Fund analysis: Arcus European Infrastructure Fund 1

Arcus Infrastructure Partners has successfully undertaken a liquidity offering process for its near mature closed-ended first fund. The offering attracted about €710 million ($787 million) of capital to allow investors taking a long-dated view on the next 10 years-plus to remain invested in the fund, while long-term investors have replaced those who chose to realise returns.

Arcus Infrastructure Partners launched a process in September 2015 to continue the €2.17 billion Arcus European Infrastructure Fund 1 (AEIF1)’s life and by June 2016 had raised €710 million commitments from new investors and existing investors.

The process, structured with help from advisers Campbell Lutyens and Clifford Chance, came about after AEIF1’s limited partners (LPs) differed in their wishes regarding the fund’s impending maturity.

Primary term nears close

AEIF1 launched in 2007 (at that time called Babcock & Brown European Infrastructure Fund) but its structure was for a 10-year primary term with an inbuilt 10-year extension option. Under the fund’s documentation 10-year extensions could be repeated, subject to LP consent, making the fund in effect almost evergreen, Arcus Infrastructure Partners’ co-managing partner Simon Gray told IJGlobal in an interview.

Gray said: “At the annual general meeting in 2015, we held an informal discussion with investors and found our investor base was somewhat split in their desires for their infrastructure investments. Roughly one third were committed to the sector for the long-term and wanted to hold the assets as long as they are performing; roughly one third wished to exit, having changed their investment strategies since the original investment in 2007; and one third had not made a decision.”

Certainly for plenty of pension funds and institutional investors the infrastructure sector offers a long-term deposit for their capital. Receiving back the capital gains from a fund when it matures for some brings with it unwelcome reinvestment risk. IJGlobal has learned that other near-mature closed-ended infrastructure funds have been exploring options to continue their funds’ lives also.

Competitive process

To create a secondary transaction for those wishing to take the liquidity, the advisers launched and marketed a two-part competitive auction process. A broad range of institutions in the first stage received high level information on AEIF1’s assets to make indicative offers, then in the second stage the shortlisted group received much more detailed information on each asset.

“One of the advantages of a GP-led process was that we could provide high quality, information rich data which would give potential new investors a higher level of understanding of the quality of the assets and serve to drive pricing, terms and conditions, which is in the interest of existing investors who are the people we are principally seeking to support with the initiative,” explained partner Francesco Nale, who led the transaction team for Arcus.

Dutch pension fund and experienced infrastructure investor APG emerged as preferred bidder to be the lead investor in January 2016, and priced an offer to invest up to €400 million. Arcus expected more sell-side demand than that single bid could provide. Therefore Arcus also ran a syndication based on the same price and terms APG had offered, to involve other institutions with less resources for making valuations.

“It was imperative we ran that competitive process hard to get a strong and respected lead investor to price the deal and set the terms and conditions. They needed to be of sufficient substance to give confidence to all other investors relying on the conditions and price point to transact,” Nale said.

Ultimately as expected about a third of the fund investors, roughly 19 LPs with almost €800 million interest, have opted to sell. A number of existing investors decided to remain while taking up the opportunity to increase their interest at the same pricing. Re-ups accounted for €170 million, while €540 million came from new investor APG and a syndicate of about six LPs, the majority of which are European.

Arcus held two closes raising €710 million approximately – one on 3 March with roughly €620 million and another with €90 million on 2 June. A further stage in the process, not yet complete, will account for the difference to the €800 million sell-side demand.

Next steps for Arcus

For the third of LPs which had said they were not sure if they wished to exit, during 2017 the fund will have a 66%-majority-rules vote on extending the term. But Gray points out that if some were to prefer to exit, Arcus now has established a process for providing new liquidity.

“Infrastructure investments are long term and there is no doubt that the world does change. From where I sit any development in the market which assists LPs to achieve liquidity on good terms and conditions within these closed-ended fund structures is only a positive to the long-term future of the infrastructure sector,” Gray commented

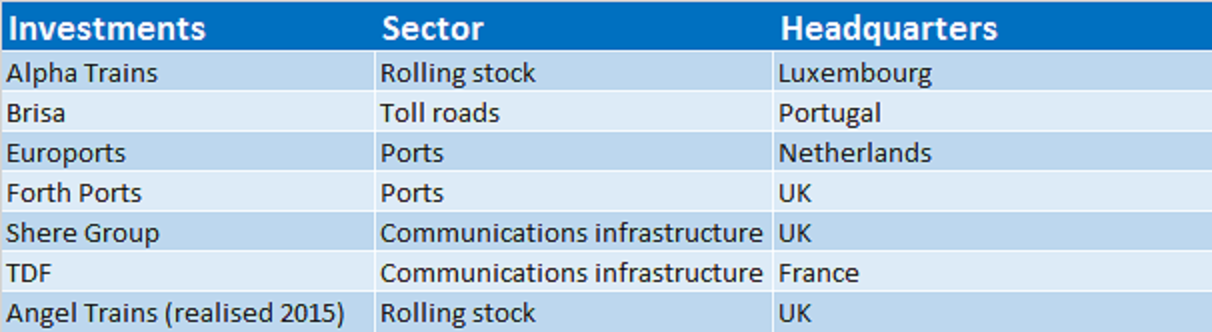

The €2.17 billion AEIF1 fund will not be adding new assets, but there is some capital available for potential bolt-on acquisitions if opportunities emerge.

With various managed accounts as well as AEIF1, Arcus is managing approximately €4 billion of equity capital. Meanwhile, Gray said: “Certainly, given the success of AEIF1 and this initiative in particular, we’ll be looking to increase that further through new fundraising, to take advantage of attractive opportunities we see in the European infrastructure space. It’s very likely we would come to market again in the next few months.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.