Europe rides the high offshore winds

The European offshore wind sector continues to grow apace. A couple of major projects have reached financial close over the summer, others are reaching commercial operation, and new capacity auctions are now on the horizon.

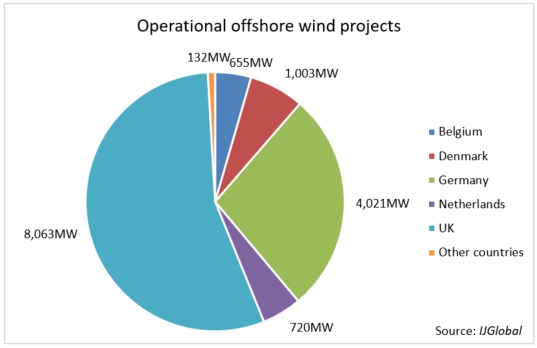

According to IJGlobal data, operational offshore wind projects across Europe account for some 15GW of installed capacity, and with the current rate of procurement this total is set to grow exponentially over the next few years.

The largest operational offshore wind farm in the world – 659MW Walney Extension in the UK – reached COD last week (September 2018), but even larger projects are being financed in mainland European countries.

A recast Blauwwind II consortium brought the 731.5MW Borssele III/IV wind farms in the Dutch Borssele Wind Farm Zone (BWFZ) to financial close in June (2018). Then Innogy closed on the 860MW Triton Knoll in the UK's North Sea in August.

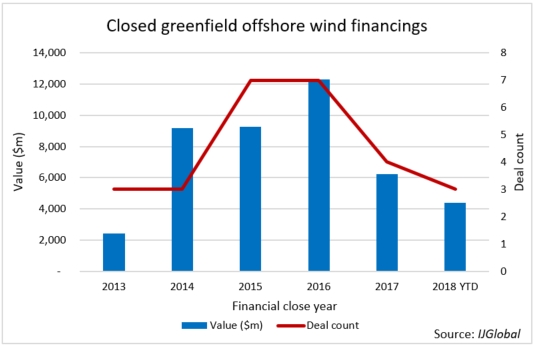

The value of closed deals for greenfield offshore wind project in 2018 to date (1 September) exceeds $4 billion. Up until 2017, the total value and volume of greenfield financing in the sector had been growing year-on-year, with $12 billion of deals closed in 2016. Though there was a dip in 2017, the total number of pipeline deals suggests total financing volumes should have bounced back to a positive trend by the end of 2018.

As IJGlobal data show, there are 12 ongoing greenfield financings for more than 16GW of prospective capacity. Among these projects are floating offshore wind farms, such as the 88MW Hywind Tampen facility which floating offshore wind park Equinor is considering to power its Gullfaks and Snorre oil and gas platforms on the Norwegian Continental Shelf (NCS).

Refinancings

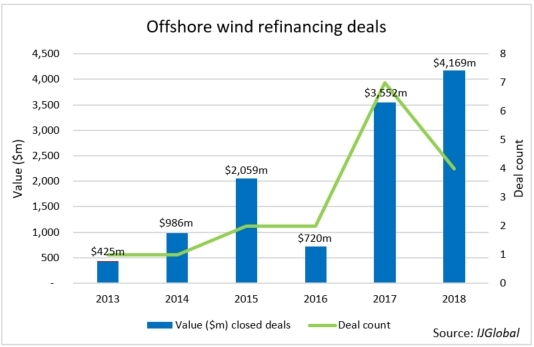

As more offshore wind farms become operational, the number of refinancings in the market has also grown. IJGlobal data show $4.169 billion of closed deals in 2018 to date – already surpassing the overall total of 2017 of $3.552 billion.

The rest of Europe is catching up quickly, with Italy’s 30MW Taranto taking shape and Turkey tendering a 1.2GW offshore wind project. And while France has drastically cut subsidies and feed-in tariffs for offshore wind power, Belgium mulls a zero-subsidy offshore wind auction in 2020 and will look to catch up with Germany and the Netherlands on financing new projects expected to be operational in the early 2020's.

The UK, meanwhile, seems determined to stay at the front with as much as 2GW of capacity planned for the next decade. All evidence points to offshore wind has what it takes to be a large-scale renewable energy source in Europe in the mid- to long-term.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.