The return of international lenders to MENA power?

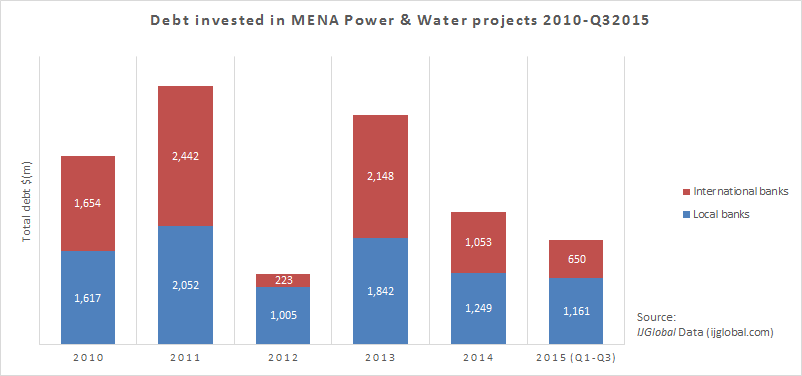

International lenders have provided less proportionally than local banks to Middle East and North African power and water deals during the last two years, IJGlobal data shows. There are signs that international bank lending may rebound in the region however, as local banks feel the impact of lower oil prices.

Investment in power and water projects rebounded strongly in 2013, after a record low year for the sector caused primarily by the delayed impacts of the global financial crisis. Investment levels have declined since 2013 however.

Local banks have been flush with liquidity in recent years, and have been increasingly keen to play leading rather than supplementary roles on transactions. A watershed came in January 2014, when the Ras Abu Fontas A2 desalination project reached financial close. It was the first project financing in Qatar to only feature local lenders.

This trend may be about to reverse however, with depressed oil prices expected to curtail local bank lending. Most regional project finance banks, particularly in the Gulf states, are heavily exposed to oil prices.

Some international lenders look primed to step into the breach. French banks for example had been significant lenders in the region, but retreated as capital controls started to be imposed at the beginning of this decade. Societe Generale has recently opened an new office in Dubai however and is now actively looking for MENA project finance deals again.

A bell-weather for this trend may be the Facility D independent water and power producer project, again in Qatar. The $3 billion deal is expected to reach financial close before the end of the year. Qatari bank QNB will be the only local lender on the deal, which will see the vast majority of debt come from Japanese banks.

QNB is also lending on the Gulf of Suez wind project in Egypt, which may also close before the end of the year. It will again be the only regional bank participating however, with the rest of the bank club made up of international institutions, including Societe Generale.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.