Engie top IJGlobal renewables Q1 2017 sponsor LT

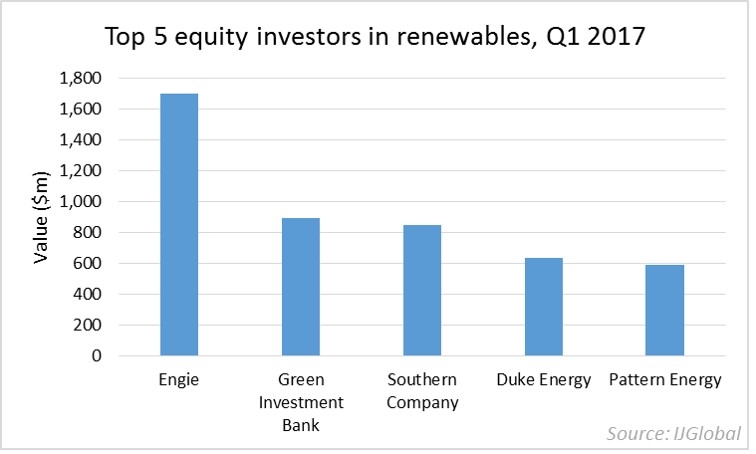

Engie made the biggest commitment to renewables investment in the first quarter of 2017, according to the IJGlobal Q1 2017 league tables. The French utility topped the renewables sponsor league tables for the quarter largely due to its $1.6 billion green bond issue in March.

This week Engie sold out of its Moorside nuclear interest in the UK in one of a series of moves to diversify away from conventional power towards renewables generation.

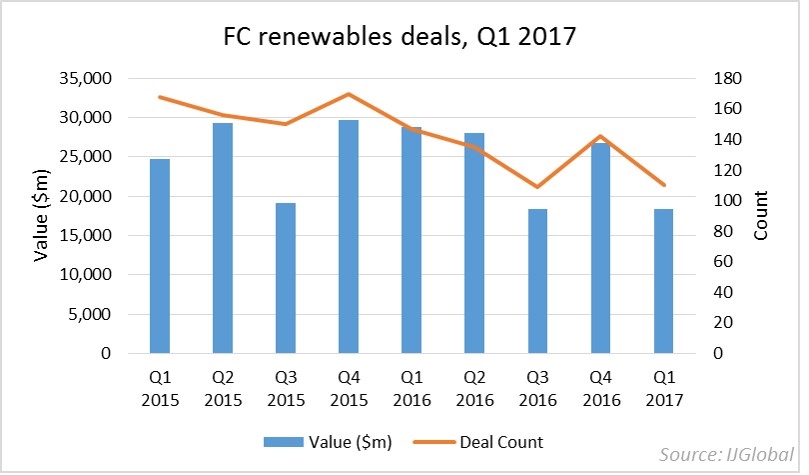

Renewables transactions continued to dominate the infrastructure finance market in terms of deal flow in Q1 2017. 110 renewables deals reached financial close in the quarter, over 50% more deals than the next most active sector (power). The largest financing for the sector was a $1.6 billion green bond issuance from Engie, only marginally beating the $1.5 billion refinancing of the Butendiek offshore wind farm in Europe.

Despite these mammoth financings the sector was dominated by small-scale financings rather than big ticket deals. The average deals size for a renewables deal in Q1 2017 was $239 million, compared to a global average deal size of $548 million. The Engie green bond aside, the five largest deals in the sector were wind transactions.

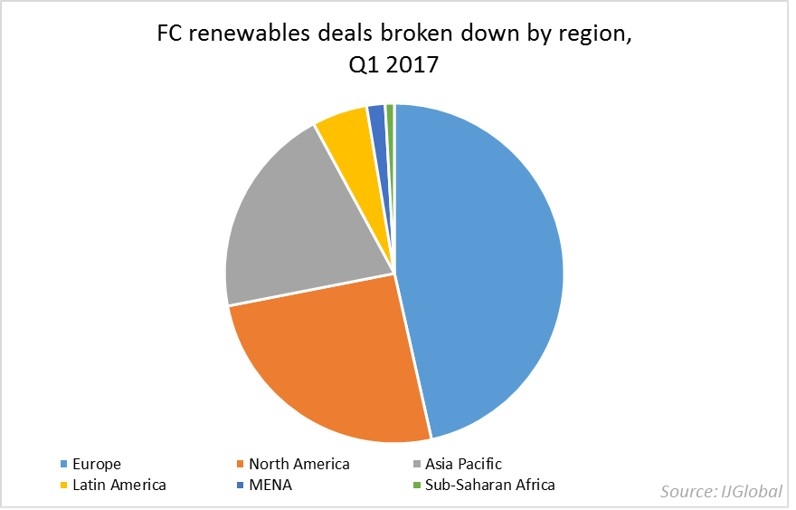

The majority of transactions closed in the renewable sector in Q1 were refinancing or acquisition deals, a sign of a maturing of certain sub-sectors of the asset class. The wind and solar sectors in Europe and North America are now well established. We have seen a cycle of projects come into operation and demonstrate track record, and those projects are now ripe for acquisition and refinancing.

Engie said the proceeds of the green bond will be used to finance renewable energy projects such as wind farms and solar parks. Click here to sign up for IJGlobal's Q1 2017 league table report: http://bit.ly/2naUcIA

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.