MENA cuts time to financial close

The MENA region, never a slouch when it came to getting projects over the finish line, appears to be getting quicker at taking projects from preferred bidder (PB) to financial close.

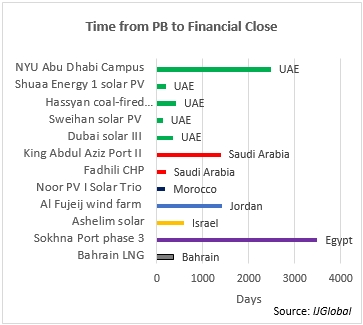

According to IJGlobal data, the UAE has become the fastest state in the region at bringing projects to financial close. Abu Dhabi’s Sweihan solar project took just 126 days from PB to close, while Dubai’s 800MW third phase of the Mohammed bin Rashid project reached close after 349 days. UAE accounted for three of the top five fastest transactions in the region since 2014.

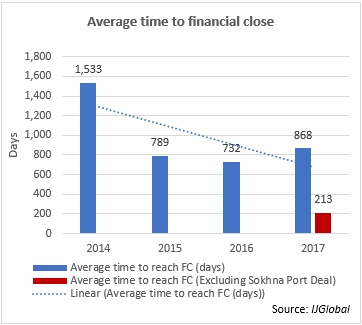

When all transaction are taken into account, the speed of procurement has slowed in 2017, increasing to an average of 868 days from 732 in 2016. That increase in average time is attributable to the just one transaction however: Sokhna Port Bunkering, in Egypt. It took 3,488 days to reach financial close – longer than any other PPP project in the region over the period.

While Sokhna Port dragged it down, the 2017 average is still around 43% faster than the 1,533 days seen in 2014. Two projects – the NYU Abu Dhabi Campus PPP (PB chosen November 2007) and the Ashelim Solar Thermal Plant (PB chosen November 2012) – took 2,478 and 588 days, respectively, before reaching financial close that year.

Excluding the Sokhna Port deal, the remaining four projects reaching close this year took an average of just under 213 days. Those project were in the UAE, Morocco, and Saudi Arabia. Sokhna was the first PPP to close in Egypt over the past four years – the country has an ambitious pipeline of projects but the government has struggled to deal with a dollar shortage and an unwillingness to deal with currency risk.

Overall, procurement times for PPP projects appear to be shortening region-wide with four of the five fastest PB-to-close processes having occurred so far in 2017. The only other transaction to make it into the fastest five is Dubai’s 200MW Shuaa Energy 1 solar project, closing 191 days after award of PB.

This acceleration in time between PB and financial close is almost certainly related to the types of project being procured in the region. Over the last two years there has been an explosion of solar projects being developed, and these typically require much less capital and fewer deal participants than projects in other sectors.

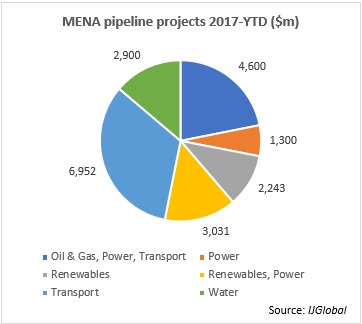

Although the transactions closing in 2017 have been quick so far, with a few months remaining things could still change. There are over $21 billion worth of PPP projects in procurement in the region right now, with transport accounting for the majority – some $6.95 billion worth – in value.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.