Data Analysis: Merchant solar struggles in Chile

Chile has one of the largest solar photovoltaic (PV) markets in Latin America and some of the largest merchant PV projects in the world. But falling PV prices at the country's northern grid have hurt projects and some financings are undergoing restructuring.

In the last three years sponsors in Chile have been able to close long-term financings for partially or fully contracted projects which benefit from power purchase agreements (PPAs), but also, more recently, for merchant projects which are designed to sell all of their output on the Chilean spot market.

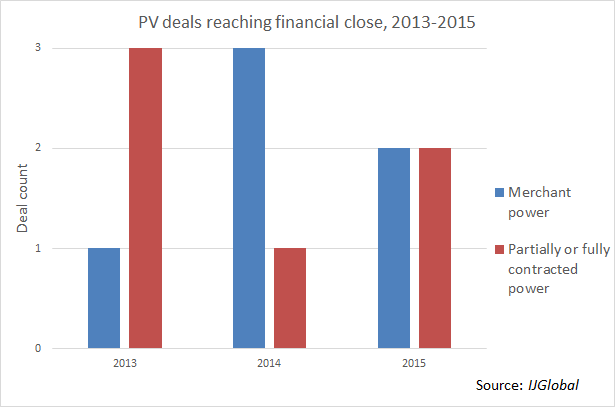

IJGlobal data shows that in 2013 most of the PV projects financed were partially or fully contracted, with only one merchant project, Saferay and Seltec’s 29.1MW La Huayca II, reaching financial close. One of the contracted projects to close was Etrion and SunPower’s 70MW Salvador Atacama project which only had agreements in place for 35% of its capacity.

By contrast in 2014, the majority of projects financed were relatively large merchant facilities. These include First Solar’s 141MW Luz del Norte project and SunEdison’s 72.8MW Crucero and 50.7MW San Andres facilities.

Many of the contracted renewable projects which have reached financial close in the last few years in Chile have obtained PPAs with mining firms. But as a depression in commodity markets is causing uncertainty for many mining projects in Chile, opting to sell on the spot market in a country in need of power has proven attractive.

However, Chile’s two power systems, the northern SING and central SIC, are disconnected. An influx of new PV power injected into Chile’s northern (and industrial) region, which has some of the best radiation levels in the world, has resulted in plummeting spot market prices at this grid.

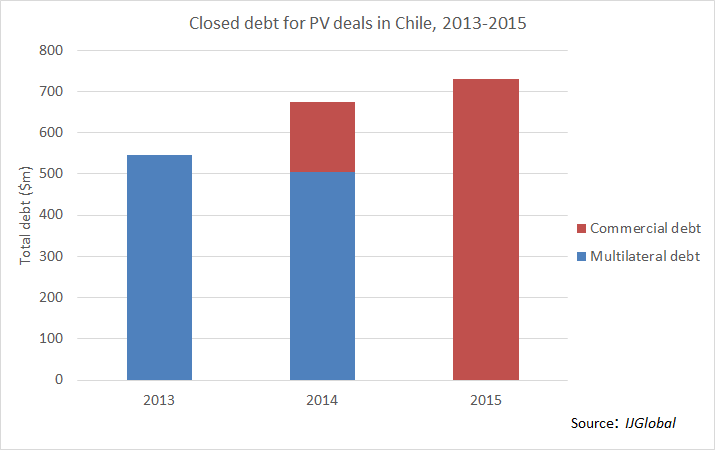

IJGlobal’s sample data shows that multilaterals, in particular the IFC, IDB and OPIC, accounted for all of the $550 million debt closed for PV projects in Chile in 2013. But by 2014 commercial lenders were providing a chunk, $170 million, of the total project-level debt to PV projects.

While multilaterals were also the first lenders to merchant solar in Chile, as sponsors’ appetite for merchant projects in Chile grew, so did some commercial bank’s appetite. In 2015, all of the PV debt closed was provided by commercial lenders. This included two deals for contracted projects – Pattern Energy’s Conejo and SunEdison’s Quilapilun – as well as EDF Energies Nouvelles and Marubeni’s 146MW Laberinto and Rijn Capital’s 55MW San Pedro III merchant solar projects. According to IJGlobal, the bank with the most exposure to Chilean merchant deals is local bank CorpBanca.

Engie is building a transmission line which will interconnect the SIC and the SING, but the power line is not due to enter operations before the second half of 2017. As a result of the low energy prices in the country's north, sources say that some merchant project financings are being restructured. Or others are expected to compete for PPAs with local distributors in the upcoming auction held by CNE. Another more distant solution, could be to transport PV power to Argentina, some indicated.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.