Data Analysis: Water projects in MENA

The value of active pipeline and procurement deals in the water sector in the Middle East and North Africa (MENA) region has grown by 10% on year, according to IJGlobal data.

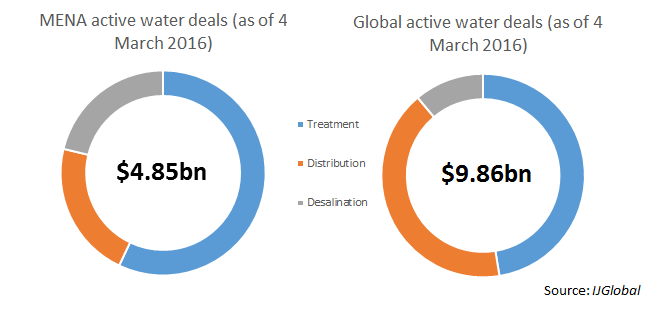

Total value of the active deals in MENA’s water sector (including distribution, treatment and desalination) has grown to almost $4.9 billion as of 4 March 2016 compared to $4.4 billion a year previously. The global value of active pipeline and procurement deals – including subsectors of water and cross-region deals - stands at a total value of $9.86 billion.

The desert conditions of the MENA region and rising populations of many of its countries means demand for water projects will continue to grow. Peaks in desalination, treatment and distribution development tend to be cyclical, as MENA states periodically build up capacity to meet future rising demand.

The recent increase in the total of active MENA deals has been spurred in particular by Egypt’s stated pipeline for public private partnerships (PPPs), which brought around $1.1 billion in new projects to the market, as reported first by IJGlobal in October last year.

The largest active project in the market is the Umm Al-Hayman waste water treatment PPP in Kuwait, with an anticipated value of $2 billion. Kuwait’s Authority for Partnership Projects is in the process of tendering a sponsor for Umm Al Hayman and recently extended the deadline for bids to 28 April 2016.

Caveat Emptor

IJGlobal defines active deals as those having materially progressed towards completion during the previous 36 weeks. Though there are a number of active deals in the water sector in MENA, investors have reasons to limit their optimism.

Kuwait has a poor record of delivering on its PPP pipeline, making the delivery of Umm Al Hayman less than a certainty, and other deals in the market also face significant challenges.

Despite the high value of Egypt’s pipeline, the viability of the country’s PPP projects has been called into question. The Abu Rawash wastewater project had been expected to sign last year but is struggling to reach completion with a lack of dollars available and the Egyptian government unwilling to absorb the currency risk.

Other water projects in Egypt’s PPP pipeline include the El Tor, Safaga, and El Alamein desalination plants.

The Red Sea-Dead Sea canal project’s first phase has fit the definition of being an active project for a number of years since it was announced in 2001, with six consortia applying to develop the project in 2012. The tender process for Red Sea-Dead Sea was revived again in late 2015 but has already been altered, with the deadline to acquire tender documents extended by two months to 30 March 2016.

Despite this, at least one other project yet to reach financial close looks as though it could be bankable; the Sohar desalination plant in Oman, which developer Valoriza is seeking financing for. Its counterpart project – Barka – is similar in size, and last week sponsors Itochu, Engie and W.J. Towell signed on debt and water purchase agreements for the $300 million project.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.