Data Analysis: UK infrastructure investment headed for a bumpy ride?

With Friday (24 June) morning's surprise referendum result regarding Britain’s membership of the European Union, fears of declining interest from private investors as a result of the upcoming implementation of Brexit are raising concerns for the UK’s infrastructure sector.

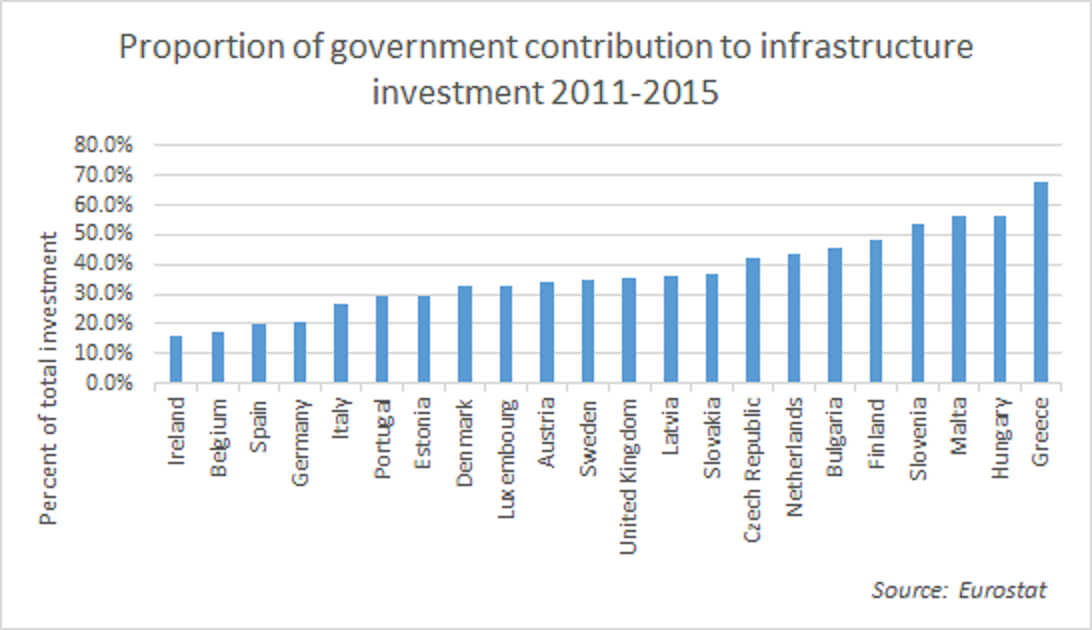

Some industry observers have pointed to the UK's greater dependence on private investment as opposed to government funding for its infrastructure sector compared to that of most EU countries, arguing that this imbalance may make Britain’s exit from the EU more painful for the industry than it would be for other EU members.

Data from Eurostat shows that the UK government’s investment in infrastructure stood at 35.4% of the overall UK infrastructure investment between the 2011 and 2015 period. In comparison, 11 other EU countries recorded lower percentages, including figures as low as 16% and 17% for Ireland and Belgium, respectively. Others like Malta, Hungary and Greece recorded over 50%.

Government funding notwithstanding, it still does not bode well for the UK if private investment declines as the country's withdrawal from the EU is carried through. Like most EU countries, the UK’s infrastructure industry still depends on the private sector for most of its investment.

And the UK’s dependence on private investment for developing new infrastructure is likely to increase in the future. According to the National Infrastructure Delivery Plan launched in 2016, the government expects £425 billion ($624 billion) to be invested in over 600 infrastructure projects and programmes across the UK over the next five years, but only £100 billion of this investment will come from public sources.

With industry participants saying a retraction in private infrastructure investment is the most likely result of carrying out Brexit, after Friday, fears of the impact of this on the infrastructure sector are very real. Even before the referendum, the uncertainty surrounding Britain's decision to leave or remain in the EU had already taken its toll.

Ratings firm Standard & Poor's managing director of infrastructure finance in London, Mike Wilkins points out that while a growing number of UK infrastructure transactions were launched in the years that followed the global financial crisis, the figures have now been declining ever since talk of the EU referendum started.

According to IJGlobal data, while the number of newly launched energy and infrastructure projects rose in 2013 and 2014, the figures began to decline last year.

Infrastructure industry members also point to the UK’s growing dependence on investment from overseas in particular and say this may now be eroded as the country leaves the EU, but some UK domiciled investors see attractive opportunities in Brexit.

Over the last few years, the UK government has increasingly courted investment from countries with large sovereign wealth funds like China, Singapore and Qatar, noted Wilkins. With many still reeling from Friday's result, opinions are divided on whether these countries will be equally interested in investing in the UK once it exits the EU, but many UK domiciled pension funds, who have typically seen themselves crowded out by overseas investors, perceive Brexit as an opportunity to increase their investment in UK infrastructure projects as foreign investment wanes.

Whether UK investors are able to mobilise investment now that Brexit is an unavoidable reality set to unfold over the next two years, only time will tell.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.