News+: Make way for the Aggregator

After a long-ish wait the UK infrastructure industry was finally presented with the government's procurement plan for privately financed schools under the Priority School Building Programme (PSBP) earlier this month.

The announcement is being seen as a positive one not only by schools that are in desperate need of refurbishment but also by the infrastructure community which is keen to see how well the government's new procurement model - PF2 - will work.

With regards to the PSBP timetable, the Education Funding Agency (part of the UK Department for Education) will tender out 46 schools in five batches under the PF2 model. These schools have a total funding requirement of approximately £700 million (US$1.1bn). The first batch to be tendered comprises a total of seven schools at three councils - Hertfordshire, Luton and Reading, with a funding requirement of £122 million in all. The EFA will be holding a bidder's day for the first batch on 28 May 2013. A notice inviting bids from firms interested in constructing and maintaining the schools will be published in the Official Journal of the European Union in June.

Below is a table listing all the 46 schools to be rebuilt under the privately funded PF2 model:

Under this latest round of procurement, under the PF2 mode, the government is taking many new approaches compared to previous years such as; central procurement with EFA as the main body, procurement to be more streamlined and quicker under PF2, single stage dialogue phase, revised procurement document approach, building designs made for the first batch will hopefully then be applied to subsequent batches and lastly the key change is the funding approach which will use a new 'Aggregator' model.

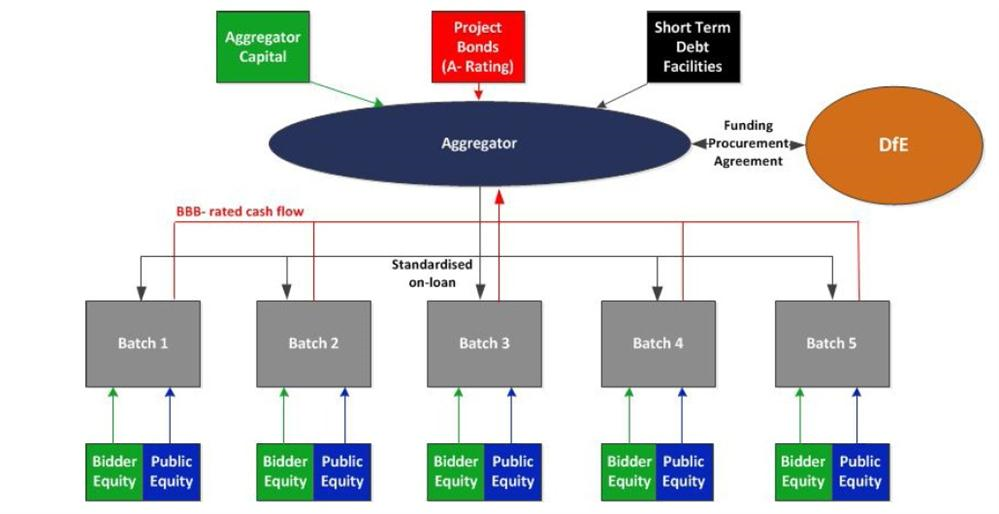

Below is a flowchart on how the Aggregator is proposed to work:

(Source: Education Funding Agency)

The key points to note regarding the Aggregator are:

- It will access both bank lending and debt capital markets

- Provide standardised on-loan to each batch

- Batches will need to be BBB- rated

- Public equity will be injected at batch level but not in the aggregator

- Completed equity at aggregator level not at batch level

No doubt the Aggregator has been at the centre of all debate since it was unveiled by the government along with the school batch information. The Aggregator is an innovative attempt by the EFA to change the way school PPPs have been financed so far while taking into consideration the changing landscape of project finance lenders. The EFA has said that while previously there was strong reliance on the bank debt market, they don’t have confidence that bank debt alone can cover the long tenors at attractive prices anymore and therefore there has been a decision to include newer sources of capital in the model.

From what is known so far the ‘aggregator’ will be able to access both bank debt and capital markets in order to secure the best deals for the taxpayer. The performance of the ‘aggregator’ model will be assessed to inform future investment in the education estate which will be identified by the property data survey programme, due to report in October this year. HSBC advised the EFA on the ‘aggregator’ model alongisde Ashurst.

While the model will incorporate both debt and equity to fund the schools like in the past, it also opens up the option for banks to provide short-term debt for projects to be followed by a capital market or bond solution, the EFA has said.

The EFA will hold a separate procurement for the aggregator model which will involve a competitive dialogue process that will run in parallel with the first batch’s procurement. The OJEU for the aggregator will be released shortly after the first batch's OJEU in June. A bidder’s day for Aggregator is scheduled to be held in mid-June 2013.

Who is finally appointed to manage the aggregator and which lenders come together to provide debt to the aggregator is all still in development. Dan Rudley, deputy director – Private Finance at the EFA was quick to provide a final caveat - at a recently held conference about the Schools procurement - that in the event the aggregator doesn’t work or fails altogether, they will need to look at the sort of funding model that the Alder Hey hopsital used recently or be forced to use whatever bank debt is available.

The UK definitely has a growing set of players operating in the debt capital markets whether it's insurers like Aviva, Allianz, M&G, Legal & General or monolines like Assured Guaranty. It will be interesting to see in what way they get involved with the aggregator.

Industry experts believe that the aggregator model will make things easier and quicker. It is one way for the EFA to be able to capture market appetite for all five batches at the same time and it also bodes well for the government's value for money concerns.

In addition, the combination of short term bank debt followed by a longer capital markets/bond solution will give a combination of financers a chance to participate in the schools programme. From the procurement point of view – it could make bidding simpler – since bidders will concentrate on what they’re strong at instead of concentrating on financial proposals.

However what still might concern the industry is the fact that procurement for the aggregator hasn't begun yet. Jon Hart, infrastructure partner at Pinsent Masons says that ideally the expectation would be that the aggregator would have been in place already before the batch procurement begins. "There is always the lingering fear of what if this leads to another delay," he said.

In addition he said that the BBB- rating that the school batches require will reflect back on the balance sheets of contractors and will therefore favour few big contractors which have always been active in this sector. This might end up defeating the UK government's attempt to encourage SMEs into construction.

The third issue he highlighted is around taking construction risk which might still be a concern for institutional investors. However the next few months will be important in-terms of how the procurement both of the batches itself and aggregator pans out. Watch this space...

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.