Data analysis: 2016 European uneven fundraising pace

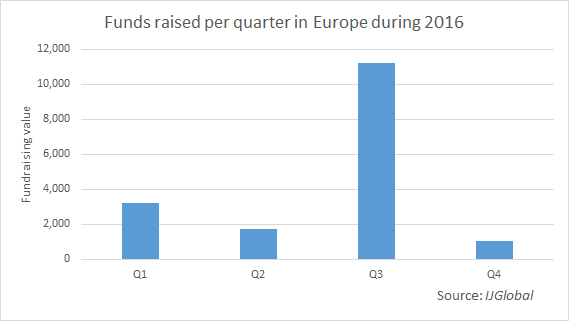

2016 has seen an uneven pace in fundraising activity among closed-ended, unlisted infrastructure and energy funds in Europe. Data collected by IJGlobal shows that of the total €17.2 billion ($18 billion) raised between 1 January and 28 November 2016, €11.2 billion was raised in the third quarter of the year.

Funds analysed within the period are those managed by European managers who reached either a first, interim or final close on their vehicles.

The year started with the final close of French Ardian Infrastructure IV which, with €2.65 billion in total commitments, was dubbed "the largest European infrastructure fund to date." At the time of final close announcement on 11 January 2016, the manager said that the fund had attracted significantly higher interest from North American investors then the fund manager's €1.75 billion third infrastructure fund, which closed in 2013.

Later in February, AMP Capital announced that fundraising had exceeded $1 billion for its brownfield Global Infrastructure Fund (AMP GIF), after raising a further $400 million in the second and third closes. AMP GIF is part of the Global Infrastructure Platform, which also includes the existing $750 million European closed-ended fund. Investors in the platform will be able to choose between Europe-only exposure or global exposure targeting OECD countries.

IJGlobal has tracked some €3.2 billion of capital raised by funds in the first quarter of 2016.

The pace decreased in the second quarter, when a total €1.7 billion of capital was recorded to have been raised, €1.3 billion of which went into Meridiam Infrastructure Europe III. The fund announced its first and final close at the end of April 2016 after four months since launch, the manager said in an official statement at the time. The majority of commitments into the fund came from France and the UK, accounting for 20% each, followed by Germany and the US with 15% and 12% respectively. Other investors came from Scandinavia and Japan.

But it was only in the third quarter of 2016, and particularly between August and September, that the European fundraising activities saw a significant spike with a total of €11.2 billion recorded by IJGlobal. Some 16 funds successfully raised capital in the period between 30 June and 30 September 2016, almost half of which went into two funds. At the beginning of September 2016, Macquarie Infrastructure and Real Assets (MIRA) closed its Macquarie European Infrastructure Fund (MEIF5) above target at €4 billion; shortly after, French manager InfraVia announced the €1 billion final close of its InfraVia European Fund III, also above target.

While the year has not ended yet, IJGlobal has reported on around €1 billion of total funds raised in the two-month period between 30 September and 28 November 2016. Quite interestingly, the vast majority of that amount was raised by AXA Investment Managers for its maiden debt vehicle Infrastructure Finance SCS-SIF - European Infra Senior 1, which announced a €730 million first close on 25 November 2016.

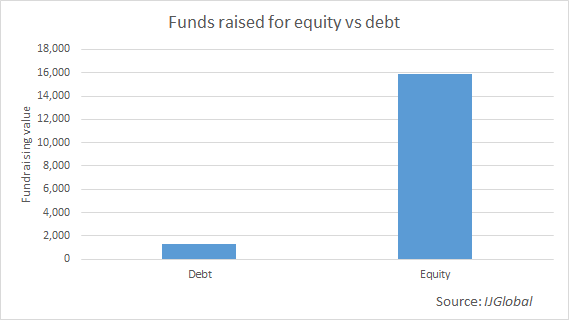

However, as previously noted, equity has dominated the year. According to data, €15.8 billion of the total €17.2 billion were raised to be invested in equity infrastructure and energy deals, while only €1.3 billion are targeted to debt investments.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.