Data Analysis: European refinancing in 2015

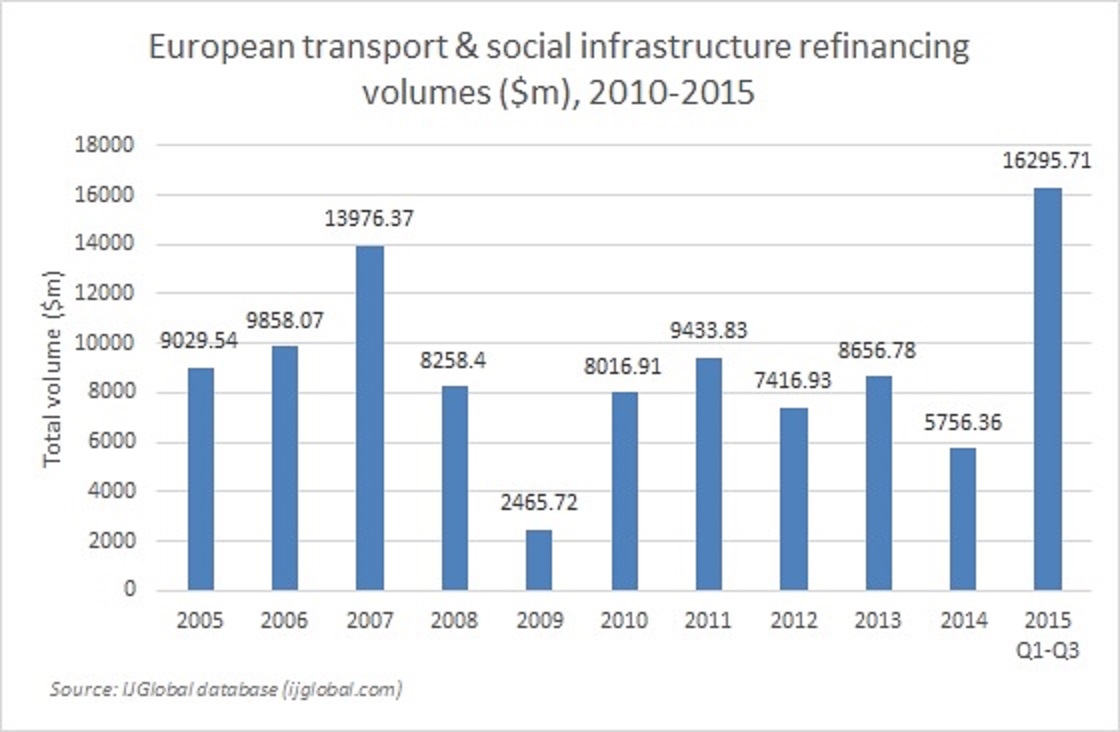

IJGlobal data shows that the level of refinancings in the first three quarters of 2015 already reached a volume unprecedented in the last 10 years, for European infrastructure project finance.

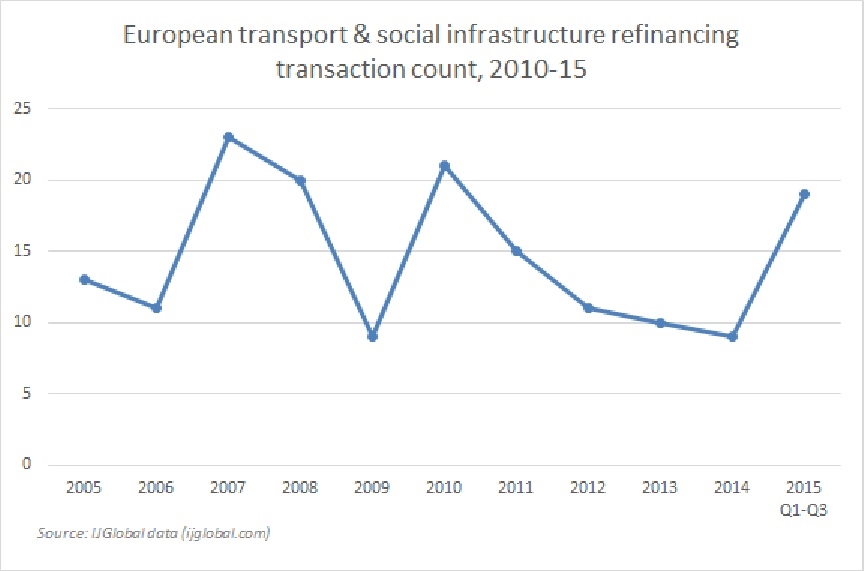

The total volume of refinancings in transport and social infrastructure that reached financial close in the three quarter period in 2015 was $16.3 billion approximately, with 19 deals.

This level is already significantly above the full year refinancings volume for 2007 ($13.98 billion), which was a peak before the economic crisis. In 2007, the deal count was not much further ahead at 23 in total. By the end of Q3 in 2007, the total transaction volume had only reached $7.01 billion, less than half the amount for 2015.

IJGlobal has heard however that lenders are pricing in extra basis points already. One banker at a top three MLA for European infrastructure league tables this year told IJGlobal in late November that they are pricing in an extra 20bp in anticipation of base rate rises and their requirements for held capital rising with Basel III.

If a window is soon to draw in, then the data shows that many sponsors and grantors have acted with favourable timing.

Refinancing volumes bottomed out in 2009 at $2.47 billion, after the financial crisis stripped lender liquidity and increased costs of funding and pricing significantly across Europe. 2014 offered the second lowest volume of refinancings ($5.76 billion) and both years saw only nine transactions. While refinancings may have launched in 2014, as investors reacted to the downward trend for pricing, many would take until 2015 to close.

2015 was a particularly strong year for the transport sector, in which 16 refinancings closed, worth $13.98 billion, rather than social infrastructure where similar deals were worth only $2.32 billion. These were Garbagnate Hospital in Italy, Staffordshire LIFT refinancing in the UK and the $2.23 billion Flemish Schools PPP refinancing.

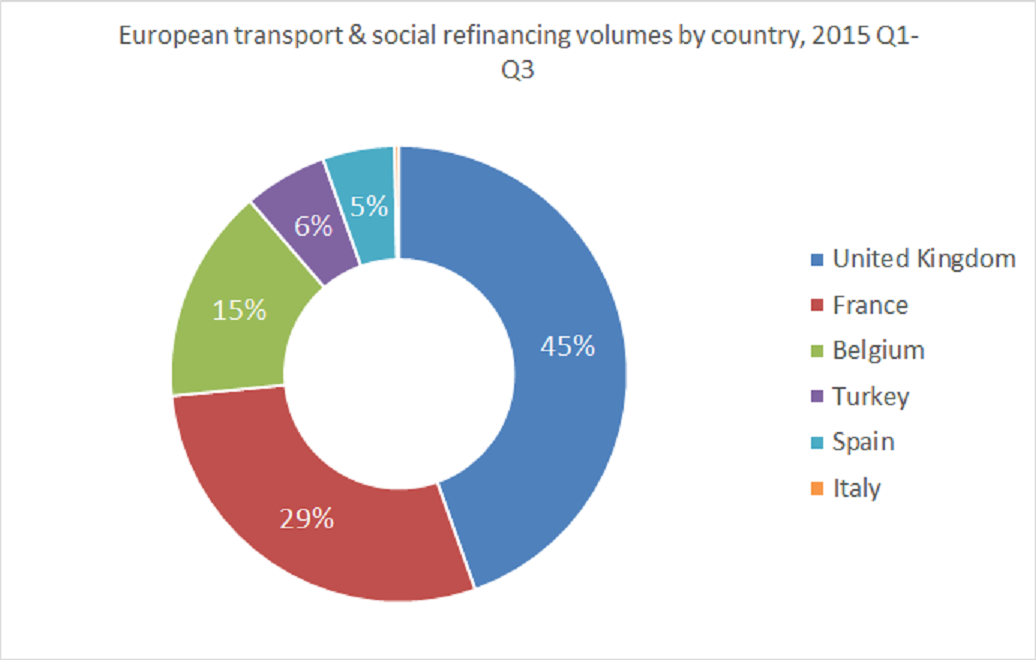

The highest volume of refinancings came from the UK ($7.27 billion), followed by France ($4.7 billion). The largest 2015 transactions were Intercity Express 1’s refinancing, the Thameslink refinancing and French toll concessionaire APRR’s.

Whereas some refinancings come about when the first debt package matures, several this year have launched to take advantage of the shrunken pricing margins.

The two UK rail deals took place at the Department for Transport’s (DfT) instigation before the manufacturers had delivered the trains. The DfT reserved the right to launch a refinancing if interest rates became more favourable. The margins achieved for the deals are 120bp over Libor (IEP1) and 125bp (Thameslink).

The A63 in France is a year in to operations, and has managed to refinance to obtain a reduction in pricing to 135bp above Euribor for the first eight years, down from a previous mini-perm that started at 250bp and would have risen to 350bp.

New refinancings that should reach financial close next year include the Balard Ministry of Defence PPP in Paris, the M80 in the UK, Madrid Transport Hubs, the A8 shadow toll motorway in Germany and the Prado Sud Tunnel in France.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.