Tomatin Distillery biomass project, Scotland

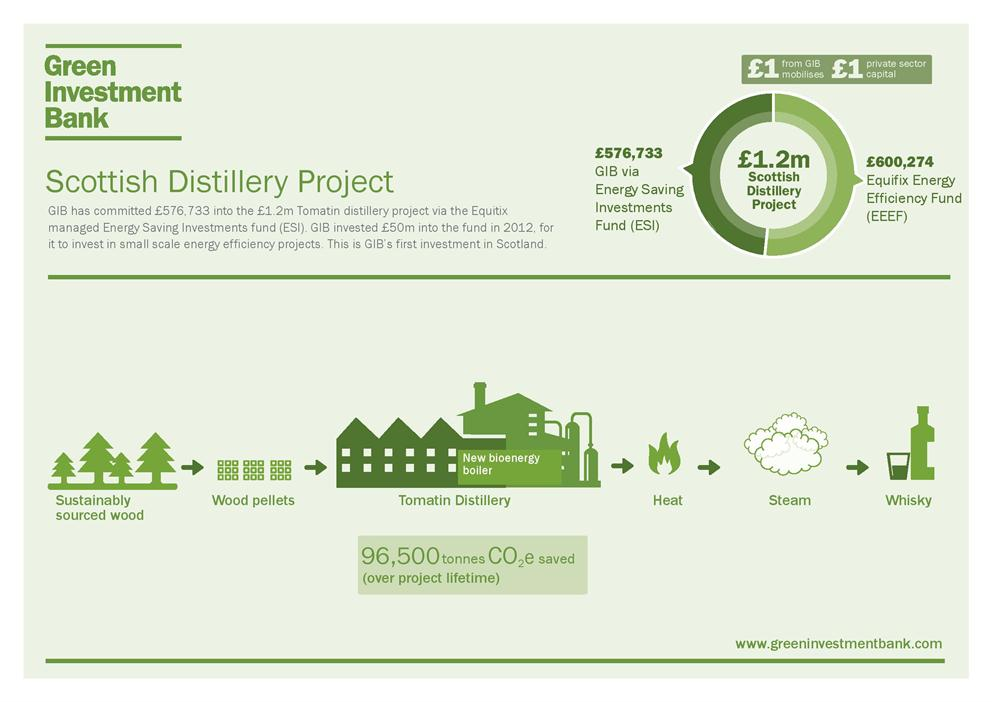

The UK’s Green Investment Bank (GIB) made its first foray north of the border this month, making a £576,773 (US$886,079) investment in the installation of a £1.2 million (US$1.82m) biomass boiler at a whisky distillery.

The project

The boiler at Tomatin Distillery, which is 16 miles south of Inverness and has been the site of whisky distilling since the 15th century, will produce steam utilised in the production of whisky. It replaces a “high-maintenance, inefficient” oil-fired device.

While such a project may sound like a twee, cottage-industry prospect, this is not the first time that a whisky distillery has been proved to be a success at more than producing spirits.

Back in April 2011, developer Helius Energy closed the £60.5 million Helius CoRDe biomass project, which uses biomass co-products from the malt whisky manufacturing process and converts them into electricity and animal feeds protein supplement (Pot Ale Syrup) in a combined heat and power plant at Rothes, Morayshire, Scotland.

Financing the project

In both projects, the financing was as innovative as the project. The Helius CoRDe transaction resulted in the project developer scooping the Renewable Energy Transaction of the Year at the Renewable Energy Infrastructure Awards. This was for its speedy progression through the development chain and its effective project financing, which saw Lloyds and RBS provided a total of £42.4 million in debt.

With regards to the Tomatin distillery project, the GIB is a “for-profit” independent bank which has £3.8 billion in government funding until March 2016.

It awarded Equitix a mandate to invest £50 million into energy efficiency projects through its ESI fund on the condition this was matched by private investors, in the aim of encouraging investment into small-scale low carbon infrastructure. ESI is to plough £4.9 million into 60 small-scale biomass projects.

The Equitix-managed Energy Saving Investments (ESI) fund, in which GIB is a cornerstone investor, is providing £576,733 in financing. Another £600,274 is coming through the fund manager’s Equitix Energy Efficiency Fund (EEEF).

Building up biomass

Biomass in the UK has seen a surge since the start of 2013. Whether it is momentum inevitably building as more projects get successfully financed and built, or EU requirements to switch from heavy carbon-emitting coal production to other forms of production, remain unclear. (What is unclear, also, is just how low carbon biomass is). The GIB ploughed £50 million into this year’s biggest biomass project, the Drax coal-to-biomass conversion in England. The UK Treasury and a raft of institutional and commercial investors have also taken tickets, suggesting that biomass is increasingly being seen as a viable investment choice by a wide range of debt providers.

And the distillery trend looks set to continue. Shaun Kingsbury, the UK Green Investment Bank's chief executive, said it would be just the first of more green power retro-fitting in Scotland’s whisky production industry.

He said: “As well as significant emission reductions, the [Tomatin] project will provide a boost to the local economy. We have a strong pipeline of investments in Scotland and hope to be able to announce further investments in Scottish distilleries, as well as other projects, very soon.”

And as IJ News exclusively reported last month, Helius Energy is talking to a club of banks as it seeks to finance its 100MW, £300 million (US$454.1m) biomass plant in the Port of Southampton. RBS, Investec and NIBC are understood to be the banks currently engaged in talks with the project sponsor. The UK biomass industry is still in its infancy, but this is one renewables sector that looks set to grow from a wee dram to something very big indeed.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.