SWFs, Brexit and UK infrastructure

UK Prime Minister Theresa May yesterday triggered Article 50 and began the process for the UK to leave the European Union.

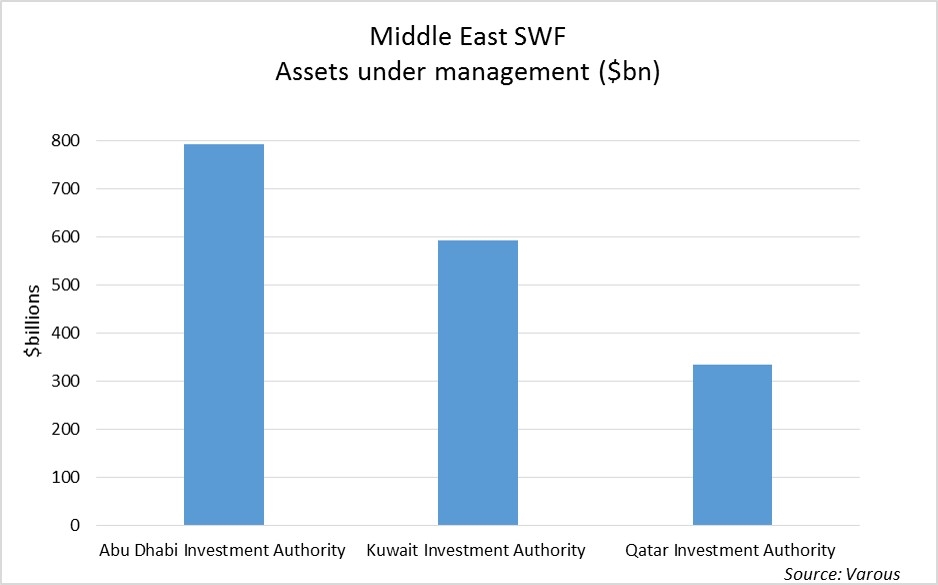

There has been considerable concern from financiers and investors about the impact the UK’s departure from the union will have on investor appetite for UK assets. But in the run up to yesterday’s withdrawal Middle Eastern sovereign wealth fund (SWF) Qatar Investment Authority pledged £5 billion of investment to post-Brexit Britain. QIA has roughly $335 billion of assets under management and has to date invested around £40 billion in the UK, mainly in commercial real estate.

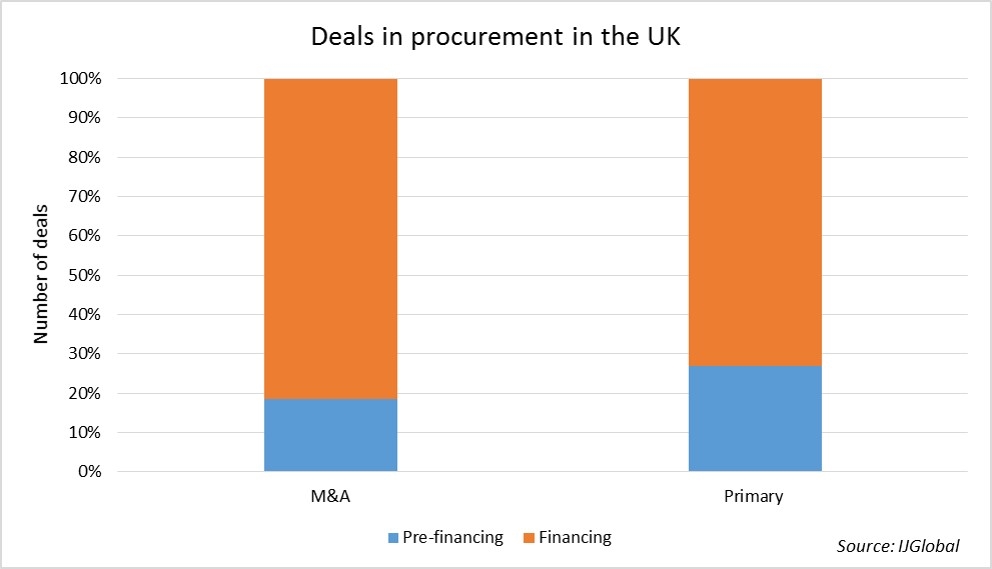

A portion of this new pot of capital has been earmarked for energy and infrastructure investment. QIA made its first investment in UK infrastructure just this year as one of the sponsors on the acquisition of 61% in National Grid Gas.

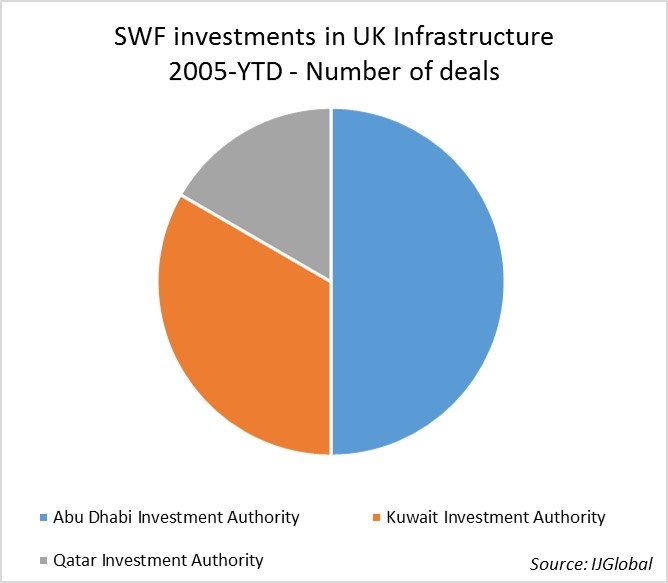

Middle Eastern SWFs have shown a growing interest in UK infrastructure as a haven for stable investment. QIA is not the first to invest. The Abu Dhabi Investment Authority has been the most frequent investor in UK infrastructure to date, according to data from IJGlobal.

It is unlikely that these funds will be deterred by Brexit having made a strong commitment to invest in Britain and forging relationships with British investors. Will post-Brexit Britain be an attractive investment destination for other large SWFs in the Middle East. Saudi Arabia’s SAMA Foreign Holdings has not yet invested in UK infrastructure and has more assets under management than both the Kuwait Investment Authority and Qatar Investment Authority. Perhaps Brexit will open the door for more SWFs in the Middle East?

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.