The Canada Infrastructure Bank

In the past few weeks, the federal government of Canada has announced a couple of senior appointments for the, yet-to-be formally launched, Canada Infrastructure Bank, signalling its commitment to bringing the bank into existence.

Even the government's March 2017 budget statement reaffirmed its plans to establish a new Canada Infrastructure Bank, after first introducing its intention to create the bank in the 2016 Fall Economic Statement. The Canada Infrastructure will work with provinces, territories, and municipalities to further the reach of government funding directed to infrastructure.

According to a government statement, the Canadian Infrastructure Bank will provide low-cost financing for new infrastructure projects backed by Canada's strong credit rating and lending authority to make it easier and more affordable for municipalities to build the projects their communities need. The bank will provide loan guarantees and small capital contributions to provinces and municipalities to ensure that the projects are built.

While government guarantees and dedicated infrastructure banks are not a novel concept, and the UK has actually put government backed guarantees to use, the US' efforts at bringing its infrastructure bank to realisation have been rather bleak so far. It remains to be seen how successful the Canadians will be at the venture, once launched and put into effect, although firm dates for the same have not been outlined yet.

Size and scope

The government has said that the Canada Infrastructure Bank will be responsible for investing at least C$35 billion ($26 billion) from the federal government into large infrastructure projects that contribute to economic growth through a broad range of financial instruments including loans and equity investments over the next decade. About $15 billion of this amount will come from the funding announced for infrastructure in the Fall Economic Statement.

In the 2016 Budget package alone the government announced immediate investments of C$11.9 billion in public transit, green infrastructure and social infrastructure. The 2016 Fall Economic Statement proposes an additional C$81 billion through to 2027–28 in public transit, green and social infrastructure, transportation infrastructure that supports trade, and rural and northern communities.

Taking into account existing programs, new investments made in Budget 2016 and the additional investments contained in the Fall Economic Statement, the Government of Canada will invest more than $180 billion in infrastructure over 12 years.

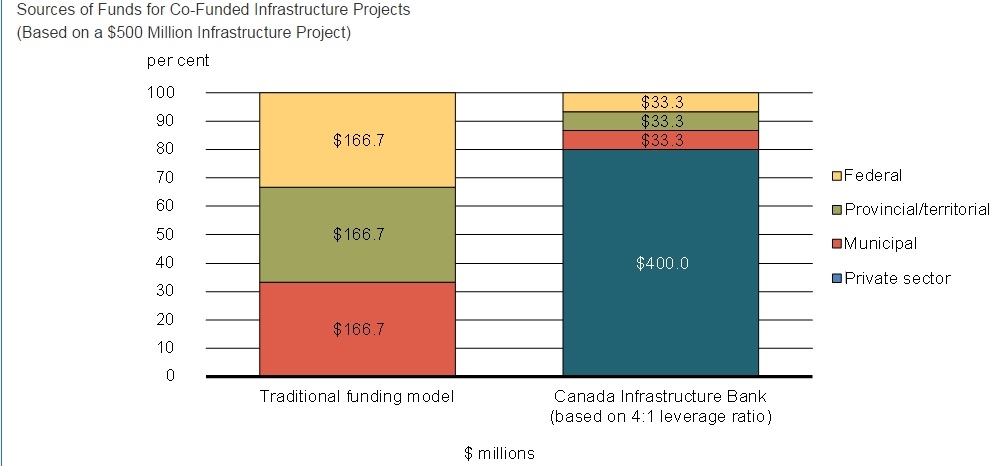

The objective of the Canada Infrastructure Bank says the government will be to structure its financial support in order to attract private sector capital into infrastructure projects.

Capturing investor base

The government’s aim with creating the new bank is to capture both private sector investment as well as that of institutional investors – of which Canada has one of the largest reserves of globally. Based on estimates developed for the Advisory Council on Economic Growth, public and private pension funds currently hold $170 billion worth of infrastructure investment globally, and there is a potential to multiply this level of investment 10 to 14 times, with Canada well positioned to attract its fair share of this investment.

As part of a broader objective to attract investment in Canada, the government hopes to provide better and sustained investment opportunities at home for these funds.

As mentioned above, the Canada Infrastructure Bank will be responsible for investing at least C$35 billion on a cash basis through direct investments, loans, loan guarantees and equity investments. Of that amount, about C$20 billion in capital will be made available to the Canada Infrastructure Bank for investments which will result in the Bank holding assets—in the form of equity or debt. This C$20 billion will therefore not result in a fiscal impact for the government. The remaining C$15 billion will come from the already announced funding for public transit, green infrastructure, social infrastructure, trade and transportation, and rural and northern communities.

The bank will be accountable to, and partner with, government, but will operate at greater arm’s length than a department.

The Bank’s mandate

According to the 2016 Fall Statement, the Canada Infrastructure Bank will make investments in revenue-generating infrastructure projects and plans that contribute to the long-term sustainability of infrastructure across the country. It will be mandated to work with project sponsors to:

- Structure, negotiate and deliver federal support for infrastructure projects with revenue-generating potential;

- Use innovative financial tools to invest in national and regional infrastructure projects and attract private sector capital to public infrastructure projects;

- Serve as a single point of contact for unsolicited proposals from the private sector;

- Improve evidence-based decision making and advise governments on the design and negotiation of revenue-generating infrastructure projects.

In-terms of governance, the government will be responsible for setting the overall policy direction and investment priorities for the bank. The bank will have financing tools such as; direct investments, repayable contributions, debt (e.g., loans, loan guarantees) both unsubordinated and subordinated, equity investments, both unsubordinated and subordinated; and a hybrid of the above, at its disposal.

The bank will also have the opportunity to participate in complex infrastructure deals including; participating as a subordinated equity partner, facilitating an interprovincial clean energy grid project through the provision of a loan guarantee to lower risk and reduce financing costs for the proponent; and providing low-cost loans to private sector investors to advance complex trade corridor projects.

A recent IJGlobal data analysis explored procurement levels across North America in 2017, and Canadian provinces especially Ontario was found to be leading the pack. Of the total 28 ongoing PPP projects at pre-financing stage in North America, 16 are located in Canada and 12 of these belong to Ontario. The province which boasts of an expanding transport sector, a step change from the social infrastructure space, where the province has traditionally had more experience over the years.

Projects across Canada will be in search of investors over the next two years. In terms of required investment, in 2017 alone Canada's PPP pipeline, which is worth about $6.84 billion, will be seeking both equity and debt investors. And this figure only includes projects where capital values have been publicly announced so far.

Two of Ontario's major rail tenders to hit the market are; the C$2.5 billion ($1.85 billion) Confederation Line extension project and the C$1 billion light rail transit (LRT) project in Hamilton. Other significant Canada-wide projects in tender at the moment are; the George Massey Tunnel Replacement PPP, Hurontario Light Rail Transit (LRT) PPP and the bi-national $2.5 billion Gordie Howe International Bridge PPP between Detroit, Michigan, and Windsor, Ontario.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.