Data analysis: Diversification targeted for funds raised in Q1

The first quarter of 2017 has seen high volumes of capital being raised at a global level, with 22 unlisted, closed-ended funds raising a total of $33.9 billion, according to IJGlobal data.

While the figure is impressive, it is worth highlighting that almost half of it was raised by one single fund. GIP III reached final close at $15.8 billion in January 2017, propelling the fundraising pace and partly skewing trends in the infrastructure and energy funds market.

The significant market share occupied by the US-based fund manager confirms a trend that has been often observed in the market in recent years, an increasing amount of capital is being raised as the number of funds in the market decreases. While this an interesting consolidation phenomenon, some other trends can still be observed as managers proceed into 2017.

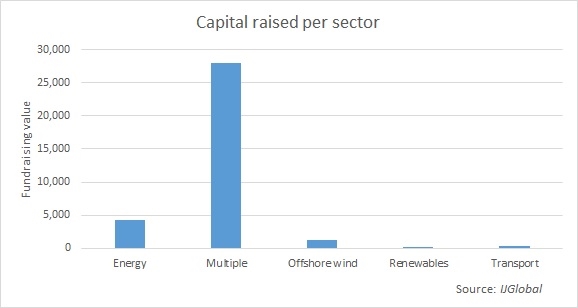

As institutional investor allocation to infrastructure increases globally, diversification continues to emerge as one of the traits they are looking for in a fund. Of the total $33.9 billion, about $28 billion was targeted at multiple sectors.

As well as GIP III, another 12 of the 21 remaining funds will seek to deploy the capital raised in multiple sectors. Among the largest ones is EQT Infrastructure III, which concluded a fast fundraising hitting its hard cap at €4 billion. This fund takes an industrial approach to infrastructure investing, and will continue to make investments in sectors such as energy, transport and logistics, environmental, telecommunication and social infrastructure mainly in Europe and North America.

Australian manager Queensland Investment Corporation (QIC) raised A$2.35 billion for its QIC Global Infrastructure Fund (QGIF). This fund has a larger geographical scope compared with EQT Infrastructure III, targeting OECD countries for deals in transport, energy, PPPs and social infrastructure sectors.

As for infrastructure debt, which has historically been raised slower than equity, AMP Capital raised at least $1 billion to be invested in mezzanine and subordinated debt in OECD countries across utilities, energy and transport sectors for its Infrastructure Debt Fund III (IDF III).

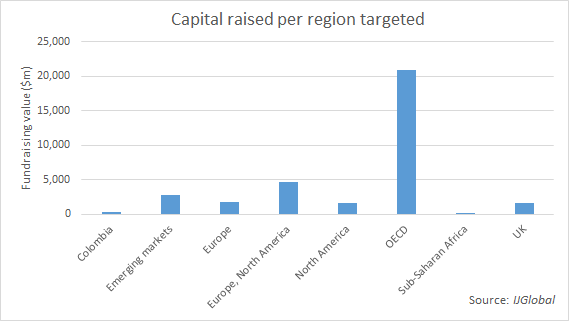

Broadening the geographical spectrum seems to be another characteristic liked by investors, as the majority of the capital raised in the quarter is tilted towards OECD assets.

Some $20.9 billion will target countries in this region, with smaller allocation going to either single-region or double-region mandates. GIP III, QGIF and AMP Capital IDF III all target deals in OECD countries. Other active funds with a similar regional mandate include Quinbrook low carbon energy fund, the AMP Capital Global Infrastructure Fund, SUSI Energy Storage Fund and Northleaf Infrastructure Capital Partners II (NICP II).

Among the sector and regionally focused funds, Actis Energy 4 has had a successful capital raise, closing its fund at the £2.75 billion hard cap. The fund's capital will be invested in select countries in Latin America, Africa and Asia targeting control investments in electricity generation and distribution businesses.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.