H1 2015 League Tables Analysis: Europe attracts highest DFI lending

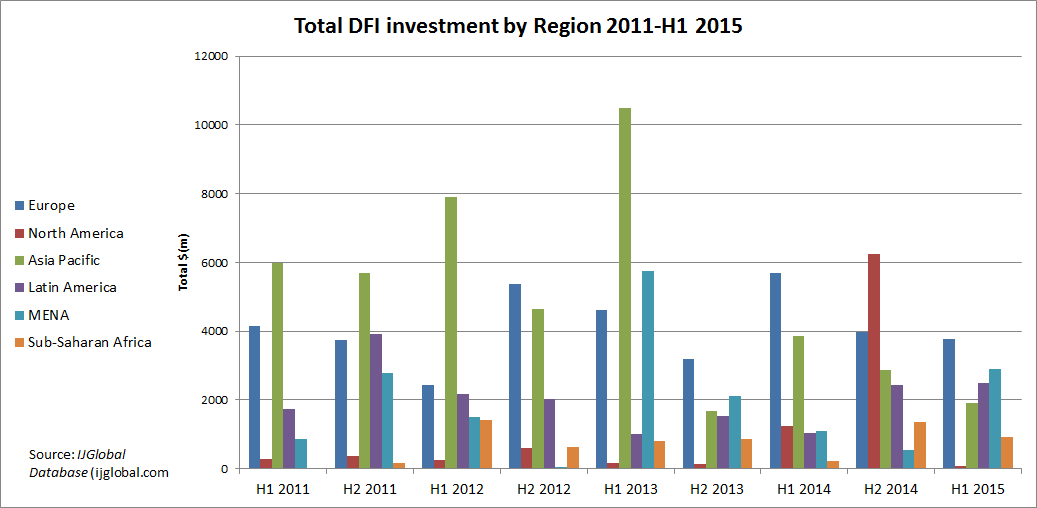

Total development finance lending into global project finance deals contracted in the first half of 2015 to a value of just over $12 billion, according to the IJGlobal H1 2015 League Tables. This was the second lowest half-year level of investment since the start of 2011, with only H2 2013 seeing a more modest total value (just under $9.5 billion).

Europe received the highest value of investment from development finance institutions of any region during the last half-year period ($3.76 billion), and has seen the most consistent level of lending in recent years.

Significant DFI investment into the Asia Pacific region during the early part of this decade, with a high of over $10 billion in H1 2013, has not been replicated in recent years. The MENA region saw a bump in lending this half, although that was almost entirely thanks to the roughly $2 billion invested by JBIC in the second stage of the PetroRabigh petrochemicals development in Saudi Arabia.

The consistent levels of DFI investment in Europe over recent years may seem counterintuitive. The traditional role of development banks has been to lend in circumstances where risk levels are prohibitive to commercial banks, which would suggest greater activity in emerging markets. Indeed, North America has seen very low levels of DFI investment in recent years, with the exception of H1 2014, though this figure was inflated by tickets of more than $2.5 billion a piece from JBIC on Freeport LNG Train 1 and Cameron LNG projects.

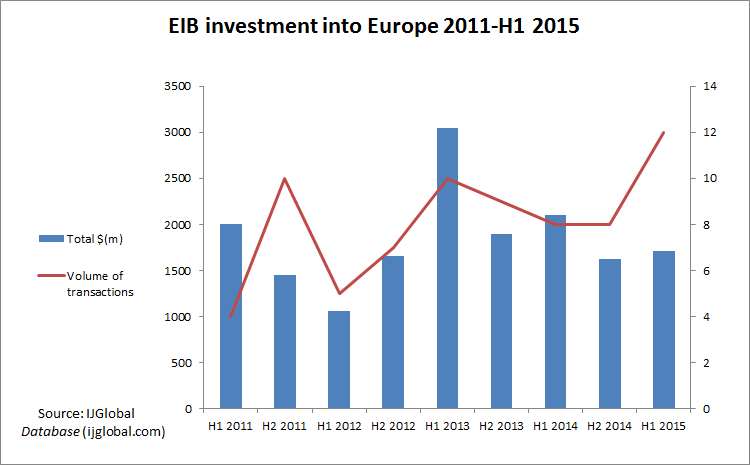

The European Investment Bank has been the most active DFI lender in the European market in recent years, lending more than $1 billion in each half-period since the beginning of 2011. While EIB lending during the last half ($1.71 billion) did not match the total value of investment seen in H1 2013 ($3.05 billion), the number of transactions peaked at 12. It also lent almost $500 million more in the period than KfW, which was the second largest DFI lender in Europe.

The projects in which the EIB participated during H1 2015 were not, in large part, located in challenging geographies. In fact nine of the deals were in the UK, with one loan each in Germany, Finland and Macedonia. Its largest loan (of roughly $660 million) went to the Thameslink Rolling Stock refinancing.

It’s continued lending volumes seem surprising, given the high bank liquidity levels in the European market, and the dearth of lending opportunities for commercial lenders. It is no surprise that its eagerness to lend in developed European markets is often viewed dimly by project-starved major banks.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.