Data Analysis: Project bonds restrained

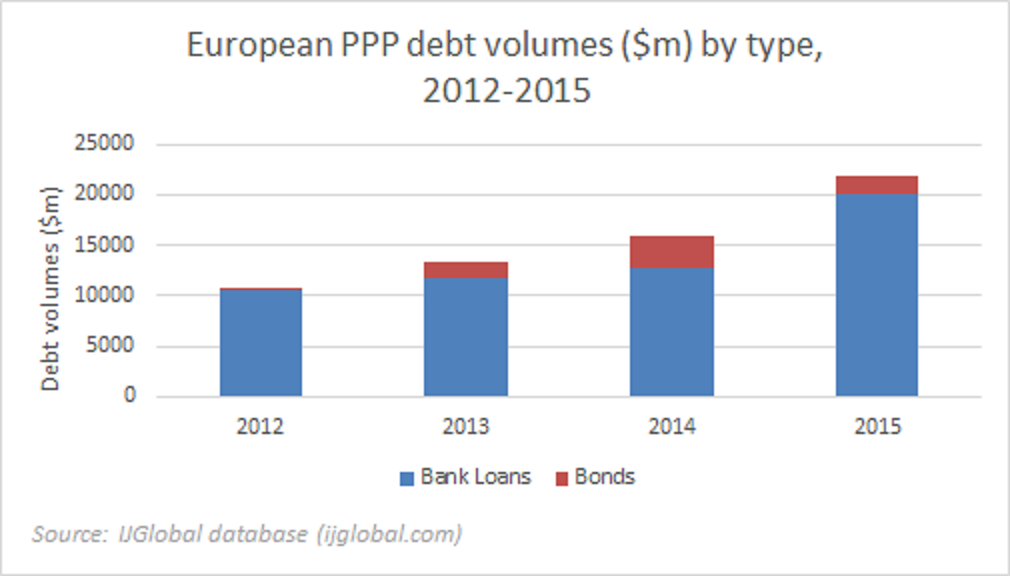

The volume of project bonds for European PPPs grew considerably between 2012 and 2014 but contracted again in 2015, according to IJGlobal data. Meanwhile bank loans rose in volume and as a proportion of total debt for the sector last year.

European infrastructure projects before 2012 had featured bond debt but these were typically wrapped by monoline insurers. Since the exit of monoline insurers from the sector, bond deals have taken a different shape.

The volume of bond financing for European PPP in 2012 was just $57.5 million, and related to just one deal - the Rochdale Building Schools for the Future bond financing. This level then soared to $1.67 billion in 2013 and then $3.34 billion in 2014. These are year-on-year percentage increases of 2,811% and 99.7%, respectively.

But in 2015 the volume of project bond deals fell 46.7% to $1.78 billion, while bank loans jumped 57.8% on 2014 levels.

The project bond has been used as a source of finance during the construction phase several times over the last three years on European PPPs, as well as for toll roads where strong operational performance is demonstrable.

Institutional investors – particularly pension funds and insurance companies – have the long-dated liabilities to make them a natural suitor for low risk, low returns availability payment-backed PPP infrastructure debt of 30 years or more. Their fixed-rate coupon also provides a natural long-term hedge for the borrower.

Sponsors for the Calais Port expansion PPP raised an enormous €504 million pre-construction 40-year project bond in 2015, with AllianzGI the sole subscriber to the debt.

The flexibility of commercial bank debt has historically made it much more attractive to project developers than bond financings, but Stewart Robinson, European head of project and structured bonds at Societe Generale, argues that this is no longer the case. “The project bond is already competitive with bank debt," he said. "There is no remaining need for an evolutionary step.”

Robinson explained that over the last three years institutions’ ability to offer deferred drawdowns over the construction period has addressed the negative cost of carry. Inter-creditor and voting mechanics have also been developed in order to give sponsors comfort on the responsiveness and ability of institutions to handle due diligence and make decisions on borrower requests for waivers. “It is really just the pricing point at the moment, affecting the sponsors’ choice.”

There are a handful of banks in Europe still running large project finance teams. In order to keep market share over the last two years they have offered tenors of up to 30 years and reduced their pricing spreads to close to 100bp for PPPs. This pricing environment is the most aggressive seen in the region since 2007/2008.

Due to these aggressive terms, bank loans regained market share in 2015. The incentives to refinance PPP bank debt with a project bond are also reduced by potentially hefty swap breakage costs.

The lower costs associated with bank loans has tarried against the project bond product realising its full potential, and taking a leading role on infrastructure PPPs in Europe.

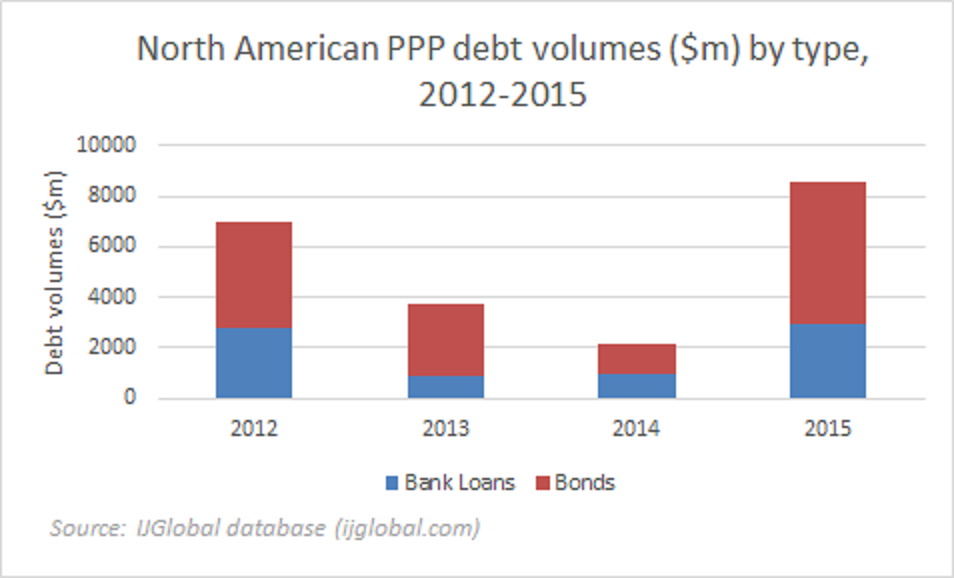

The state of the PPP market in Canada and the US would back up the assertion that the project finance market functions well when institutional investors take the lead as long-term lenders. In North America the majority of PPP financing comes from project bonds, and IJGlobal data shows an almost reversal of the trends seen in Europe over the last few years.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.