News+: Turkey's project financing renaissance?

In January Turkish Transport Minister Binali Yildirim announced the launch of a tender for a new six runway airport which will be procured under the PPP model. The tender signifies a surge of activity in the Turkish market which also witnessed important financial closes last year restoring confidence in the country's project finance potential.

In December TAV Airports reached financial close on a €250 million debt package for the Izmir Airport expansion project. In addition, the high profile US$1.22 billion Eurasia Tunnel PPP was brought to close by a combination of local and international lenders, government agencies and IFIs in December. This was a major feat as for nearly 12 months the industry waited for a financial close date to be set.

The Tunnel, said to be one of widest and deepest to be built yet, is expected to reduce east-west journey times across Istanbul from 100 to 15 minutes which will of course boost both trade and tourism in the country. This might also relieve the pressure on Istanbul's existing airports which seem to be overcapacity. Although the Turkish government already has big plans to tackle airport overcapacity by building what could possibly be the world's largest airport.

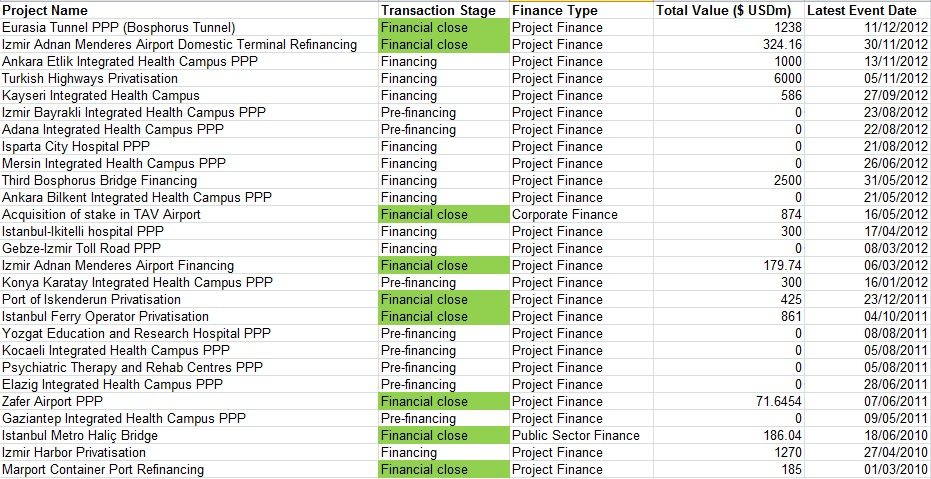

New tenders and financial closes aside, the country has a string of deals for which it will be looking for investors this year in hopes of keeping the enthusiasm in its project financing market alive (see table).

Source: Infrastructure Journal

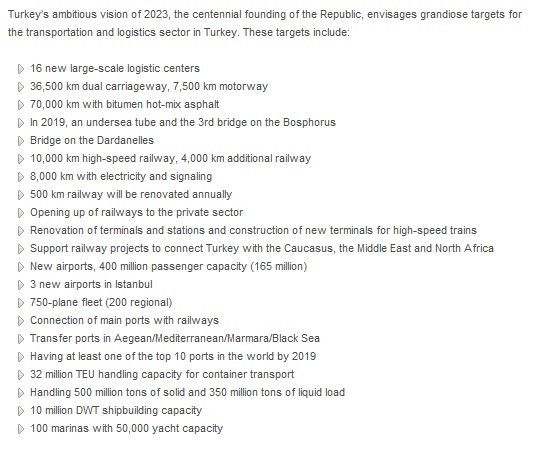

Since Turkey’s economy emerged strongly from the global financial crisis, and its GDP has seen consistent growth over the last two years compared to other OECD countries, it is no doubt a market to watch out for. In addition, Turkey itself has set some ambitious infrastructure development targets for the next 10-15 years especially in the transport and logistics infrastructure sectors.

According to the Turkish Investment Support and Promotion Agency, apart from a long list of projects envisioned to be operational by 2023, it is also planning to invest around US$23.5 billion in railway development by the same year. While those targets may have seemed unrealistic a couple of years back, based on the country's current enthusiasm and financial close successes, those targets may not be totally misplaced.

“Mehmet the conqueror began a new era by conquering Istanbul; now . . . Istanbul is opening the door to a new era of the future,” Transport Minister Binali Yildirim was noted as saying during a press conference held in the city in January. He is now seeking investors for the new airport which will occupy an area of around 90,000m2 between the Yeniköy and Akpınar districts in İstanbul. The new airport will have a capacity to handle around 90 million passengers a year, with the potential of increasing capacity to handle 150 million people.

Apart from transport, healthcare is another sector which will hopefully see more activity this year with international lenders and equity funds already dipping their toes into this space with more comfort than before. The country's first PPP modeled hospital, the Kayseri Hospital, is expected to reach financial close soon while the larger US$1.5 billion Ankara Etlik Health Campus PPP is being readied for financial close in the first quarter of this year too.

"The coming quarter will see financial closes on some hospitals which will then set the template for other projects in the pipeline," said one European equity investor.

Positives & Challenges

One of the immediate positives that the Turkish market is witnessing as deals close is that projects are becoming more bankable in the region. The government, investors and sponsors are together able to understand a project's risk profile better. However it would be fair to add in the same breath that Turkey is still an emerging PPP market and lacks experience in some sectors more than others. Issues like economic instability, high inflation rates, exchange rate fluctuations and political uncertainty are those that have disturbed this part of the world more than others in the past two years, which is also something investors pay close attention to before they invest.

Turkey has a steady pipeline of projects and the hope is that the pipeline does not out run the lending capacity since there is still a dearth of international lenders in the country. That said, it is ofcourse encouraging that so far international lenders have been involved in most transport and social infra PPP projects.

Source: Turkish Investment Support & Promotion Agency

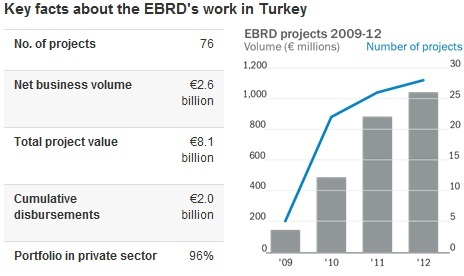

Going forward, experts say that the role of IFIs like the IFC, EBRD, EIB will continue to be key in financing infrastructure projects in Turkey. The risk profile of projects including transfer and distribution of risk will be central to lenders' decision on whether to finance a project or not.

Source: EBRD

Demand for projects in the transport and power sector is expected to remain high on the back of energy and logistics gaps the country needs to fix, along with the need to refurbish ageing infrastructure in the hopes of starting a "new era" that Turkey so desires.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.