Oil rebound sparks investment hopes

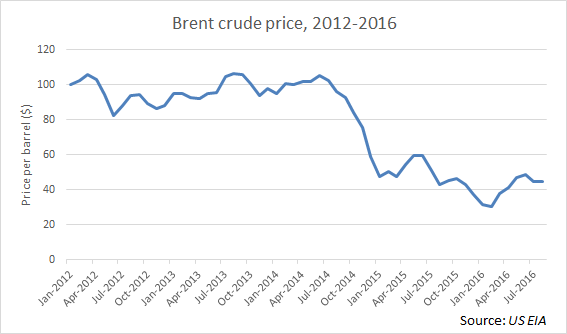

The price of Brent crude oil grew to its highest level in a year earlier this week, raising hopes that investment levels in the beleaguered oil and gas sector could also soon begin to increase.

The slight recovery in price has been spurred by an agreement between inter-governmental cartel the Organisation of Petroleum Exporting Countries (OPEC) to cut production, and then further boosted by support for the agreement by Russian President Vladimir Putin.

Brent dipped slightly yesterday, amid reported disagreements between OPEC members, to end trading on 12 October 2016 at $51.71 per barrel, according to Nasdaq data. But there are real hopes in the market that the price can finally beginning to climb in the coming months, after a prolonged period of depression.

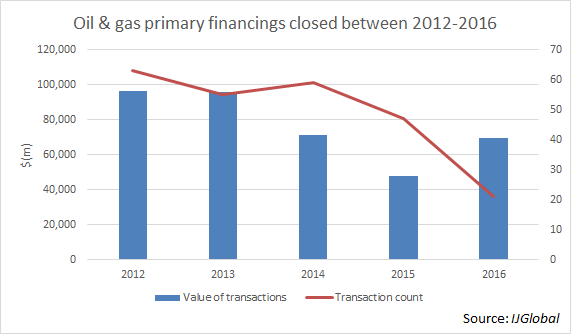

In turn it is hoped that a rise in prices can help restart stalled new capital investment in oil and gas infrastructure. There has been a noticeable decline in closed transactions in this sector over the last three years, according to IJGlobal data.

Though the total value of transactions has risen this year, that rise is almost entirely down to two huge transactions - the $16 billion first stage of the Tengizchevroil upstream expansion in Kazakhstan and the $30 billion Yamal LNG project in Russia. The volume of closed deals has been steadily declining since 2014.

It is possible that trend may continue into next year, even if prices recover. Major oil and gas projects, particularly in the downstream and petrochemicals sector, take many years to prepare and bring to financial close.

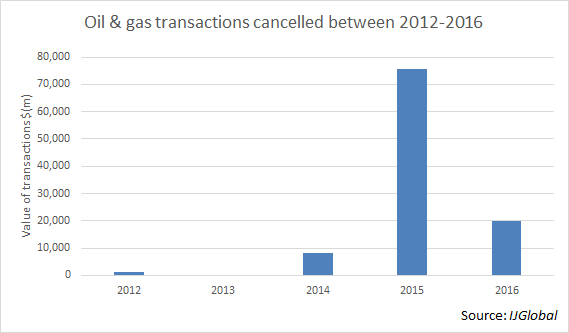

IJGlobal data shows that there was a peak of project cancellations in 2015, and these figures only represent major projects which were publically abandoned. Many other significant projects, especially in the LNG sector, have been put on hold until prices recover and stabilise.

And stability will be vital, as investors need general consensus on future prices to be able to gain comfort with capital commitments. But after more than a year of immobility, there is likely to be a growing pool of capital looking for oil and gas investment opportunities.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.