News+: UK Energy Bill raises big questions for renewables

The introduction of a complex new Energy Bill may leave developers in limbo with the project pipeline potentially drying up within 18 months, industry leaders have warned.

The long-awaited Energy Bill, announced in the Queen’s Speech last week, is set to come before government within the next month. It aims to support low-carbon technologies and reform the UK’s electricity market through new pricing mechanisms.

This morning it emerged that six major energy developers – SSE, Ecotricity, Good Energy, Renewable Energy Systems, Natural Power and Fred Olsen Renewables – have written a joint letter to the government, saying that the “train wreck” reforms would only benefit the nuclear industry.

Whilst the UK government made a coalition pledge not to subsidise new nuclear, the energy companies say that the new measures in effect provide state aid through the proposed incoming carbon floor price and contract for difference electricity pricing. These will replace the existing system of feed-in tariffs (FiTs) for renewables and Renewable Obligation Certificates.

"The only logic we can see in this is that they [ministers] are still trying desperately to hide their nuclear support. They seem to be prepared to make life more difficult for renewables in a last-ditch effort to keep the nuclear option open," SSE head of policy Keith MacLean told The Guardian.

Pinsent Masons energy partner Euan McVicar told IJ News that he believed the existing ROCs had been generally well received by the renewables industry, and said that the incoming EMR may well have been designed in part to facilitate the development of new nuclear projects. “The ROC system was working very well for renewables…[the EMR] seems to have been developed in a way that would allow the government to provide support to new nuclear without a specific subsidy,” he said.

The transition from the current scheme to the new one could be a major risk to the UK renewables industry. McVicar said that “the government must minimise the risk of any delay to the project pipeline up until 2017, otherwise within the next 18 months people will start asking questions.” As it stands, if developers can get their projects online by 2017, they will be able to adopt the current ROC scheme. But this further pressure on developers to rush through projects in a market already rocked by UK regulatory reform may mean that investors become wary of the risk profile involved in backing projects, and will have to become comfortable with the as-yet unknown credit risk of projects qualifying under the new system.

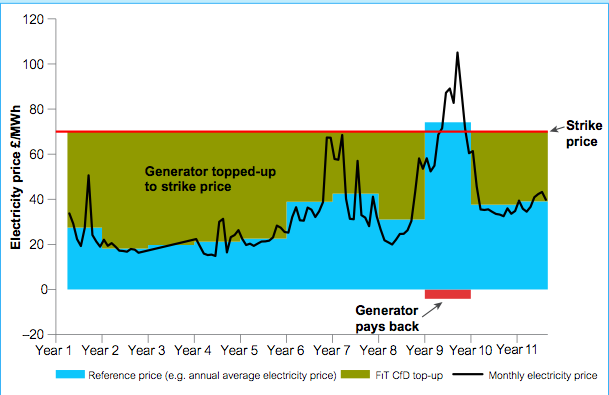

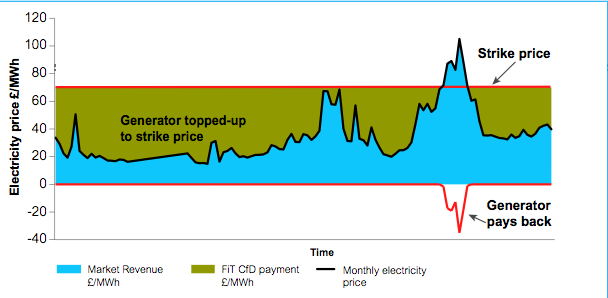

The developers’ other main point of concern surrounds the proposed introduction under the Bill of a ‘contract for difference’ mechanism. This would see a reference price set for the cost of low-carbon electricity, with electricity buyers paying sellers if the strike price is above the reference price, and vice versa. The mechanism is designed to create more stable returns and thus encourage investment. Here's a DECC graph, contained in the White Paper, which sets out models of how it could potentially work:

Table 1: The operation of a baseload Feed-in Tariff with Contract for Difference

Table 2: The operation of an intermittent Feed-in Tariff with Contract for Difference

Source: DECC

McVicar said that the devil will be in the detail: “It becomes incredibly important how the reference price is set,” he said. The perceived complexity of the scheme could also put off investors, he added. “The moves may have been engineered to attract investors looking for long-term, lower-risk returns, such as pension funds. It might attract a new pool of investors […] there is a concern that the type of investor that wants these assets are the ones interested in regulatory-based rather than equity-based returns. The premiums for developers might have to go up to keep them interested.”

McVicar said that it was too early to tell what the true effect of the reforms would be on the green industry, and added that more legislation is due to follow. “The scale and ambition of the reforms should not be underestimated. The Energy Bill is only part of the story. The subordinate policy that is yet to come is also important […] the big issue is making sure that the policy is right.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.