP Arca Previdenza

- Luxinvest

- London Borough of Haringey Pension Fund

- AXA

- Deutsche Arzteversicherung

- Matignon Alternatif

- Global Infrastructure Solutions 3

- Multibrand SICAV-SIF - Valida Infrastructure Fund

The fund has also attracted a number of commitments from across the Atlantic, from investors such as the New Mexico State Investment Council which is said to have recently approved a $50 million ticket.

GRP II has already invested almost 20% of client commitments in five undisclosed wind and solar projects across the US, Norway and Japan. "The strategy of the fund is to build a diversified, global portfolio of wind and solar projects," BlackRock said. While wind and solar remain the focus of BlackRock's renewables strategy, the company is increasingly looking at energy storage.

Full product range

When it comes to renewables, BlackRock has positioned itself as a first-mover. Since 2012, it has invested in more than 100 wind and solar projects globally, and manages more than $4.2 billion of equity assets in the renewable power sector.

GRP II is the fourth vehicle on the BlackRock renewables platform, which now manages over $4.8 billion of equity assets in the renewable power sector. GRP II is the follow-on fund to the $611 million BlackRock Global Renewable Power Fund (GRP I).

In summer 2016, it raised €650 million for its Renewable Income Europe fund (RI-Europe) and it has just concluded the third re-opening of the Renewable Income UK fund (RI-UK).

"While GRP I & GRP II aim to deliver attractive risk-adjusted returns through both cash yield and capital appreciation at exit, RI-UK & RI-Europe seeks to deliver long-term income by taking a buy-and-hold approach," BlackRock explains.

Overall, BlackRock Real Assets manages capital across private real estate debt & equity, real estate securities and infrastructure debt & equity via funds, co-investments and managed accounts, and has $30 billion in invested and committed real estate and infrastructure assets and capital.

Renewables opportunities

David Giordano, head of renewable power North America, APAC and Latin America at BlackRock and portfolio manager of the fund, said that the company has "maintained the discipline of investing exclusively in renewable power, one of the most active sectors for deal flow in the growing infrastructure asset class".

According to BlackRock’s 2017 Global Rebalancing Survey, which polled 240 of its largest institutional clients, 61% of respondents intend to increase exposure to real assets.

"As institutional investors seek to generate sufficient return in the low-return environment, many are turning to infrastructure and renewable energy assets to meet long-dated liabilities. Renewable power is gathering momentum globally. Advancements in technology and substantial cost improvements have helped to make renewable energy sources – particularly wind and solar – more competitive with fossil fuels and one of the most active sectors within infrastructure," the company said in a statement.

With funds increasingly focused on renewables – and energy more broadly – there was a good run throughout 2016. However, as funds are becoming increasingly liquid with plenty of dry powder, the sector is destined to become over-crowded which is expected to re-focus managers and investors towards more traditional ones like transport… or force them up the risk curve with 'infra plus' assets, venturing into new markets like digital infrastructure.

"Over the last five years, renewable power has represented over 25% of total infrastructure deal value globally. According to the International Energy Agency, 2.5 wind turbines and 30,000 solar panels will be installed every hour around the world. We believe that the active renewable power market mitigates current asset class challenges for infrastructure investors such as slow deployment of capital and elevated valuations in core infrastructure assets," BlackRock Real Assets told IJGlobal.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.