Is the UK still the leading European infrastructure market?

It is common to hear London-based infrastructure professionals complain about the pipeline for domestic greenfield projects, but exactly how active is the UK market in comparison to the rest of Europe?

The UK has long been the main hub of private investment in European infrastructure, pioneering the use of the Private Finance Initiative (PFI, a forerunner to modern PPPs) through the late 1990's and through much of the 2000s.

That activity waned as the then Labour government was replaced first by a Conservative-Liberal Democratic coalition and then by a fully Conservative administration which were both far less supportive of the PFI model.

Gradual growth

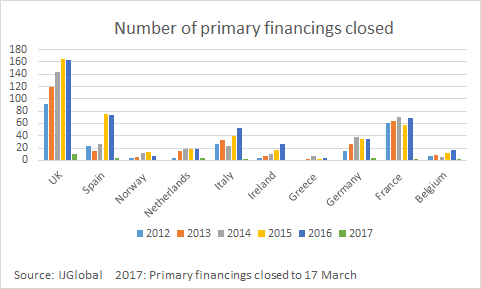

Although numbers of infrastructure and energy transactions closed in the UK are now lower than in the heyday of PFI deals, IJGlobal data shows gradual growth in the number of primary financings closed in the country since 2012.

And with a pipeline of new PF2 projects expected to be announced by the government in the coming weeks, the trend is set to continue.

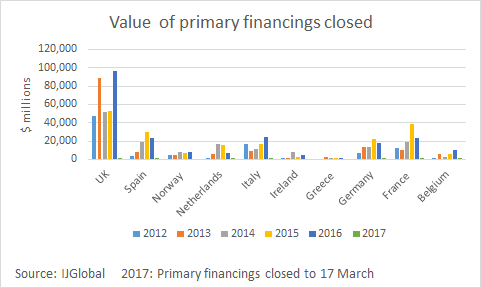

Some market watchers have hinted at concerns that infrastructure spending in the UK may fall behind that seen in other western European countries. But data shows private infrastructure investment in the UK in recent years dwarfs that seen in the rest of the continent.

Although investment in some countries, in particular Germany and France, is healthy, numbers and total values of deals closed in these markets are still significantly lower than in the UK.

However, the comparison in terms of spending may be misleading, one source noted. After all, for most European countries, large-scale infrastructure and energy projects are usually government funded rather than privately financed, in contrast to the UK.

In the UK, private finance has been heavily involved in delivering projects in all infrastructure sub-sectors since the 1990s. In other European countries the use of the PPP model has been for the most part restricted to transport infrastructure, with the majority of social infrastructure still state funded.

PF2 doubts

Although the upcoming PF2 pipeline is reassuring for the UK market, doubts over the PFI/PF2 model remain. Many market observers question whether PF2 is the best option in terms of value and user benefit for developing infrastructure projects.

While attempts have been made to iron out issues such as ensuring projects stay off government balance sheets, improving flexibility of contracts, and improving the ultimate value of infrastructure projects for taxpayers, a number of these problems are not entirely resolved, prompting some observers to suggest perhaps other procurement models should be considered.

The government has yet has yet to publicly address these concerns. It was expected to announce a raft of new PF2 projects within its annual budget published on 8 March, but failed to so. An announcement is now eagerly expected in the next few weeks.

The UK infrastructure market has kept busy in recent years, compared to other European countries, but many will feel that more could have been developed and that even more will be developed in the coming years.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.