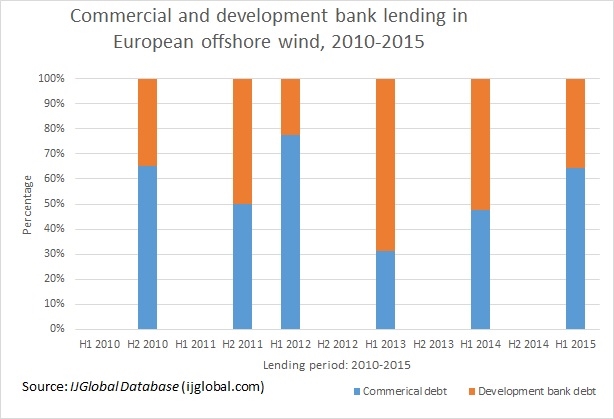

Data Analysis: Commercial banks' increasing role in European offshore wind debt

Commercial banks have recently improved their standing against development finance institutions (DFIs) in construction-stage debt for European offshore wind projects. Commercial bank debt accounted for 64% of European offshore wind lending in the first half of 2015, up from 48% in H1 2014 and 32% in H1 2013, according to IJGlobal data.

Commercial lenders' appetite for construction-stage offshore wind is increasing. UniCredit told IJGlobal last month that it estimates around 15-20 banks are active or at least engaged with offshore sponsors.

DFIs have traditionally helped commercialise fledgling sectors, or technologies, before commercial banks step in. But these lenders have retained a strong, and varied, position in the European offshore wind market despite the sector's increasing maturity.

Offshore wind sponsors haven't wholly migrated towards commercial banks for construction-stage debt. Northland Power, for example, chose a blend of the two on its €1.2 billion Nordsee One and €2.8 billion Gemini projects off the coasts of Germany and the Netherlands, respectively.

Some sponsors still favour pure development bank debt over private funding. The most recent European offshore wind deal to sign will use DFI debt exclusively. The €410 million ($462 million), 111MW Nordergründe offshore wind project off the Lower Saxony coast, Germany, signed in early June. The €312 million debt portion of the deal is split equally between the European Investment Bank (which structured the deal) and German state bank KfW.

The UK's Green Investment Bank, in particular, remains a big player in domestic offshore wind. It has contributed £1.1 billion of debt to the sector since its debut in H2 2012, and will continue to deploy state-issued capital into the sector. But the bank is headed towards privatisation, as IJGlobal reported this week.

The reasons for DFIs' enduring clout are numerous. Technology risk remains; as offshore projects scale up and move into deeper water, first-of-their-kind turbine technologies are often involved. Newer technologies also add to construction risk, which may discourage some commercial lenders from participating.

As the most recent closed deals suggest, liquidity in the commercial and development bank markets is available for offshore wind sponsors. The question that remains is how the interplay between these two debt sources will evolve in the next wave of offshore wind deals.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.