Data Analysis: GCC refinancings surge

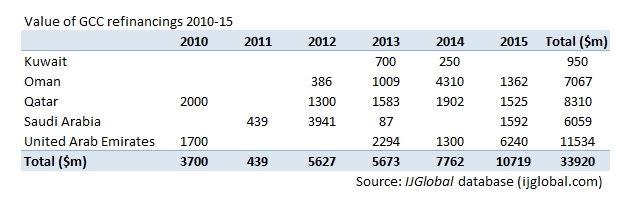

Refinancing of energy and infrastructure projects in the GCC countries totalled $10.7 billion in 2015, the highest yet since 2010, driven in particular by deals in the United Arab Emirates which accounted for over $6.2 billion of the total, according to IJGlobal data.

Two factors have helped spur the total value of refinancings in five of the six GCC countries (none closed in Bahrain) to the present levels - the availability of cheap debt and projects financed at a higher cost just after the financial crisis now seeking to reduce their debt burden.

Although projects have been able to achieve lower pricing in recent years, the cost of lending is steadily rising. Market conditions are contracting and lenders are more risk averse, according to a senior Emirati banker.

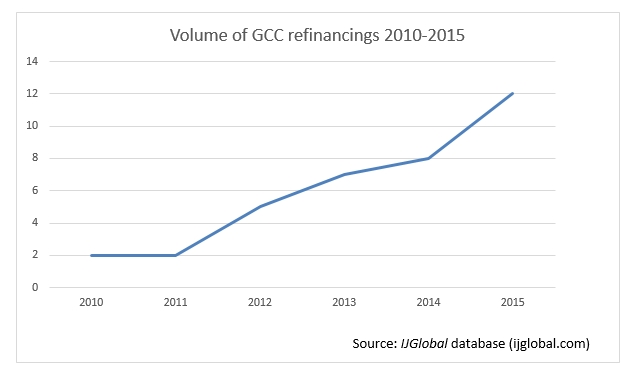

Sponsors are looking to capitalise on that cheap debt whilst it is still available. The market may also see more refinancings in 2016 as sponsors look to reduce debt costs before liquidity in the region dries up as a result of the slumping oil price. Each successive year since 2010 has seen a greater volume of deals with a total of 64 refinancings closed over the five-year period.

Projects such as PP11 and the Rabigh 1 independent power producer were both financed in 2010 in the aftermath of the financial crisis, when pricing was higher. With both projects having been operational for some time and debt available at a lower price, their sponsors are now taking the opportunity to reduce costs.

PP11’s refinancing, for example, is set to close imminently, sources told IJGlobal recently. The deal will see PP11 achieve pricing around 100bp lower than the original debt package.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.