Q1 2015 League Table Analysis: European renewables vs conventional power

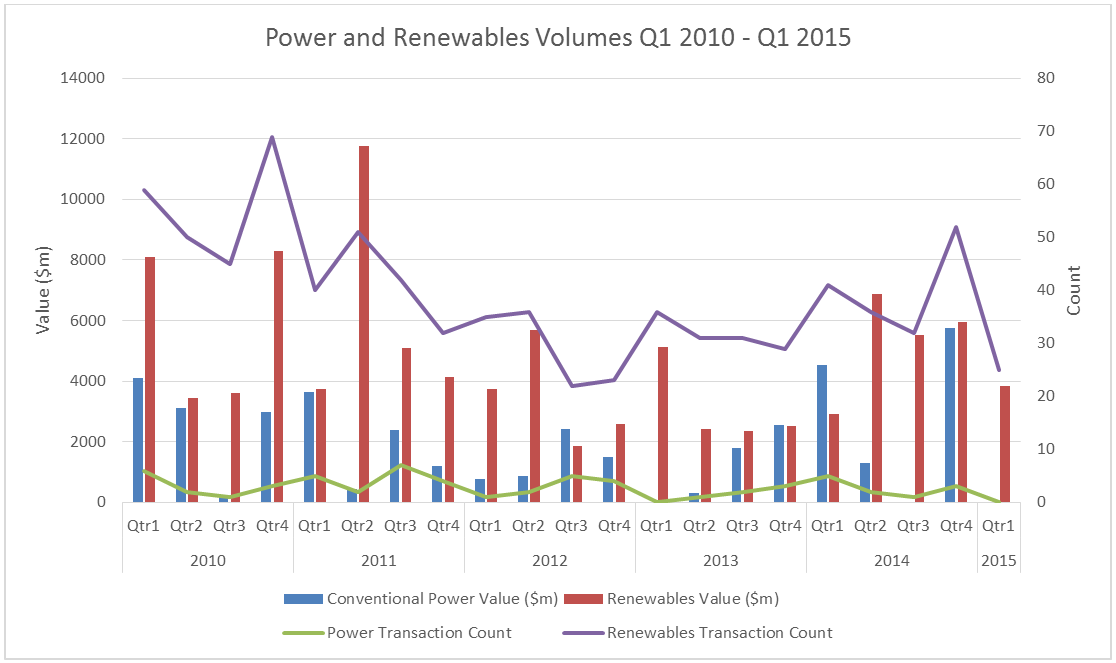

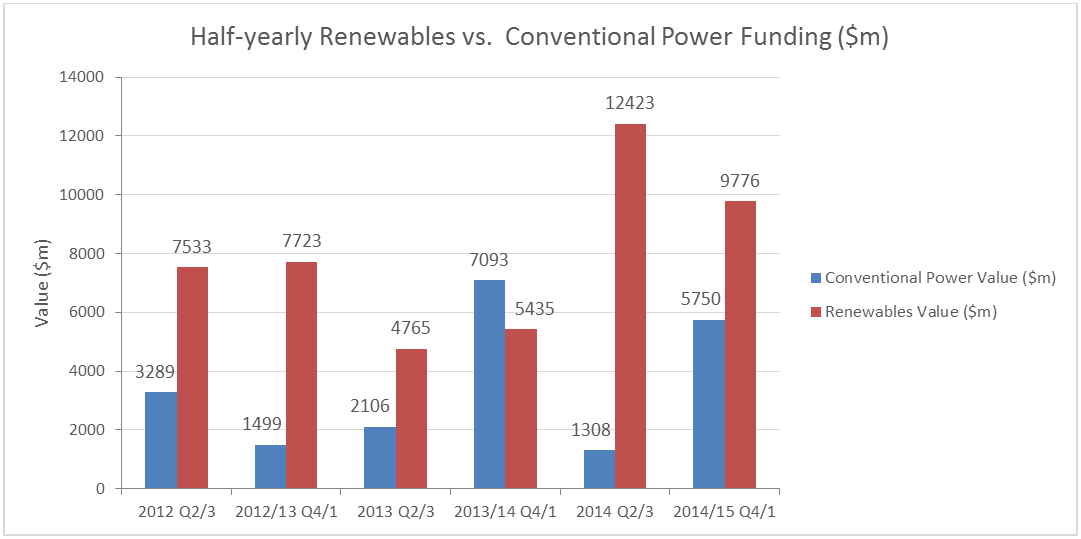

IJGlobal’s Q1 league tables for 2015 show investment into European power projects could be returning to 2010/2011 levels, though activity is increasingly concentrated in the renewables sector. Total investment in renewables and conventional power in Europe reached $32.1 billion in 2014, closing in on 2010’s height of $33.1 billion whilst narrowly exceeding 2011 levels of $32.4 billion. Renewables investment in Q1 2015 continued this trend.

The largest European power deal to reach financial close in the quarter was the $1.38 billion 332MW Nordsee One offshore wind project in Germany. It was Europe’s only greenfield offshore deal in the quarter however the roughly $660 million acquisition of the 576MW Gwynt y Mor’s OFTO transmission assets in the UK was Europe’s second largest Q1 transaction. This recent trend for offshore investment is set to continue this year, with Germany’s €1.8 billion Veja Mate projected to close in June.

The UK biomass sector was also very active, producing four deals with a combined investment of $877 million. The largest transaction was Macquarie European Infrastructure Fund’s $307 million refinancing of its biomass portfolio. This rush of deals was due to developers trying to complete commissioning before the March 2017 deadline for the UK’s renewable obligation certificate (ROC) scheme.

Total investment in European solar fell in the quarter to $306 million from $1.28 billion in Q4. This decline reflected Western European governments peeling back support schemes. Germany, France and the UK, all previously seen as leaders in solar, have reduced government support, and private capital is failing to fill the gap. The UK in particular is unlikely to see much solar investment in 2015, with the new CfD regime forcing solar to compete against other technologies. Two projects previously granted £50/MWh strike prices in the country recently failed to sign contracts.

While there was an absence of conventional power deals in Q1, looking at that data in isolation may give a skewed impression. Looking at the data in half years – with the most recent quarter included with Q4 2014 – recent investment values for both sectors have been above average for the past few years.

Access the full Q1 2015 league tables and analysis here.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.