Data Analysis: Brazil’s time to shine

Investment into Brazilian infrastructure, particularly in the transportation and oil and gas sectors, has been hampered by the recent economic downturn and a sprawling corruption scandal involving many major developers. By contrast, investors still appear convinced by the economics of wind and solar in Brazil.

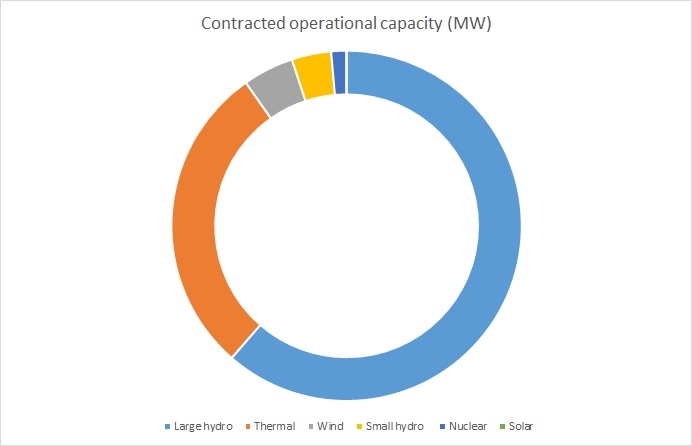

Like many Latin American countries, Brazil has long-since relied heavily on hydro generation to meet its power demand, and in particular the construction of large, capital intensive dams. According to Brazil's national power agency Aneel, it has awarded supply contracts to over 87GW of operational large hydro plants. But devastating drought in recent years has thrown the reliability of hydro power into question.

Source: Agência Nacional de Energia Elétrica (Aneel)

While Brazil has pioneered innovative biofuel generation, it has been a relative latecomer to wind and solar, and currently has some of the fiercest untapped resources in the world. Brazilian wind association ABEEólico estimates the country's wind potential at about 300GW.

Wind power facilities presently account for around 5% of the operational installed capacity and solar facilities just 0.02%. Though the government’s energy policy is decisively in favour of boosting these industries. In June 2015 President Dilma Rousseff pledged that by 2030 Brazil would generate 20% of its energy sources from non-hydro-based renewable energy sources.

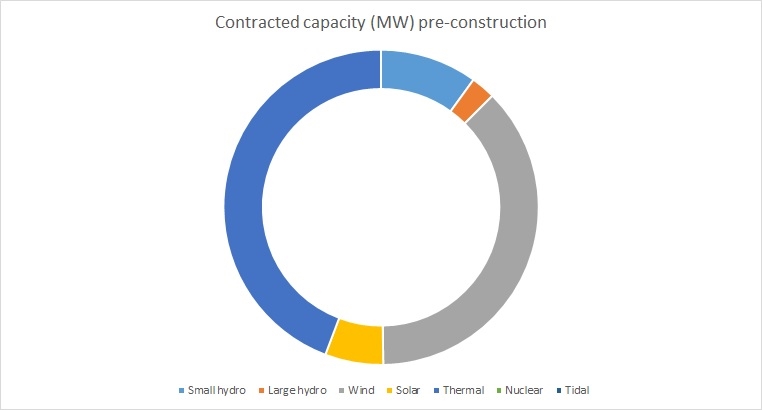

Wind’s share rises to 37%, solar’s to nearly 6%, of projects in the pipeline - which have been awarded power purchase agreements (PPAs) by Aneel but not yet begun construction – while the allocation of large hydro projects falls to a little over 2%.

Wind is the fastest growing renewable source in Brazil and is one of the most competitive in terms of price. In an August 2015 reserve energy auction, 19 of the 29 winning projects were wind-based. These ventures fetched an average price of R181.14MWh, just under the ceiling price set by Aneel.

Aneel included a specific allocation for solar PV projects for the first time in a reserve auction in November 2014 in which more PV projects won capacity than wind. It held the first solar tender the following August. Contracts were won for an average price of R301.79MWh, 13.53% below the referential rate.

The next tender for wind and solar (exclusively) contracts is due on 13 November, but ceiling prices are marginally higher overall. Bids for wind energy must sit below R213.00/MWh and R381.00/MWh for PV. Whether or not increased costs of funding and exchange rate volatility deter investors is crucial for Brazil. Many local players have been hit by the economic downturn and have less capital readily available to invest in projects. The government hopes that new foreign firms will be persuaded to enter the sector.

According to the Ministry of Mines and Energy (MME), 1,379 projects – with a combined 39,917MW of capacity – have registered to compete in the upcoming process.

Source: Agência Nacional de Energia Elétrica (Aneel)

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.