Data Analysis: The European gas grid selloff

European utilities’ need to relieve stressed balance sheets has prompted sales of gas grids, and existing investors are increasing their shareholdings in the assets.

The secondary market for European gas transmission and distribution assets has been buoyant for more than three years. The activity precedes and succeeds the global collapse in commodity prices.

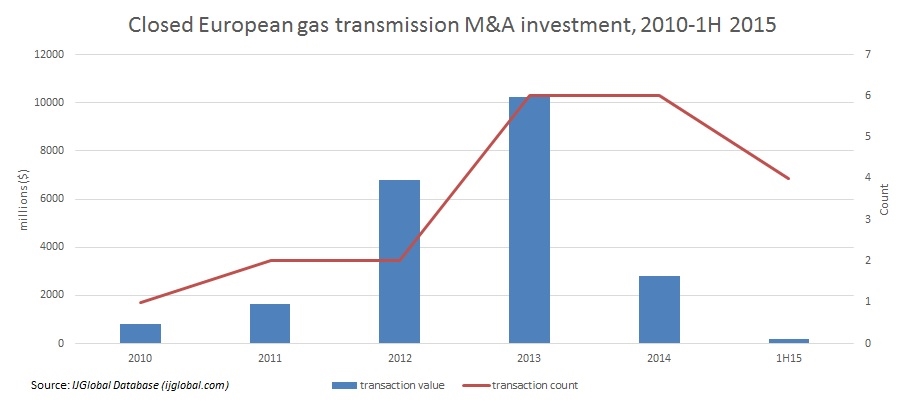

About $2.96 billion in sales of operational businesses or assets closed across nine deals between 1 January 2014 and 30 June 2015, according to IJGlobal data. Utilities were the sellers in seven of those transactions.

Deal flow during that period increased over the 18 prior months, though volumes fell sharply. Between 1 July 2012 and 31 December 2013, €7.6 billion ($8.3 billion) of sales closed across three deals. E.ON’s divestment of German gas transmission company Open Grid Europe to a Macquarie-led consortium was the largest transaction – €3.2 billion.

The trend towards smaller deals seems likely to continue. Morgan Stanley Infrastructure Partners, for instance, has agreed to sell Madrileña Red de Gas to a consortium of EDF Invest, Gingko Tree Investment, and Dutch pension fund manager PGGM for a reported €1.25 billion. And existing investors in grid assets have begun augmenting their shareholdings.

Factors

Until this recent divestment wave, utilities built and owned distribution networks, lines and grids that deliver gas from upstream sources to end users. These networks were part of vertically integrated businesses.

But in July 2009, the European Union (EU) enacted unbundling rules that forced utilities to ring-fence their transmission businesses as standalone companies. Divestments began in late 2010, and gained traction in 2011 and 2012, when five deals closed.

Falling thermal power prices also contributed to utilities’ need to unload distribution assets. Thermal power prices fell from $83 per short ton in November 2010 to about $42 per short ton in July 2015.

“Pressure on utility balance sheets is driving these sales,” explains Joanna Fic, a structured finance analyst at Moody’s Investors Service in London. “Larger utilities have been selling regulated businesses to release capital and deleverage their balance sheets.”

“Utilities need to protect their ratings,” adds Philip Roberts, EMEA head of energy and natural resources at Mitsubishi UFJ Financial Group in London. “This has led them to divest assets and focus on specific areas under their portfolio. Some have chosen to stay with upstream, others are focusing on generation.”

The buyers

Utilities have found a deep pool of would-be buyers – investors seeking modest but stable returns from contracted infrastructure assets.

“Transmission and distribution are typically offering 6-7%,” Hall notes. “Institutional investors, for example, are looking for exactly that type of asset.”

Private equity firms and banks are also competing for these assets. But despite the competition, several sales didn’t originate in auctions, Fic says. Many transactions have been conducted privately.

European distribution assets may be more popular than regional offshore wind and road assets, which investors have also chased in recent years.

“Part of the attraction of distribution assets is that they are essential infrastructure,” says Alessandro La Scalia, a senior analyst at Moody’s in London. Adds Fic: “Their desirability is mainly about the predictability of cashflows, their future visibility. Investing in a regulated gas distribution asset infrastructure is not the same as, say, toll road infrastructure where you have an exposure to traffic volumes which tend to be difficult to forecast.”

Western Europe’s ongoing tensions with Russia have enhanced the preciousness, and thus the desirability, of distribution assets in EU countries.

“International gas transit assets – such as NET4GAS – which typically operate based on contracts, could be more exposed to geopolitical risk,” Fic says. German utility RWE sold NET4GAS, a Czech gas transmission operator, to Allianz and Borealis Infrastructure for €2 billion in 2013.

Amid the backdrop of commodity and political instability, valuations on domestic assets in the EU have risen.

“In France in 2013 TIGF was acquired by Snam, GIC, and EDF for €2.4 billion, a valuation of 10x Ebitda,” La Scalia says of the French gas transmission operator. “The consortium sold a 10% stake to Crédit Agricole two years later, in January 2015, for 12x Ebitda, without any particular change in the fundamentals.”

The next wave

Given slumped commodity prices, sellers are understandably cautious about the timing of sales.

“Sellers will be trying to make sure that there’s no embarrassment for them later,” says David Baker, an energy partner at White & Case in London.

But agreements of sales haven’t stopped since gas prices began falling in July 2014.

In March 2015, as global natural gas prices approached a three-year nadir of $2.48 per million British thermal units (btu), Fluxys and Enagás agreed to buy Swedegas from an EQT Infrastructure fund. The Fluxys-Enagás duo is expected to pay €500-600 million.

Most upcoming sales will involve existing investors boosting their stakes – effectively edging aside utilities’ co-ownership.

A consortium of funds managed by Macquarie Infrastructure and Real Assets (MIRA), for example, said in February 2015 that it plans to acquire a further 15% interest in RWE Grid Holding, the largest natural gas distribution network in the Czech Republic. That would increase MIRA’s stake to 49.96%.

Two months later, Paris-based Antin Infrastructure Partners said that it will buy BP’s 36.22% stake in UK offshore gas transmission business Central Area Transmission System (CATS). Upon close of the transaction, Antin will own 99% of CATS.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.