Data Analysis: Strong fundraising pace in 2017

The final close of Global Infrastructure Partners III (GIP III) at $15.8 billion has pushed total funds raised globally in the first month of 2017 to some $23 billion.

While the US-based fund manager contributed to more than two thirds of the total funds raised in one month by unlisted, closed-ended infrastructure and energy funds, nine other funds announced fundraising results in January 2017.

Two other North American fund managers have seen inflows at the beginning of the year. Toronto-based Northleaf Capital Partners hit the hard cap at C$950 million ($715.2 million) on its Northleaf Infrastructure Capital Partners II (NICP II); while according to a Securities and Exchange Commission (SEC) document, Starwood Energy Infrastructure Fund III (SEIF III) raised $854 million at the beginning of January 2017 and is headed for a final close in Q1, targeting $1.5 billion in total commitments, sources told IJGlobal.

Both GIP III and NICP II have a multiple-sector target which includes transportation, energy, water and waste in the first case and regulated utilities, toll roads, contracted power and PPPs in the second. SEIF III targets energy assets, specifically gas-fired, power, renewables and battery storage sectors in North America.

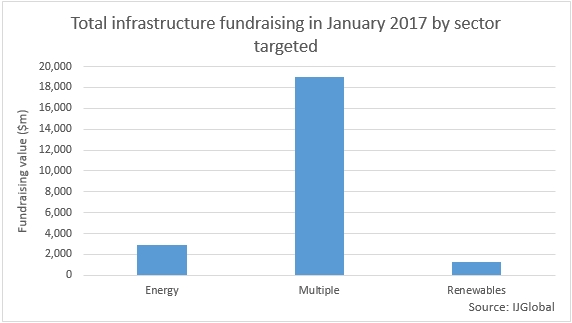

While the majority of the funds raised in the period are intended for multiple sectors - some $19 billion-, sector-specific funds were geared either towards energy - around $3 billion - or renewables-only assets - $1.3 billion.

As well as SEIF III, Actis Energy 4 has managed to attract a significant $2 billion to invest in power generation and distribution assets in emerging markets in Africa, Asia and Latin America including Nigeria, Brazil and other countries. The fund already reached its target size but it is continuing fundraising in order to meet its undisclosed hard cap.

A couple of funds also successfully raised capital for investments aimed specifically at renewables assets. South African manager Inspired Evolution Investment Management announced that it reached first close at $90 million on its second renewable energy fund Evolution II towards the end of the month. The vehicle aims to deploy capital into clean energy power plants, both in the solar and wind space, in sub-Saharan countries. The manager continues fundraising as it targets total commitments of $250 million at final close, which is expected to be achieved by the end of the year.

In the UK, the Green Investment Bank Offshore Wind Fund has passed its initial £1 billion ($1.2 billion) target by gathering commitments of £1.12 billion from investors. The fund, which received commitments from a number of UK's Local Government Pension Schemes (LGPSs), invests in operational offshore wind farms in the UK.

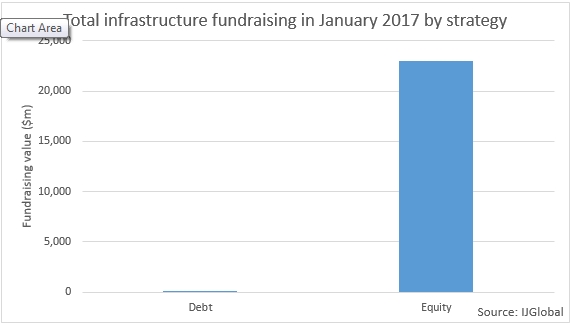

In a trend previously highlighted by IJGlobal, the vast majority was raised to be invested in equity deals - $22.9 billion - while only $157 million was raised by a debt fund manager.

Benjamin de Rothschild Infrastructure Debt Generation II (BRIDGE II) was the only debt fund to announce a close in the period, according to IJGlobal reports and data. The $157 million first close was reached in December 2016 with commitments coming in from five institutional investors from Italy, Germany and France, the manager said. The Luxembourg-regulated fund is expected to hold an interim close by the end of January 2017 and a final close by Q2 2017 at a similar amount as its predecessor, which closed at €595 million in 2015.

The fund targets senior secured debt deals in Europe across transport, energy, social infrastructure and social infrastructure assets.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.