GCC refinancings drop by a third

Refinancing deal value closing throughout the GCC dipped by 34% in 2016, according to IJGlobal data. The downward trend is expected to continue with fewer refinancings set to close in 2017, sources say.

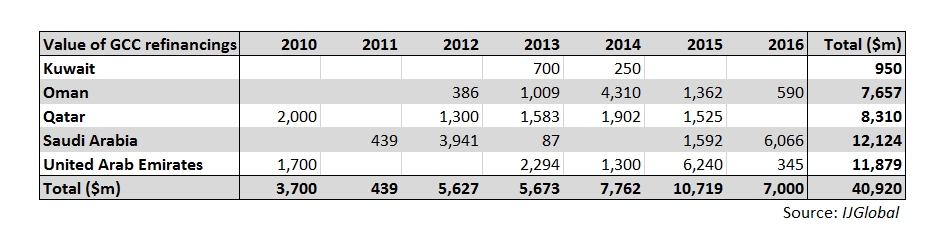

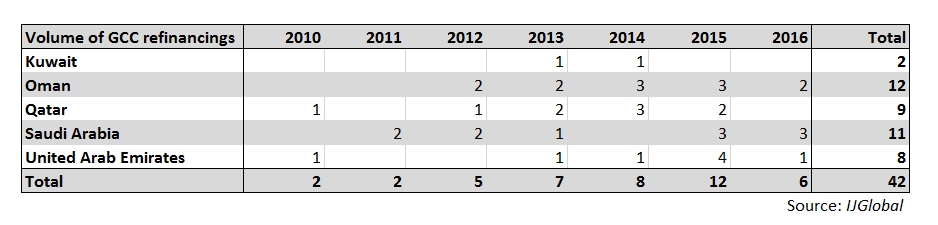

There were $7 billion of refinancings reaching financial close across the GCC in 2016 (apart from Bahrain, where none closed). This represented a substantial drop from the $10.7 billion closed in 2015 – itself the highest total value for a number of years.

Saudi Arabia made up half of all refinancing deals to close in the region last year, and accounted for $6 billion of the total value reaching financial close.

Refinancings in the GCC across 2015 were spurred on by sponsors rushing to take advantage of lower debt costs – and the potential for debt prices increasing in the coming years as lenders become more risk averse.

Despite this, debt prices are still facing downward pressures, sources said. Short term tenors have dropped around 25-30bp since the start of 2017, with long term debt priced between 25bp and 50bp lower, one banker based in Saudi told IJGlobal.

“Banks want prices to go up but it’s being pressured downward by the amount of liquidity in the market,” another based in the Emirates commented. “Prices are being pushed down by deal scarcity both in corporate and project financing.”

Despite lower debt prices available, both the total value and volume of refinancings decreased across the region in 2016.

“Projects that need to be refinanced have been done already”, the Saudi banker said.

And the GCC refinancing market may be even slower for 2017 – nearing the end of the first quarter, no refinancing deals have reached financial close yet and there are few obvious candidates for refinancing expected to be coming to market.

However at least one deal is anticipated to be coming down the pipe – although it’s unclear if it will arrive this year or in 2018. Saudi Arabian Mining Company (Ma’aden) is expected to refinance its bauxite mine and alumina refinery once it is fully operational.

Ma’aden previously completed a $3.1 billion refinancing of its phosphate mine operations in Saudi Arabia in the fourth quarter of 2016, representing the largest to close that year.

Other Saudi refinancing deals to close in 2016 included Acwa Power’s $1.8 billion refinancing of the Rabigh 1 independent power producer and Engie’s close on the $1.14 billion Riyadh PP11 gas-fired project – the second and third largest value deals to close, respectively.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.