News+: Nord/LB and the new financial guarantee

Earlier this month Nord/LB launched a new and innovative product, Blue Rock, designed to improve the bank’s capital ratio and provide capital relief. Blue Rock took a junior tranche from a tailored portfolio of Nord/LB’s UK PPP/PFI loans and placed it with London listed infrastructure fund GCP Infrastructure. In doing so the bank was able to improve its capital ratio by reducing the risk rated assets held on its books.

But the product is not all that innovative.Japanese bank SMBC did a similar thing two years ago, with the same fund. And there have been a number of other European banks performing similar deals. Is this securitisation for the new project finance era?

Motivation

As banks ready themselves for the impending Basel III banking regulation, a major review of debt portfolios is underway as banks find themselves under enormous pressure to improve their regulatory capital ratios. For project finance lenders things are particularly tough. Basel III lumps project finance debt into one bucket, and the outcome is that project finance lending becomes very expensive for banks. In order to prepare themselves for the implementation of the new capital requirements banks are looking to free up regulatory capital. For this they have two options, sell assets or hedge their portfolio.

Many project finance lenders have exited the business as a result. Earlier this year Portuguese lender BESI said it would cease project finance lending for the time being. WestLB and Dexia, two banks that were also active in the project finance space, closed their doors earlier this year.

Selling down your portfolio is not always the best option however.

Olivier Renault,head of structuring and advisory at StormHarbour Securities, which brokered the recent Nord/LB deal, told IJ News: “Long dated loans such as project finance loans are harder to sell. Also if project finance is part of your core business you don’t really want to dump the assets in order to raise capital.”

Option two; hedge the loans and buy protection on your existing portfolios.

The structure

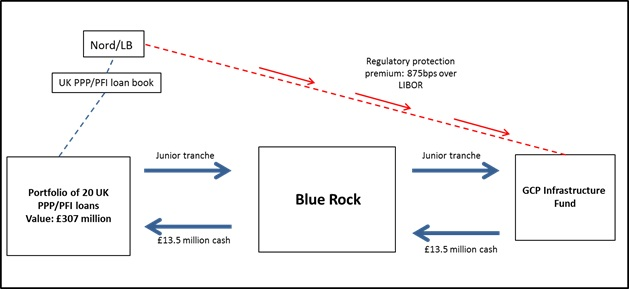

Banks can buy protection for their project finance portfolios either through a financial guarantee or a credit default swap. Nord/LB’s Blue Rock solution fits into the former. The structure does not buy protection on 100 per cent of the portfolio but rather buys loss cover on a junior tranche, which allows the bank to release a significant proportion of capital tied up in the portfolio, whilst holding onto the loans until maturity.

In its deal with GCP Infrastructure Fund, Nord/LB bought £13.5 million (US$21.9mn) of protection on a £307 million portfolio of 20 UK PPP/PFI loans from Blue Rock, a vehicle created especially for this transaction. Blue Rock passed the risk onto GCP and in return GCP deposited the £13.5 million with Nord/LB via Blue Rock. In essence Nord/LB has created a junior tranche in the portfolio of 20 loans and sold that to GCP. The tranche covers approximately four per cent of the risk, above a small percentage retained by Nord/LB.

Renault said: “It is highly unlikely on a PFI portfolio that you are going to get more than one or two per cent of losses. If you are hedging say the first five per cent of losses in a portfolio then you are hedging against those losses.”

Renault added that it is important in this sort of deal for the banks to receive 100 per cent of the cash up front so that the regulator is comfortable that they have suitable collateral to cover the losses. Following the transaction the assets in the portfolio consume less capital on the Nord/LB balance sheet.

In structuring the deal GCP selected the loans that it wanted from the bank’s PFI/PPP loan book rather than Nord/LB selecting the loans it wanted to hedge against.

Rollo Wright, a partner at GCP said: “GCP was particularly interested in including quality loans from the Nord/LB portfolio. We chose the loans that we consider to be the most secure in what is already a relatively stable sector.”

Nord/LB also pays a regulatory protection premium to GCP for the first loss cover on the portfolio. The fund receives a fee of 875bp over Libor, which is paid on a regular basis, either quarterly or six monthly depending on the specifications of the deal.

More deals to come?

The Blue Rock transaction is certainty innovative and a good example of how an infrastructure fund can play a part in providing capital relief for project finance banks. Credit protection deals have been few and far between in the infrastructure sector due to the complex nature of the asset class. The deals require a certain skillset and expertise amongst those providing the credit protection. An infrastructure fund is best placed to do this, given their infrastructure expertise. While innovative this is not the first transaction of its kind, and nor is it expected to be the last.

SMBC did a similar deal with GCP two years ago, minus the Blue Rock style vehicle. The bank bought protection for a £233 million portfolio to cover losses from £2.33 million to £14 million. In this instance the deal was brokered by SMBC itself.

In 2008 Spanish bank Santander, through its Boadilla programme, bought protection on a €500 million (US$652m) portfolio from Dutch pension PFZW. The following year the bank did another deal with the pension fund on an €850 million portfolio.

Wright said: “Nord/LB approached us on the basis of a prior regulatory capital deal that we did as they were looking to do a similar thing.”

Wright added that a number of banks had spoken to the fund about similar deals. Similarly Renault said StormHarbour was in discussions with a number of banks to do something similar. According to Renault a number of other trades are also being worked on at present, in the renewables and core infrastructure sectors.

Wright said the model currently worked well for German and Japanese banks, and said he had seen interest from other banks following the Nord/LB deal. However Wright added that this model doesn’t work as well for UK banks due to a recent change in the way that the UK’s Financial Services Authority views regulatory capital relief transactions.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.