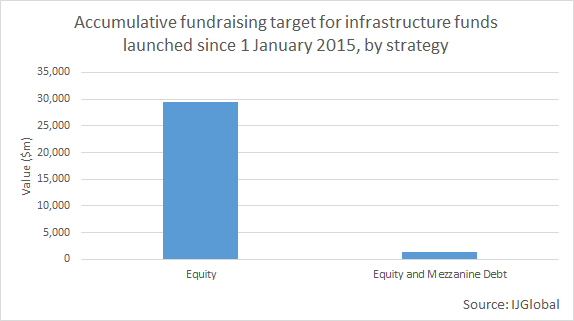

Data analysis: Equity dominates fundraising since 2015

Of the closed-ended, unlisted infrastructure funds launched since the start of 2015, the vast majority have been raising funds for equity investments, with only one fund also targeting mezzanine debt.

According to IJGlobal data, funds launched between 1 January 2015 and 23 August 2016 have targeted raising an accumulative $30.7 billion. Once fully raised, $29.5 billion of this total will be invested in equity while $1.3 billion will be targeting equity and mezzanine debt opportunities.

The table above does not include the $1.5 billion fundraising target set by AllianceBerstein for its European infrastructure debt platform. The debt vehicle was announced in October 2015 but then shelved in August 2016 as the manager took a "strategic decision to focus our private credit opportunities on commercial real estate, residential real estate and middle market lending". The platform was meant to include a senior debt fund with a $1 billion target and a junior debt fund with a target of $500 million, as well as segregated accounts or commingled funds.

Among the managers to launch an infrastructure debt strategy over the past year is Schroders, which announced it was entering the debt space at the beginning of 2016. Schroders, however, only offers segregated accounts at present and IJGlobal understands that the possibility of launching a fund will only be considered after the assets managed by the team reach a "critical mass". In April 2016, IJGlobal understood the assets invested by Schroders to be at around €500 million across six investments in transport and energy.

The $1.3 billion targeted at both equity and mezzanine debt investments is being raised by the Pensions Infrastructure Platform (PiP)'s Multi-Strategy Infrastructure Fund (MSIF). MSIF reached a £125 million first close at the end of April 2016 . For debt only transactions the fund managers are targeting a return of 0-2% above the retail price index (RPI) inflation rate, whereas for transactions featuring debt and equity investments they are seeking a return of 2-5% above RPI.

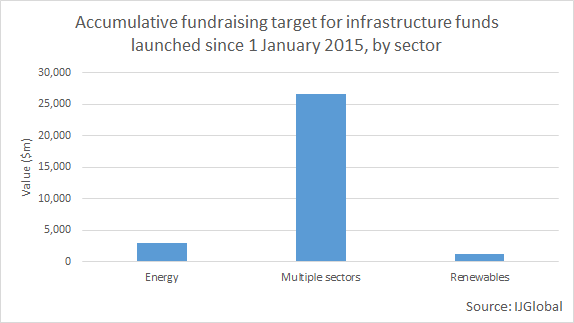

The vast majority of fundraising activities since the start of 2015 have been geared towards multiple sectors rather than aimed at one single sector.

A total of $26.6 billion is being raised to invest in two or more sectors. When targeting a single sector, some $3 billion was aimed at energy assets and around $1.2 billion at renewables projects.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.