LT analysis: Flight to maturity

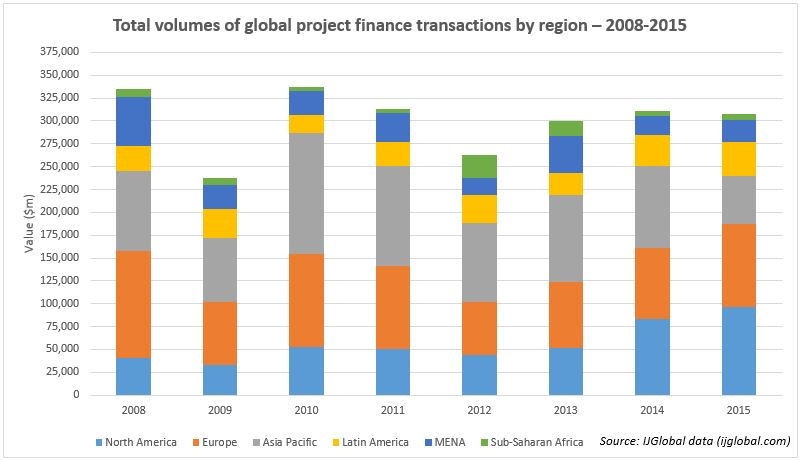

IJGlobal's full-year league tables show that the total value for all transactions reaching financial close globally during 2015 was only fractionally up on the previous year. Global investment into project finance transactions rose to $309.1 billion in 2015, compared to $308.4 billion in 2014. However, investment shifted decisively to more mature markets.

While investment into Latin America and the Middle East and North Africa remained steady, and grew slightly in Sub-Saharan Africa, the total volume of transactions closed in Asia Pacific declined steeply. A total of $85.1 billion of transactions reached financial close in the Asia Pacific region 2014, whereas the 2015 total was just $52 billion.

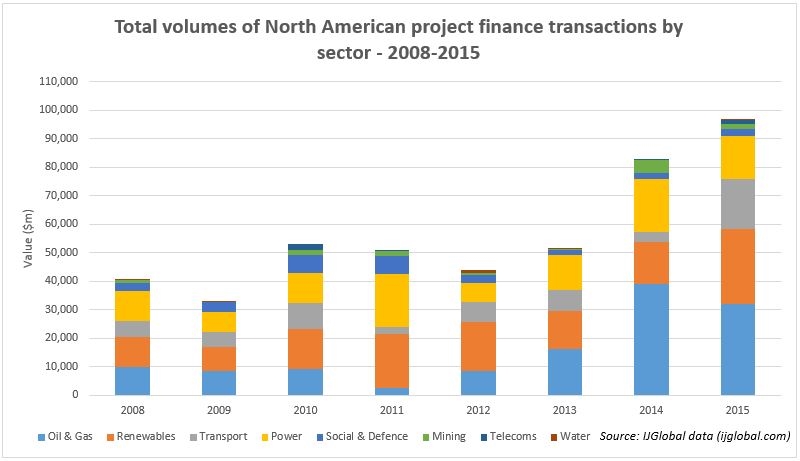

The weakening of some of Asia’s economies can be blamed for some of this downturn, though the biggest contributory factor is probably depressed commodity prices. Plummeting oil prices caused a halt on many capital-intensive oil and gas projects during 2015, but more mature regions were able to counterbalance this with greater investment in other sectors.

North America also saw a big reduction in oil & gas transaction values, but investment in renewables and transport grew by roughly $12 billion and $14 billion, respectively, compared to 2014. This trend is replicated in Europe, where clear rises in renewables and transport investment were accompanied by an almost $4 billion increase in investment into social & defence projects, to $9.8 billion.

The universe of investors has grown significantly in the last few years to include an increasing number of institutional investors. While these institutions are becoming increasingly open to a variety of assets across the infrastructure space, the majority still prefer stable returns in less volatile markets. This makes mature market projects with revenues derived from reliable contracts (transport/social defence), or from heavily regulated markets (power/renewables) the most attractive.

That concentration of interest led to highly competitive debt pricing in mature markets, particularly in Europe, although global interest rate rises and banking regulation may deflate this effect somewhat in 2016. One trend present in the 2015 data for Europe and North America which is set to continue this year however is the growth in renewables investment, spurred on by lower costs and governmental commitments to reduce carbon emissions.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.