Data Analysis: Europe set for record year in infrastructure M&A

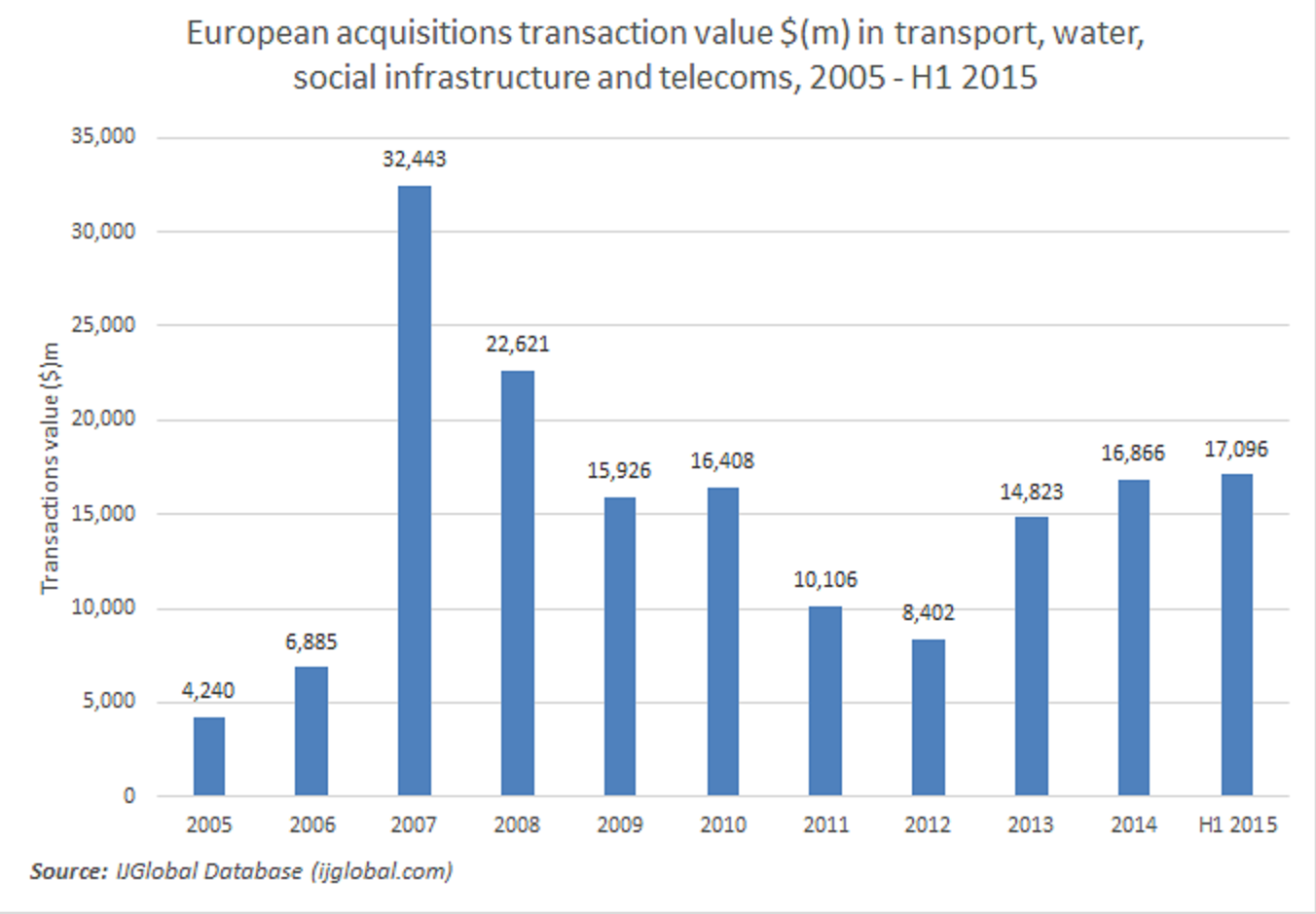

A high volume of acquisitions in the year-to-date suggests that 2015 year could surpass 2007 as the most active year for infrastructure mergers and acquisitions (M&A) over the last decade.

IJGlobal data for the transport, telecommunications, social & defence and water sectors shows transaction volumes for H1 2015 at over half the total for the 2007 full-year period.

Before the 2008 financial crisis, M&A deal levels rose globally as sustained worldwide economic growth looked set to continue. Companies looked to expand internationally, stock markets performed well and liquidity was high.

Total M&A transaction value for the region peaked in 2007 at approximately $32.4 billion. The largest deals were Macquarie’s acquisition of National Grid Wireless based on an $8.7 billion transaction value, the $4.7 billion acquisition of Airwave Telecoms and RREEF’s purchase of 49% of Peel Ports with a $3.1 billion transaction value.

A total of 17 transactions were recorded during 2007, however for H1 2015 alone IJGlobal data shows 19 transactions have closed. At $17.1 billion H1 2015 is ahead of the first half of 2007, which saw seven deals with a $13.05 billion total transaction value,

There were a few direct pension funds, as well as infrastructure funds, investing in the sector in 2007. But the number of infrastructure funds, pension funds, sovereign wealth funds and insurers from across the world investing in the space has grown rapidly in recent years, pouring fresh liquidity into the market. Competitive bidding for infrastructure assets has led to higher bid prices, while a highly liquid lending market has pushed debt margins lower.

Another factor spurring activity is closed-ended funds launched between 2005 to 2007, such as Global Infrastructure Partners and Macquarie European Infrastructure Fund, approaching the end of their lives and selling assets.

Sellers are clearly making the most of the flush buyer competition.The biggest deals in H1 2015’s dataset were Altice’s acquisition of Oi’s telecommunication assets in Portugal at $8.34 billion, the acquisition of TDF’s French telecoms business for $2.69 billion and the $2.47 billion sale of 33.3% of Associated British Ports.

An infrastructure fund manager said they expect telecoms sales to grow in number soon as large companies divest towers portfolios to invest in the latest broadband technology.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.