European floating offshore wind

A major milestone for renewable energy was reached in late 2017 with the world’s first floating offshore wind farm entering commercial operations in October. The 30MW Hywind Scotland pilot park is located offshore Peterhead in Aberdeenshire, and consists of five floating 6MW turbines. The project was developed by energy majors Statoil and Masdar.

In its first three months of generating electricity, Hywind Scotland achieved a 65% capacity factor, compared to the average 40-60% achieved by bottom fixed offshore wind installations. With deep-water locations often having the largest and most consistent wind resources, Hywind Scotland’s performance goes some way in proving that wind turbines located farther out at sea will be more efficient.

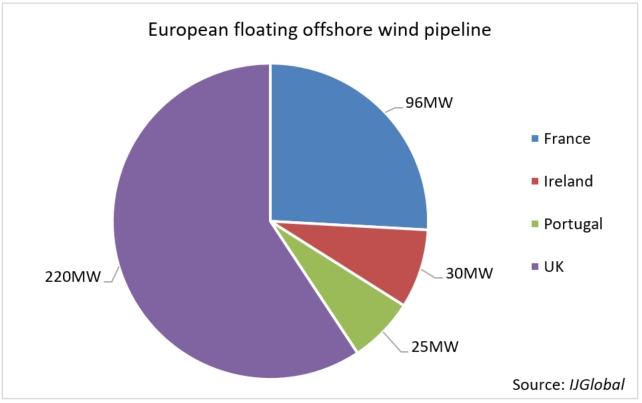

A number of European countries have floating offshore wind plans, and there is a growing pipeline of projects.

IJGlobal data shows that the majority of planned projects are located in French and UK waters, but the two countries seem to have different sets of priorities.

State support

Due to delays, UK floating offshore wind developments 60MW Forthwind and 10MW Dounreay Tri – both off the Scottish coast – are in danger of missing UK regulator Ofgem’s Renewables Obligation (RO) deadline. The projects have until October (2018) to gain accreditation under the RO, but have asked for an extension to April 2020. Not achieving an extension casts doubt on both projects.

Pilot Offshore and Atkins' 50MW Kincardine floating offshore wind farm, however, looks set to meet the current RO deadline.

UK trade association RenewableUK has suggested that an extension to the deadline would allow the government to keep the existing end date for Renewables Obligation Certificates (ROCs) which has been set for 2037. It would mean that the projects would receive less state support, as ROCs are typically provided over a 20-year period.

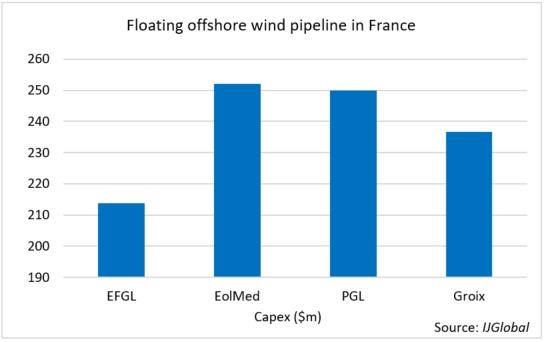

In contrast to the UK’s rigid regulations, France is fast-tracking its offshore wind farms in order to catch up with its neighbours. The country’s multi-annual energy plan proposes up to 2GW of floating wind and tidal capacity, in addition to the four 24MW projects that were selected in a 2015 tender for floating offshore wind farms launched by state energy department L’Agence de l’Environnement et de la Maîtrise de l’Energie for renewables technologies.

The winning projects comprised:

- PGL floating offshore wind farm

- EFGL floating offshore wind farm

- EolMed floating offshore wind farm

- Groix floating offshore wind farm

France is envisaging long-term calls for floating offshore wind tenders and there is a strong state commitment to implement the necessary investment.

According to IJGlobal data, the projects are estimated to cost around $952 million. What is more, they are expected to meet their start-of-operations deadlines of 2023.

Meanwhile, two other floating offshore wind projects in Ireland and Portugal are in the pre-construction stage.

The next big thing

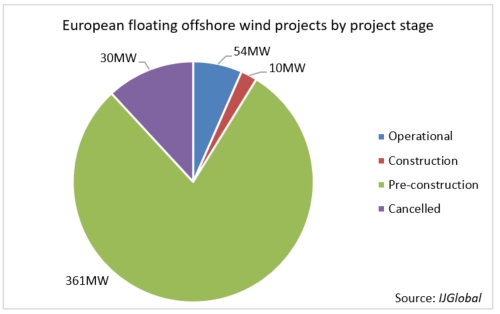

As shown by IJGlobal data, Europe could see some 361MW of floating offshore wind capacity installed in the coming years if all projects are delivered as planned. These pilot projects, if successful, are expected to lead to much larger developments once the technology has been proven.

Floating offshore wind could have a number of advantages over fixed offshore wind. More efficient turbines with improved design, which can be assembled close to the shore before being pulled offshore by low-cost ships, are expected to drive down costs.

Moreover, shortening the timeline for construction and commissioning of floating wind farms would allow companies to bring costs for offshore developments close to onshore turbines. Statoil and Masdar already plan to reduce the costs of energy generated at the Hywind Scotland site to €40-60 per MWh by 2030, making the asset cost competitive with other renewable energy sources.

As shown by estimates from the European Wind Energy Association (EWEA), floating offshore wind could meet the EU’s electricity consumption four times over, so this technology should be expected to be the focus of renewable developments across Europe over the next decade and beyond.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.