Data analysis: Renewables in focus for Q3 European fundraising

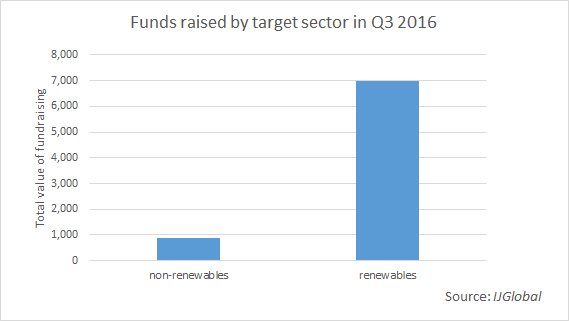

Of the total funds raised in Europe in the third quarter of 2016 by unlisted, closed-ended vehicles, a vast majority is targeted at investments in renewable energy assets, IJGlobal data shows.

Around 10 European closed-ended funds reached final close between 30 June 2016 and 30 September raising a total of €7.9 billion ($8.66 billion). Of this total, €7 billion has been raised to be invested, either exclusively or as part of a broader mandate, in renewables projects throughout Europe.

The vast majority of this renewable-oriented fundraising came from the Macquarie European Infrastructure Fund 5 (MEIF5) and the InfraVia European Fund III which both went above target by raising €4 billion and €1 billion respectively.

Both these funds have renewables as one of the sectors in target and will also seek assets in transport, utilities and telecommunication. MEIF5 has already reached an agreement to acquire a 30% stake in EP Infrastructure (EPIF) from Czech energy company EPH.

The remaining €2 billion came from funds which had renewables as their only focus.

Among them were the BlackRock Renewables Income Europe (€650 million); the Meridiam Transition Fund (€425 million) and the SUSI Renewable Energy Fund II (€380 million). The BlackRock and the SUSI Partners funds focus on wind and solar farms, while the Meridiam Transition fund will invest in the energy efficiency sector, including local energy services such as heating networks or the energy recovery waste, electricity and gas networks and renewable energy.

At the beginning of August, BlackRock said its fund had invested approximately a quarter of client commitments in nine wind and solar projects across the UK and Ireland and that it will continue to target similar deals in Europe.

Only about €890 million was raised to buy assets in more than one sector, not including renewables. The funds raised with this purpose target transports, utilities, telecoms and social infrastructure.

Such non-renewables oriented funds included the Abraaj Turkey Fund I (ATFI I) which raised $526 million targeting mid-sized businesses operating primarily in sectors poised to benefit from growing domestic consumption such as consumer goods and services, healthcare, financial services, logistics and retail.

Another was the Mirova BTP Impact Local (BTP IL) which raised €131 million to be co-invested with local small and medium enterprises (SMEs) in construction and operation PPPs deals in transport, telecoms, utilities and social infrastructure in France.

The only single-sector, non-renewables fund that reached final close in Q3 2016 was that of the Resonance Industrial Water Infrastructure Limited. It reached a third close at $300 million at the beginning of July 2016 and then reached an undisclosed final close a few weeks after.

Confirming a trend highlighted by IJGlobal data in a previous analysis, it is worth highlighting that the whole amount raised by unlisted, closed-ended funds in Europe in the third quarter of 2016 will target equity deals rather than debt.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.