Interview: Mainstream's Bart Doyle

Mainstream Renewable Power was one of the first international developers to enter the Chilean renewables market in 2008, but it has been most active in the last 18 months.

The Irish developer now has more than 2GW of renewables projects – 1.2GW of wind and 850MW of PV – at varying stages of development in Chile.

“Chile was a slow burner for us. When we arrived, renewables in general were still considered a joke by the incumbents” explains Mainstream’s general manager in Chile, Bart Doyle, “and I don’t think that changed until 2014 when renewables won a big portion of contracts in a distribution tender”.

Chile has historically suffered power shortages and extremely high energy prices, which has threatened its key industries, including mining. In 2014 Chile’s national energy commission CNE introduced new rules for the public electricity supply tenders, which make up half of the power market, to encourage investment into new renewables projects.

Wind and solar won 20% of the 11,000GWh of 15-year contracts offered in the first auction to benefit from the new scheme in December 2014. This signalled the start of a major change in Chile’s power sector.

In the next auction held in October 2015, renewables swept the floor, winning the entirety of the 1,200GWh of long-term contracts up for tender.

Triumphs at tender

Mainstream, in a joint venture with private equity firm Actis called Aela, won nearly two-thirds of the auction (65%) with wind projects.

All of Aela’s assets are Mainstream developed projects. Aela, the JV which is split 60:40 in favour of Actis, owns the operational 33MW Cuel wind farm in central Chile. It is also negotiating a debt package backing the 170MW Sarco and 130MW Aurora wind projects, which won PPAs with distribution companies in 2015.

In the following and most recent public tender held in August 2016, the developer bid for contracts alone and won almost 1GW of capacity with seven projects, which it estimates will require $1.65 billion of investment.

Bidding alone in the latest auction was the result of a change in strategy for Mainstream in Chile.

“We came to the realisation that wind projects could fill power 24/7 (as required under the contracts with distribution companies)” says Doyle “Historically renewables have been seen as intermittent, but in 2015 we combined the output of projects in different geographies, which have different wind profiles which reduced the risk in supplying the demand from distribution companies”.

"And in the July 2016 tender, by combining a larger number of projects we were able to further reduce the spot market risk in the PPA and to offer lower price due to scale” he adds. In its offer, Mainstream combined the wind regimes of seven different projects.

The auction was 7x oversubscribed and achieved an overall average cost of $47.6 per MWh.

Falling energy prices

As a direct result of the auction prices achieved, Chile has revised down its long-term spot market projections for when these PPAs will be active, which Doyle points out works in favour of developers. “It’s a self-fulfilling prophecy for renewables”.

The other portion of Chile’s power market is formed of private bilateral contracts between large energy users. “Industrial users are now looking for the price being achieved in public auctions and these customers are now securing prices around $50 per MWh”, comments Doyle.

Solar prices in auctions across the world are continuing a downward trend, as the appetite for clean energy grows and the prices of turbine and solar panels continues to fall.

Solarpack broke ground with its record low bid for PV in the 2016 auction. The Spanish developer offered a price of $29.1 per MWh from its proposed 120MWp Granja project. The record was later beaten by Marubeni and Jinko Solar’s price of $24.2 per MWh for Sweihan in Abu Dhabi.

Mainstream’s bid for two PV projects came very close to Solarpack’s.

“Incumbents challenge that the price of energy will continue to fall. I don’t agree that the continuous price drops over the last few years will stop” argues Doyle.

Banking the PPA

Of the number of shovel-ready renewables projects in Chile, a modest proportion have so far won PPAs in public auctions.

Doyle comments: “The PPA is the value point for any project. There are a number of incumbents with existing PPAs that will soon mature. Once you have it then it’s a question of how to be funded – banks will be looking at capex, turbine prices”.

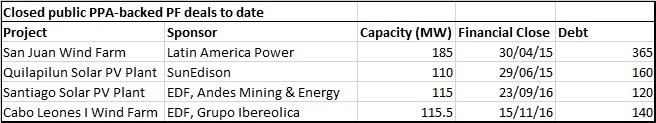

IJGlobal data shows that since the December 2014 auction, four renewables projects which are either contracted or partially contracted through public auctions have closed project financings.

The PPAs which have been increasingly awarded to new renewables projects in Chile offer the same contract terms to all technologies. “There is a long track record of this PPA being banked many times before for conventional projects by local and international banks and now we are beginning to see a steady flow of project financings for renewables”.

“It is not a new PPA like in Argentina or Mexico” he adds.

These projects have been mainly funded by international lenders. SMBC, DnB NOR Bank and Credit Agricole have been particularly active in financing these PPA-backed deals. Aela’s wind portfolio financing is expected to close by the end of the first quarter of 2017.

“A project bond is also now looking more attractive”, comments Doyle, “as you can raise it once, get a rating, and draw down when you need it.”

Sponsors of operational wind farms elsewhere in the region have tapped the international capital markets for funding. These include Acciona with its Oaxaca II and IV Mexican wind farms in 2012, ContourGlobal with its Talara and Cupisnique Peruvian wind farms in December 2014. Spain’s Renovalia also placed a local offering in December 2015 in support of its 90MW first phase of Piedra Larga.

One sponsor of operational wind assets in Chile is known to already be exploring a bond financing option.

Death of merchant solar?

Several years ago sponsors of even fully merchant solar projects in Chile were able to find financing relatively easily. Multilaterals demonstrated a particular appetite for these assets.

IJGlobal data shows that in 2014, the majority of renewables deals financed were large merchant facilities.

But following a large injection of PV to the northern grid (SING) in recent years, the price of power has plummeted and hurt merchant projects. As a consequence, the market for merchant PV deals to get project finance has mostly closed. According to IJGlobal, the last such deal to achieve financial close in the country was in 2015.

A number of previously closed merchant deals are undergoing restructuring, or their sponsors are urgently seeking either public or private PPAs.

Mainstream closed a merchant financing in 2013 for the Cuel wind project, but has since contracted the asset via public PPAs.

“We think there will be space for merchant power in Chile in the future but this is not something we see in the near-term”.

Two major transmission projects are underway in Chile – Engie's TEN and ISA's Cardones-Polpaico power lines – which are expected to and alleviate congestion and improve Chile's grid. Both deals were financed in 2016 and are due to enter operations by 2019.

TEN will connect Chile’s central (SIC) and northern (SING) grids, and the Cardones-Polpaico is expected to boost capacity at the SIC. The interconnection is also expected to allow some PV projects stranded in the north to export power to areas of high demand, such as Santiago.

New frontiers

As many other Latin American countries have rolled out major renewable energy programmes and set ambitious new clean energy mandates, Mainstream is eyeing potential new markets for entry.

“We opened an office in Mexico (last year) and we would like to do Argentina”, says Doyle, “but I’m still not comfortable on how you would fund a project, even after RenovAr 1 and RenovAr 1.5. The country has great wind, a great grid and lots of progress with the government, but very limited finance”.

Mainstream did not bid in either of the auctions, but is following developments in both markets closely. It is also exploring private PPA options in Argentina.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.