Aberdeen takes over SWIP

Aberdeen Asset Management is one of Europe’s biggest investment managers. Yet, its alternatives portfolio represents a small percentage of its business, and until very recently none of that was infrastructure.

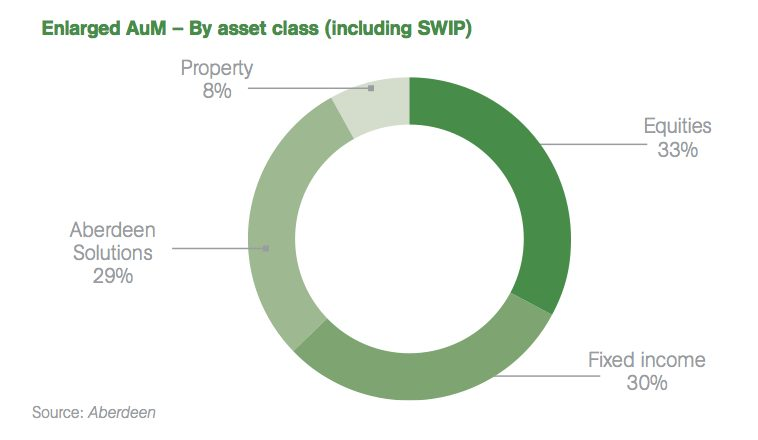

In April 2014, Aberdeen closed a £550 million ($915 million) deal to acquire Scottish Widows Infrastructure Partners (SWIP) from Lloyds Banking Group and subsequently renamed the business Aberdeen Infrastructure Funds (AIF).

The SWIP deal marks Aberdeen’s first foray into the infrastructure space. The incresing reliance on institutional investors to help fund infrastructure, coupled with the competititon in the general equity and fixed income sectors, encouraged Aberdeen to move into the space explains Andrew McCaffery, Aberdeen’s global head of alternatives in London.

“We recognised that the general equity and fixed income investment classes have become very competitive and as investor appetite changes Aberdeen is also looking to expand its focus,” says McCaffery.

The Scottish Widows platform, McCaffery maintains, offered Aberdeen direct access to infrastructure across a range of geographies and sectors.

Global PPP platform

Aberdeen Infrastructure Funds is a £1.3 billion fund management business specialising in equity investment in greenfield social and transportation PPP projects in the US, UK, Australia and Europe.

The acquisition involved 24 staff moving to Aberdeen. “AIF will sit alongside similar teams within Aberdeen and will complement the alternatives business,” McCaffery says. The infrastructure business will be run independently, with Gershon Cohen, a SWIP principal and former head of project finance at Lloyds, as its head. Cohen will be global head of infrastructure funds and will be responsible for growing the fund business, hoping to draw on Aberdeen’s relationships with is institutional client base when raising fund commitments.

Aberdeen’s acquisition of Scottish Widows is just the company’s first step in building out an infrastructure investment business, Cohen explains. “We are looking to grow both the number of assets in the portfolio and the size of the team.”

Today, AIF manages four main funds, differentiated by vintage, currency and geography. As of 30 March 2014, the AIF portfolio comprised around 90 infrastructure projects with a weighted average concession life of over 20 years.

The first fund launched in 2008 under Lloyds’ ownership, and today has £650 million invested in operational PPP assets. In 2012 Lloyds established another fund – a £220 million vehicle focused on UK investments. Today this fund is mostly invested. A euro-denominated European fund was also launched in 2012, with €222 million in commitments.

In 2013 Scottish Widows (SWIP) launched a first global fund, an Australian dollar-denominated vehicle with total commitments of A$150 million. That fund is now fully invested.

AIF plans to bring out another global fund by year-end 2014, and is also considering a second European fund. The new global fund will also be Australian dollar-denominated, will invest in Australia and the US, and has a minimum target size of A$150 million.

The opportunities for greenfield PPP investment in Australia is encouraging the formation funds denominated in Australian dollars, Cohen explains. AIF has four investments in Australia. Aberdeen Asset Management already has an office in Sydney, positioning AIF to pursue opportunities in Australia.

SWIP’s business has a narrow focus on greenfield social and transport infrastructure projects. Aberdeen faces criticism that with a purely greenfield focus, it could alienate investors wary of construction risk or seeking immediate yield.

McCaffery disagrees. “On the contrary, an additional consideration and attraction of SWIP was that the platform is a pure-play focusing on greenfield social infrastructure projects rather than wider economic infrastructure e.g. airports, ports, and utilities, where there is much higher demand/volume risk, regulatory risk and/or counterparty risk,” he says.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.