Funds: Meridiam Infrastructure North America Fund II

In early October Paris-headquartered fund manager Meridiam Infrastructure closed its second North America focused infrastructure fund, raising a total of US$1.05 billion. Here IJ Online takes a look at the fundraising process and breaks down the fund’s investment mandate.

Quick facts

Fund manager: Meridiam Infrastructure

Final fund size: US$1.05 billion

Target: US$1 billion

Launched: July 2010

Final close: October 2012

Life of the fund: 25 years

Investment mandate: The PPP fund will invest in public infrastructure projects only, primarily greenfield, along with some brownfield projects, and will focus on investments in the US and Canada.

Fundraising

Meridiam Infrastructure North America Fund II (MINA II) is the second fund from Meridiam that will make investments in North America. Meridiam’s first fund, which closed in February 2008 after raising US$1 billion, had a global focus making investments in North America and Europe.

MINA II made a total of eight closings over its two year fundraising period, raising US$1.05 billion, just over its US$1 billion target.

The eight closes were as follows:

- Close 1 – US$115.5 million (11 per cent)

- Close 2 – US$147 million (14 per cent)

- Close 3 – US$210 million (20 per cent)

- Close 4 – US$294 million (28 per cent)

- Close 5 – US$346.5 million (33 per cent)

- Close 6 – US$462 million (44 per cent)

- Close 7 – US$861 million (82 per cent)

- Close 8 – US$1.05 billion (100 per cent)

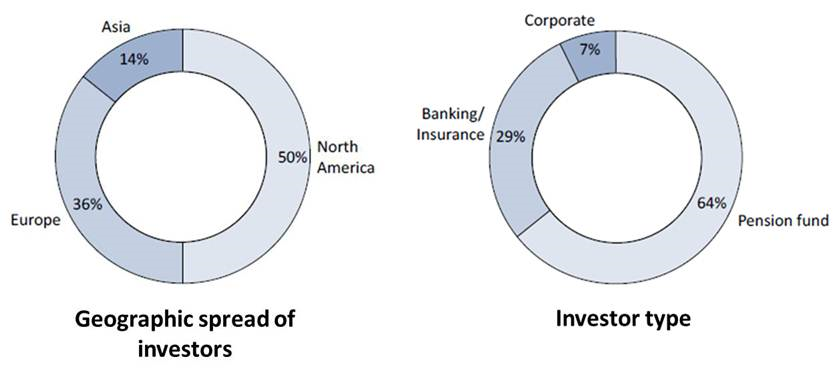

Investment came from a mixture of both new and existing investors and included commitments from US pension fund CalSTRs, Dutch pension fund APG, Development Bank of Japan and MainePers as well as investors in the US, Canada, Australia, Europe and Asia. The following charts show the breakdown of investors by region and type.

Alongside the fund, Meridiam has established a small co-investment group comprising investors who have made commitments to either or both of the fund manager’s US or European funds.

Thierry Déau, founding partner and CEO of Meridiam told IJ that the fundraising environment had changed since Meridiam raised its first fund in 2006.

Déau said: “Our first fund, the global fund, was raised in 2006/2007, which was a more favourable environment for fundraising though we were a first time fund and team. We then raised two funds back to back over the last few years.”

He added: “LPs are much more advanced in terms of the due diligence carried out compared to pre-crisis. LPs want to understand the counterparty risk profile, especially the country risk profile and how the fund will deal with that. LPs are certainly more focused on this than they used to be.

“With this in mind LPs are really looking at the track record of the team more so than five or six years ago. They want detail on the markets you are investing in and a pipeline of projects. The internal processes of a fund are a big focus for LPs now.”

Returns

The targeted return for MINA II at a portfolio-level on both a gross and net basis is expected to be 13-14 per cent and 11-12 per cent respectively.

Investment mandate

MINA II has a mandate to invest in public infrastructure projects in North America, with the majority of investments expected to be in the US and Canada. There is the option for the fund to make investments in OECD non-European countries outside North America also and Meridiam said it may look at investments in Chile.

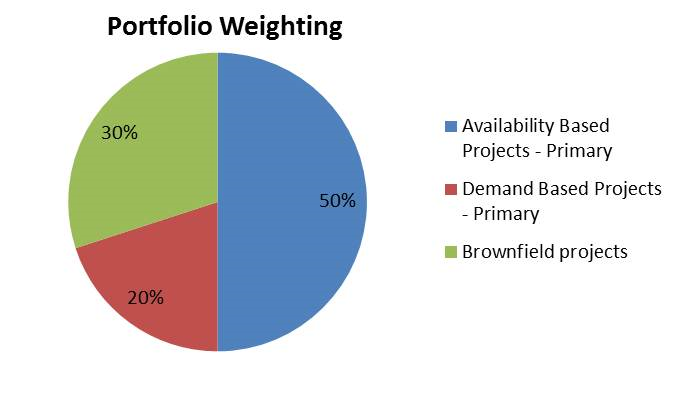

The fund is predominantly a greenfield fund but has the option to invest in some brownfield infrastructure.

Déau said: “We have opted for a small brownfield allocation as we want the ability to be opportunistic. We want to take advantage of the opportunities coming from construction companies trying to sell off assets and deleverage. This allocation also helps the fund early cash yield."

The fund will invest in a mixture of availability and economic risk projects in order to realise the best return for investors. The following chart shows how the portfolio will be weighted across the different project types.

Meridiam expects to invest the majority of the fund in the transport sector. This is largely a consequence of transport projects being larger scale in comparison to social infarstrcture projects. However Meridiam said it expected to see a pick up in the social infarstructure sector in the US and this will be one of the fund’s main markets for investment.

The fund will make investments of between US$10 million and US$150 million.

Investments to date

The fund has already made investments in five seed assets:

- Long Beach Courthouse, California (100 per cent equity)

- Presidio Parkway project, California (50 per cent equity)

- IH-635 Managed Lanes project, Texas (38 per cent equity)

- Northeast Anthony Henday Drive project

- Montreal University Hospital Research Centre, Canada (40 per cent equity)

Meridiam Infrastructure is headquartered in Paris, France with a main office in New York for North America

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.