Fund analysis: AMP Capital IDF III

AMP Capital signed off on the final close for its third infrastructure debt fund at the $2.5 billion hard cap on 10 August, having started fundraising in Q1 2016.

AMP Capital IDF III launched with a target of $2 billion and was able to also attract a total $1.6 billion in two sets of co-investment options. The fund is a 10-year vehicle domiciled in Luxembourg and targets a gross IRR of 10% per year, with a focus on cash yield.

The investment mandate focuses exclusively on mezzanine debt deals in regulated utilities, transport and renewables in OECD countries. Brownfield assets are the primary target, but the manager can invest in the greenfield space as well, especially for renewables deals.

Capital has been so far deployed into fairly large deals in the range of $200 million in value. Andrew Jones is the global head of infrastructure debt for AMP Capital.

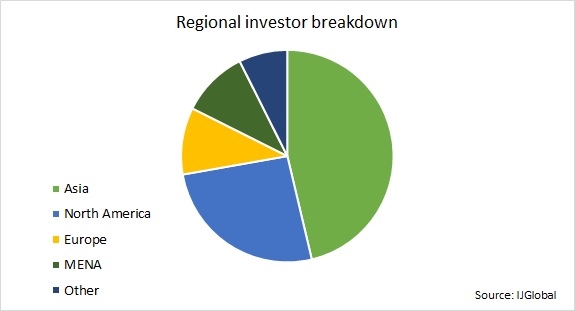

Investor breakdown

IDF III proved particularly popular among Asian investors, which made up 50% of the fund’s total capital. This is attributable to both the manager’s strong historical relationship with investors in the region, but also to their conservative attitude which makes them inclined to deploy large sums of capital into global debt strategies.

At the time of final close, AMP Capital said that more than 125 investors from 12 countries invested in the fund, with strong interest from institutional investors in Japan, Korea, Canada and Germany.

“We had success in new markets such as Korea, where we raised more than $300 million, and Canada where some of the country’s large pension plans invested in our strategy for the first time. Japanese investors, early adopters of infrastructure debt as an investment strategy, were also strong supporters of the fund," the firm said at the time.

North American investors are the second largest participants in the fund, having contributed to 28% of the capital. European and MENA investors were the smallest group to invest in IDF III with an 11% share in the fund’s capital.

Among known investors, there are four local government pension schemes from the UK which in total invested $100 million, including:

- Northamptonshire County Council Pension Fund

- East Riding Pension Fund

- Cambridgeshire Pension Fund

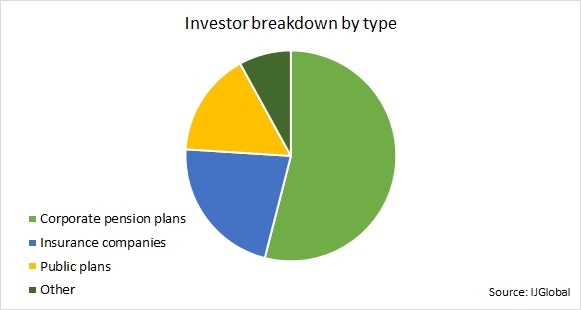

Corporate pension plans were the primary investor type in the fund, representing 54%. They are followed by insurance companies – 22%; public plans – 16%; and unspecified others – 8%.

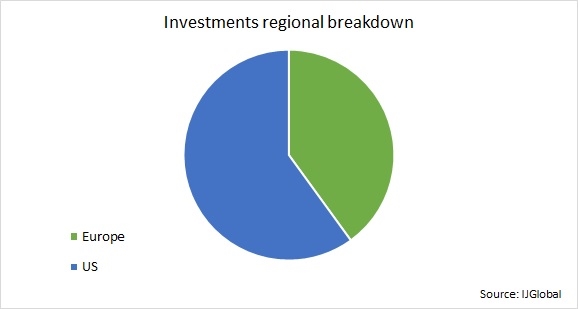

Investment breakdown

While it has an OECD mandate, the fund’s capital has so far been equally distributed across the US and Europe. Targeting mezzanine debt for equity-like returns of 10% a year, IDF III’s strategy is likely to produce loans to companies as well as to specific assets and projects.

The manager has so far closed five investments – two in Europe and three in the US – for all of which it signed checks in the region of $200 million each.

The latest investment to be announced was Vertical Bridge, a US-based telecoms tower owner.

AMP Capital's infrastructure debt principal Patrick Trears said: "We see the North American telecommunications infrastructure space as particularly attractive right now, and expect it will be a driver of future growth for our platform. #&91...#&93 The facility for Vertical Bridge is designed primarily to support its future M&A activity."

Other investments include a UK port-operator company; a desalination plant in San Diego; a US-based energy company and a Swedish district heating operator. More specifically, the assets in the fund include:

- Peel Ports - Europe

- Carlsbad desalination plant in San Diego - US

- Invenergy - US

- Värmevärden – Europe

- Vertical Bridge - US

Debt and co-investment options

An interesting feature of this fundraising is the high amount of capital committed to two different sets of co-investment options. AMP Capital raised $1.6 billion for this purpose, equally distributed across the two sets.

The first one works as a traditional co-investment option, where investors go into deals alongside with the fund; while the second $800 million tranche serves investors who wish to have access to the fund’s origination and deal capabilities.

Emma Haight-Cheng, a principal in the infrastructure debt team, explains that co-investment rights provide a cost-effective way for large investors to increase their exposure to the types of assets that their target funds are providing.

“Most funds do not charge for co-investment rights or charge only a minimal amount. While funds have an exposure limit per investment, even if a fund takes its maximum possible exposure to an asset, the one asset exposure limit is unlikely to be reached from the point of view of larger investors in that fund. Co-investment rights mean that they can still take a view as to whether to increase their exposure to larger assets over and above the relevant fund's exposure,” she says.

But co-investments work both ways, Haight-Cheng says. “It is also efficient for funds to have co-investors so that they can provide larger tickets to various investments than they would otherwise be able. This is particularly important for equity funds, where co-investors can help funds avoid going to competitors to secure controlling stakes in assets.”

Co-investments have been on the rise in the fundraising environment recently. And debt funds as well as equity funds are starting to take a bite of it.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.