Data Analysis: US conventional power investment increases as renewables investment recedes

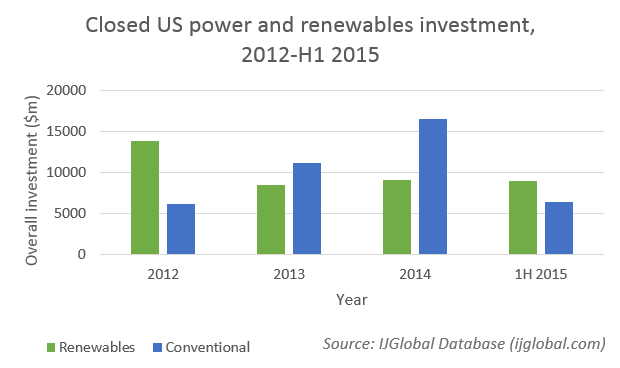

Conventional power investment in the US increased from 2012 to 2014, while renewables project investment has mostly fallen over that period.

In 2012, almost $14 billion of investment closed for renewables, according to IJGlobal data. That year, about $6 billion closed for conventional power. But in 2014, that dynamic reversed; conventional power closed more than $16 billion of investment, while renewables closed $9 billion.

Conventional power owes its increased deal volumes to a rise of greenfield gas-fired projects, and specifically those located in the PJM Interconnection market (spanning the mid-Atlantic) and in New England. Both markets anticipate increased energy demand due to the retirements of older coal- and oil-fired plants. Furthermore, gas-fired projects in PJM are also situated near cheap natural gas found in area shale basins, including the Marcellus.

A spate of gas-fired projects closed in 2014 and more should close by year-end 2015 in New England and the PJM market. Panda Power Funds’ 778MW Stonewall in Virginia, Competitive Power Ventures' 725MW St Charles in Maryland and Energy Investors Funds' 869MW Oregon Clean Energy in Ohio are among the projects that closed financings in 2014.

The first half of 2015 showed a modest volume for conventional power, but many large gas-fired projects are in early stages of financing and should close by year-end. Most are located in PJM, which includes Maryland, Ohio, Pennsylvania and West Virginia:

|

Sponsor/Developer |

Project name |

State |

Size (MW) |

Status |

|

NTE Energy |

Ohio |

525 |

Debt launched |

|

|

NTE Energy |

North Carolina |

475 |

Lead banks mandated |

|

|

NTE Energy |

Texas |

237 |

Early |

|

|

Panda |

Pennsylvania |

1,000 |

In talks with lenders |

|

|

Panda |

Maryland |

859 |

Early |

|

|

Invenergy |

Lackawanna |

Pennsylvania |

1,300 |

In talks with lenders |

|

Clean Energy Future |

Ohio |

940 |

Equity raise |

|

|

Energy Solutions Consortium |

West Virginia |

565 |

Advisor mandated |

|

|

Advanced Power, GE, Marubeni |

New York |

1,000 |

Early |

|

|

Moxie Energy, Caithness |

Pennsylvania |

900 |

In talks with lenders |

|

|

CPV, GE |

Connecticut |

785 |

In talks with lenders |

Meanwhile, fewer utility-scale greenfield renewable projects are seeking finance today than in 2012, which has contributed to the fall in investment. Renewables often need long-term power purchase agreements (PPA) to be financeable, but such contracts have become scarcer as states reach their mandated renewable portfolio standards.

So, the renewables markets have had to become more differentiated to find opportunities.

Since 2013 wind financings underpinned by hedges – in lieu of PPAs – have become more common, especially in Texas. Alterra and Starwood’s Shannon wind and Pattern’s Panhandle 1 wind farms have closed with hedges.

Portfolios of distributed generation (DG) solar projects are also seeking finance today. Smaller projects are finding PPAs with homeowners and corporates. SolarCity has closed three securitisations backing DG portfolios, and began marketing a fourth this week. Sunrun, True Green Capital and AES have all closed commercial bank debt backing residential solar portfolios.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.