Data Analysis: Canadian LNG export indecision

Last week Pacific NorthWest LNG became the latest in a line of Pacific coast LNG export facilities to receive approval from Canadian government bodies, but the question remains whether the project will ever see shovels in the ground.

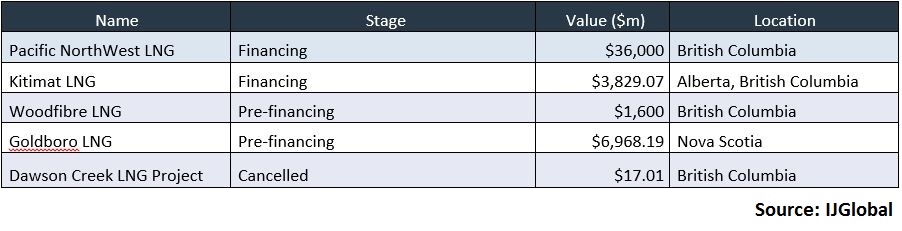

Several projects including the $3.8 billion Kitimat LNG – co-sponsored by Chevron and Woodside Energy – and Woodfibre LNG have delayed final investment decisions, and Malaysian state-owned lead sponsor Petronas may be faltering on its C$36 billion Pacific NorthWest LNG project as well, though about $11 billion has reportedly been spent in pre-development.

After promising to present a final investment decision in the fourth quarter of 2015 on the Douglas Channel LNG project, widely expected to be the first LNG export facility on the Pacific coast to move forward with development, AltaGas chief executive said that the consortium backing the project was unable to agree a meaningful offtake agreement and it was shelved in February.

That same month, Royal Dutch Shell decided to postpone a final investment decision on its $25 billion to $40 billion LNG Canada project.

The much smaller $1.6 billion Woodfibre LNG project owned by Singapore-based RGE near the town of Squamish, British Columbia received federal environmental approval in March after having already gotten a nod from The Squamish Nation. The developer has committed to making a final investment decision in the fourth quarter of 2016, but challenging economics could make for a difficult business case in the board room. Still, Woodfibre is considered among the most likely projects to move forward on the west coast.

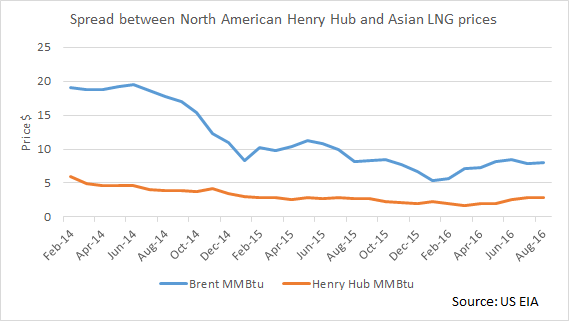

Since the most recent spike in February 2014, the Henry Hub price for LNG has fallen from $6 per million British thermal unit (MMBtu) to $2.82 per MMBtu, according to the US Energy Information Administration (US EIA). Meanwhile, Asian offtakers report oversupply and the spread between North American Henry Hub prices and Asian LNG prices, which are typically linked to Brent crude oil spots – though local LNG spot indexes are emerging – have collapsed from about $16 per MMBtu in early 2014 to between $6 and $8 per MMBtu today.

The drop in spread amounts to a severe cut to profits for LNG exporters from western Canada, and without infrastructure in place to support project development – which exporters in the US Gulf Coast benefit from – project economics are extremely challenging.

Despite the tough environment, Steelhead LNG reported in September that plans continue to move on its Malahat and Sarita Bay LNG export projects, and Alberta gas producer Seven Generations Energy signed a non-exclusive agreement for a small stake in the endeavors. The Canadian National Energy Board approved five licenses to export up to 30 million tonnes of LNG per year for 25 years the two projects in October 2015.

As for the Pacific NorthWest LNG project, Reuters has reported that Petronas is considering pulling out. The company has denied those rumors and stuck with its official line that along its co-sponsors, it is considering all options before making a final investment decision.

Meanwhile on the east coast, the Pieridae Energy-sponsored Goldboro LNG project in Nova Scotia appears to be moving forward, with Honeywell announcing in August that it had won a contract to provide full automation and safety systems to the under-construction facility.

With expectations of $65 per barrel of oil equivalent at the end of 2017, it may be that Pacific coast LNG projects in Canada could see a renaissance sometime in the coming months, but with US exports ramping up until 2020, oversupply will likely be continuing challenge for Canadian project sponsors.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.