Renewables in Thailand post-adder

Thailand’s Council of Ministers has finally approved the country’s 2015 Power Development Plan. The new PDP forecasts that the amount of energy generated from renewable sources will more than double by 2036 to 14,206MW (including hydro imported from Myanmar and Laos). Out of this figure, solar and wind count for the largest increases, up from 1,298.5MW to 6,000MW and 224.5MW to 3,002MW respectively.

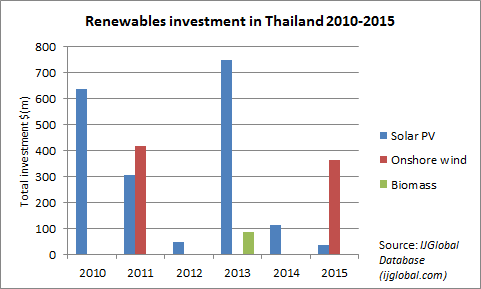

Out of these two, Thailand’s solar sector has experienced the most success. Data from IJGlobal shows investment in solar photovoltaic (PV) peaked in 2013, surpassing the $700 million mark. Thailand’s adder programme, which was first introduced in 2007 and provides developers with an additional payment on top of wholesale electricity prices, has been hugely popular with investors spurring high levels of investment in the sector.

The adder programme was so successful that the government was forced to cut the adder rate in 2010 from Bt8/kWh to Bt6.5kWh. The government also sought to gradually phase out the programme, replacing it with a less popular feed-in tariff. State utility EGAT had however already signed power purchase agreements with several projects which were only due to come online much later, and so financing volumes in solar PV only started to fizzle out in the last two years.

Thailand’s wind sector, which has traditionally run a poor second to solar, has started to show some promise. Two major projects, Wind Energy Holdings’ Bt6.4 billion ($179 million) Nakhon project and EGCO’s Bt5.4 billion Chaiyaphum wind project have already reached financial close this year. Thailand’s wind resources outside of the northeast are poor although a cluster of projects are still awaiting approval from the new government, so this year’s figures may not be an aberration.

If Thailand is to meet the targets outlined in the 2015 PDP and reduce its dependence on natural gas, then the country will likely have to increase the capacity of energy generated from renewable sources. As biomass’ patchy history alludes to however, this does not necessarily translate into an uptick in financing volumes. Thai lenders continue to struggle to finance biomass deals because of the poor creditworthiness of fuel suppliers.

As Thailand's renewable sector adjusts to a new post-adder reality, the government will hope the demand for new wind and solar generation will not outstrip the supply of ready available financing.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.