Data Analysis: European wind and solar M&A on the rise

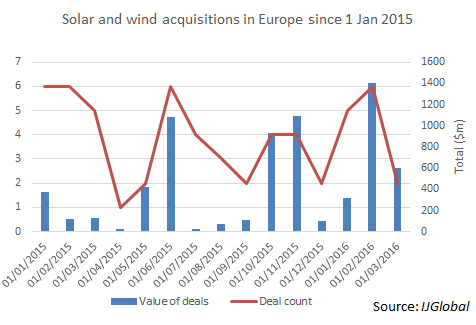

The total value of wind and solar acquisition deals reaching financial close in Europe has seen a steady increase since the start of 2015, according to IJGlobal data.

IJGlobal has tracked sixty wind and solar acquisitions which have closed across Europe since the start of 2015, with a total transaction value of $6.7 billion.

It seems that while deal flow has experienced peaks and troughs, the value of deals has continued to rise. Since the third quarter of 2015 in particular, monthly total transaction values have shown a marked increase, peaking with over $1.4 billion of closed transactions in February 2016.

The increasing scale of projects may contribute to this volume growth. For example, Greencoat UK Wind and GLIL, a joint venture between the London Pensions Fund Authority and the Greater Manchester Pension Fund, purchased a stake from SSE in the 349.6MW Clyde wind farm in Scotland for £355 million ($500.3 million) this month. The farm is one of the biggest in the UK.

But even without this deal, UK wind and solar still would have seen a significant increase in total acquisition transaction deal value. In that region, four other deals totalling $380 million have closed since the start of 2016.

What has changed over the period? The UK was home to over half of the total transactions over the period – 31 out of a total 58 transactions.Activity in the country may have been spurred by a change from coalition government to Conservative Party majority rule in May last year. The UK has also followed a trend seen elsewhere in Europe of utilities looking to take advantage of increasing liquidity in the market to unload non-core assets.

Capital recycling by developers will remain a trend during the rest of 2016. SSE has said it plans to spend the proceeds it raised from the Clyde selloff, for example, to invest in new greenfield projects.

Continued growth in the secondary market for European renewables may also be indicative of increased comfort with the sector’s risk profile, particularly at the pre-operational stage. ERG, for example, will fund construction as part of its recent acquisition of the 45MW Brockaghboy wind farm in Northern Ireland from TCI Renewables.

The Clyde deal, which closed on 18 March 2016, was also indicative of another trend for 2016, that of local UK pension funds making designs on the renewables sector. By clubbing together, the fragmented local pensions market in the UK hopes to start mimicking the pooled local authority funds seen in the US, Canada and Australia. These newcomers bring increased appetite and competition for wind and solar assets, as well as the ability to take large ticket sizes.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.