News+: Mexico still in the dark

Following President Enrique Peña Nieto’s grand unveiling of Mexico’s hotly anticipated infrastructure plan on 15 July, the country remains in the dark about what exactly this will mean for infrastructure over the next six years.

While Fernando Estandia, head of infrastructure at the British Embassy, told IJ News that the plan has been warmly received by the Mexican public and that the general concensus regarding the plan is positive, what has been so dramatically revealed looks incomplete.

As previously reported by IJ News, the plan, which will seek ratification by the lower house in September, projects investment of at least Ps4 trillion (US$314bn) into infrastructure projects spanning the transport, telecommunications, health, education, sanitation and energy sectors.

So far the President has only disclosed investment projections for the transport and telecoms sectors.

It was announced that Ps1.3 trillion will be invested in transport and communication infrastructure to improve transportation links countrywide and lower service costs: Transport Ps582 billion; Telecommunications Ps700 billion

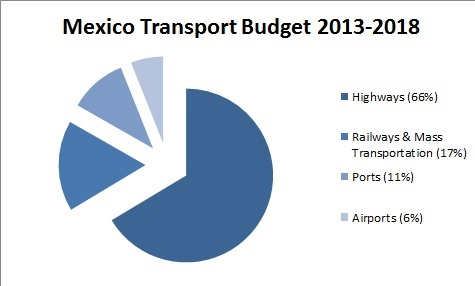

Two-thirds of the transport budget will be spent on highways, around 17 per cent on railways, 11 per cent on ports and six per cent on airports:

Figure 1: Mexico Transport Budget 2013-2018

Source: Secretariat for Communication and Telecoms (SCT)

However, there is a conspicious lack in detail of financing methods and timelines for any of the projects listed in the index of the two documents published by the Secretariat for Communication and Telecoms (SCT). In particular, the definitive extent of private sector investment in the plan.

The plan has been praised for its attention to passenger rail, it is the first time in decades the government will invest in passenger-focused railways and such projects are set to revolutionalise travel throughout the country.

One such project is the México-Querétaro high speed railway, for which tender procedures should begin in August as previously reported by IJ News. But further information on the timeline for the project remains vague, with construction to begin "some time next year".

The attention to ports is also considered a key aspect of the plan, in helping to boost the economy by nearly doubling cargo handled at Mexican ports. In a press release issued on 25 July, Guillermo Ruiz de Teresa, confirmed investment into four ports: Manzanillo, Lázaro Cárdenas, Altamira and Veracruz . According to Ruiz, the projects will require around Ps62 billion, Ps45 billion of which would be sourced from the private sector, but no further details were offered on the finance model.

Concerns have prompted a comparison between Calderón's version six years ago, which served as a detailed guide to Mexico's project pipeline, outlining each project with its individual financing models and timescales.

Nevertheless, the ambiguity of the plan does not seem to have put off potential investors. Odebrecht has become the first international company to submit an EOI for one of the first Mexican highways to come to market, the Tuxpan-Tampico, which will require Ps7billion (US$559m) worth of investment as previously reported by IJ News.

A source close to infrastructure projecs in Mexico told IJ News, "looking at it, two-thirds of (the plan) is fluff" he continued "it doesn't say much more than what we already knew".

It seems the expectations that Mexico will be the next big thing are yet to come to fruition. Mexico has waited patiently for the announcement of the plan to kick start the boom in national infrastructure projects, but the reality is lacklustre.

Energy sector investors are also eagerly anticipating the energy reforms to be announced by the government later this year, which could see new opportunities in oil and gas exploration and production and pave the way for new concession opportunities in the power sector.

Indeed, Ed Pallesen, head of the Infrastructure Investment Group for the Americas at Goldman Sachs said in a recent interview with IJ News " later this year the (Mexican) government is committed to bringing to congress a significant overhaul of the energy market. So that may create some additional opportunities”, he added “or it may not”.

Some industry participants are skeptical as to the extent such initiatives will reform the sector. Reforms were introduced in 2008, that a source close to the Mexican power sector describes as "lacking impact".

Germaine Manchon, country head of GDF Suez in Mexico, told IJ News he thinks that Pemex could realign its priorities in years to come through more alliances with the private sector, but that this would not necessarily be a direct consequence of the energy reforms.

And so Mexico remains in limbo, awaiting critical details of the plan to be revealed, more feasibility studies to be underway, and yet more reforms to be introduced, after what might feel like a false start to Mexico's bullish infrastructure ambitions.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.