Data Analysis: European transport refinancings peak

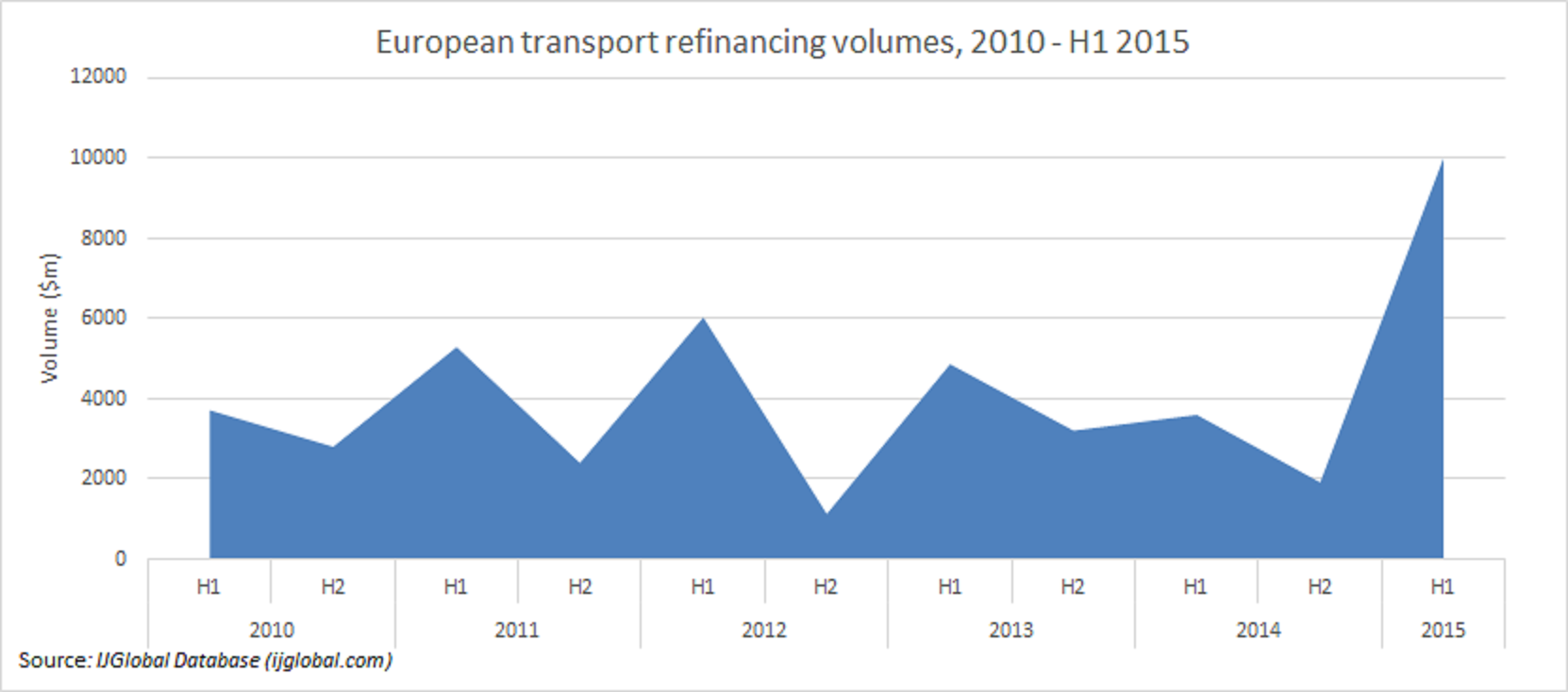

The first half of 2015 saw a conspicuous growth in refinancings in the European transport sector in comparison with levels seen over the last five years. High liquidity and the resuting low debt pricing has offered a window of opportunity for borrowers to make savings.

The European total transaction volume for refinancings was approximately $10 billion for the first half of 2015, representing a year-on-year rise of 177.9% from the first half of 2014.

Global interest rates have been falling since 2013, with this trend particularly pronounced in Western Europe. The region has also seen increased competition between lenders, with a growth in the number of banks and institutions competing in the space. As a result European PPP debt has been closing this year with margins as low as 100bp floating rate.

Many market observers perceive that debt pricing in the ultra-competitive European transport market has hit rock bottom, and sponsors have been taking advantage of this to enact early refinancings.

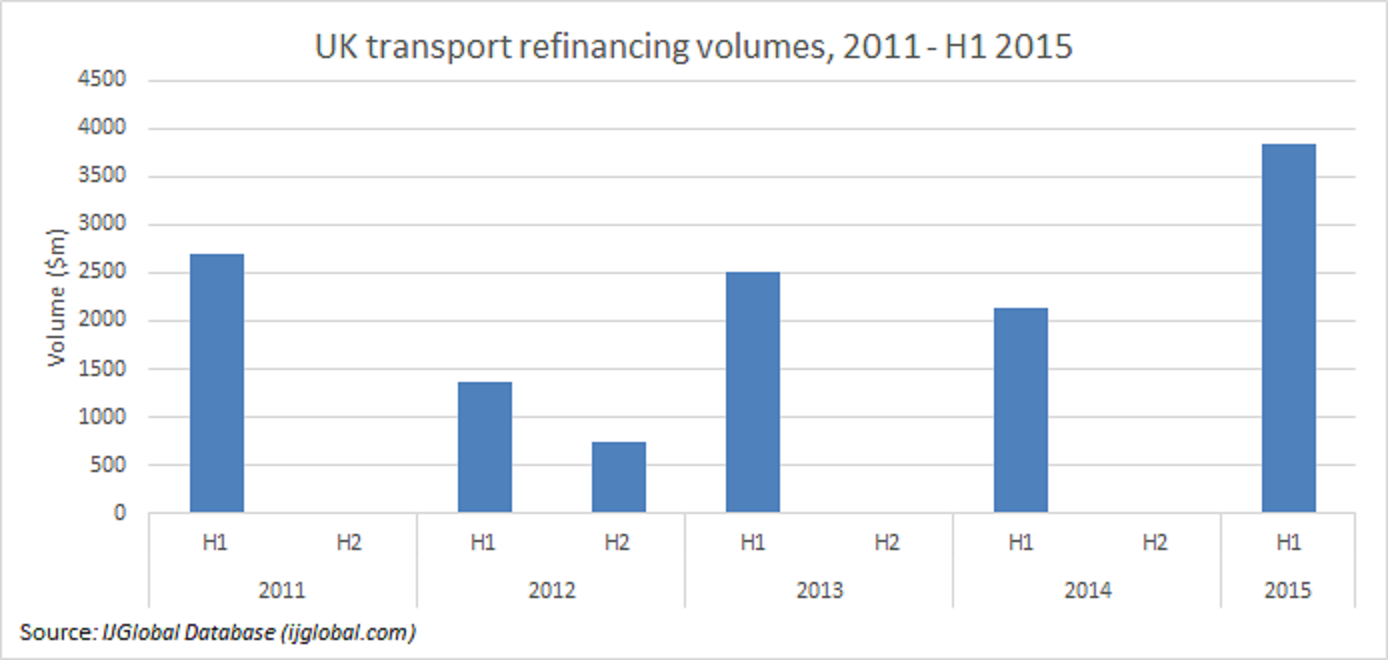

The refinancing trend has been most pronounced in the UK market, with refinancings in the UK accounting for 29.5% of the total European volume over the five-year period. The high number of UK refinancings may be reflective however of its high number and long history of private financings for infrastructure compared to other countries.

The total volume of UK refinancings was roughly $3.85 billion in H1 2015, after a quiet second half of 2014. Volumes were 80% higher during the period year-on-year.

IJGlobal data records four UK transactions in H1 2015, double the number from H1 2014. The largest refinancing was the Thameslink rolling stock procurement in the UK at approximately $2.48 billion. The other deals were Bristol Airport at $536 million, Luton Airport which was $471 million, and the Channel Tunnel Rail Link (HS1) refinancing of $365 million in debt.

For the Thameslink deal, which only signed the original debt two years ago, the exercise was a repricing that the Department for Transport enforced to capitalise on the low pricing in debt markets. The refinancing resulted in 20-year debt with a starting margin of 120bp over Libor rising to 150bp. This was down from an initial 265bp in the 2013 deal.

UK transport refinancing volumes should remain high during the second half of 2015, with similar Department for Transport-led refinancings. Refinancings for both the Intercity Express Programme first phase (IEP1) rolling stock and England’s M25 road widening project are expected.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.