Data Analysis: Asia-Pacific investment volumes

Asia Pacific’s infrastructure deficit is vast but the number of bankable deals is still small, leading to patchy deal flow and wild fluctuations in investment volumes when comparing one year to the next.

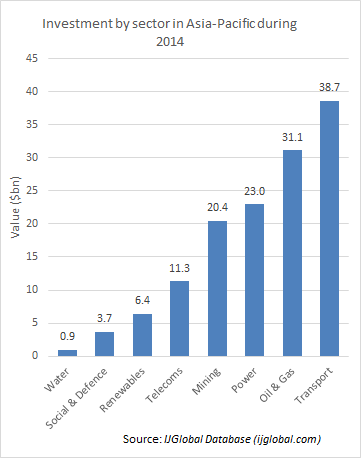

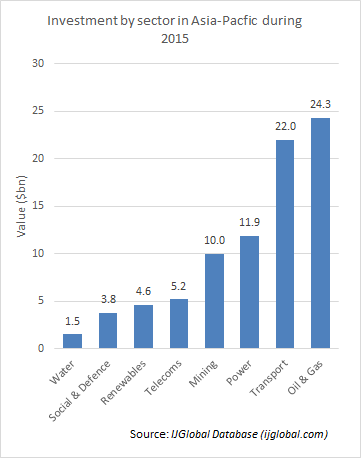

Data from IJGlobal shows that the cumulative investment total for Asia Pacific for the year-to-date is down almost one third on last year’s total, falling from around $145 billion to slightly over $100 billion. This decline is the case across nearly all sectors with transportation, mining, oil & gas and telecoms experiencing the largest dips in volume.

The collapse in commodity prices and the deterioration in the health of some of Asia’s economies has impacted investment volumes considerably. This explains the reduction in investment in the mining and oil & gas sectors, down by around a half and a quarter each, respectively.

The drop in investment in the transportation sector, traditionally considered counter-cyclical as governments seek to invest in economic infrastructure during downturns to boost productivity, shows that Asia’s inadequate procurement process is more to blame for the patchy deal pipeline.

“It has felt like a very busy year even though the number and volume of deals reaching financial close has been lower than we’d like” says Bill McCormack, partner at Shearman & Sterling. “I think this is more a consequence of the timing of specific deals rather than a function of the market itself. We are currently working on a number of deals where closing is expected to happen in early 2016. And notwithstanding the oil price environment we do have a number of early stage oil and gas projects.”

The Asia-Pacific region had a bumper year in 2014, with several large deals closing such as the $2.8 billion Donggi-Senoro LNG project, the $1.5 billion Sarulla geothermal project, and the $9 billion Roy Hill iron ore project.

The largest financing to date this year has been the $1.5 billion Sydney Light Rail PPP and several large deals in financing, such as the Central Java power project, the CHP5 combined heat and power project, and possibly the Oyu Tolgoi mining deal, look likely to drag into next year.

The final quarter of this year will likely prove more fruitful than the previous three. Hastings and its consortium partners are aiming to close the $7.5 billion acquisition of Australian electricity distribution company TransGrid before year-end, which would act as a significant boost to total investment figures. This is unlikely to be enough though to raise investment volumes to last year’s level however and until Asia's various procuring agencies improve their ability to bring bankable deals to the market the region will continue to experience vast swings in deal volumes from one year to the next.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.