Data Analysis: European upstream M&A investment increases

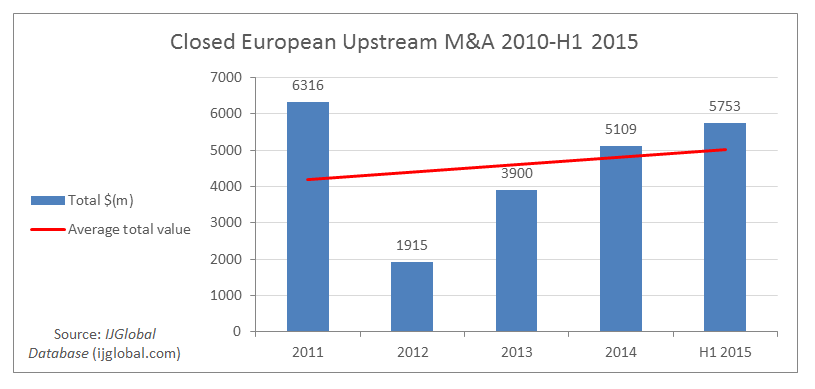

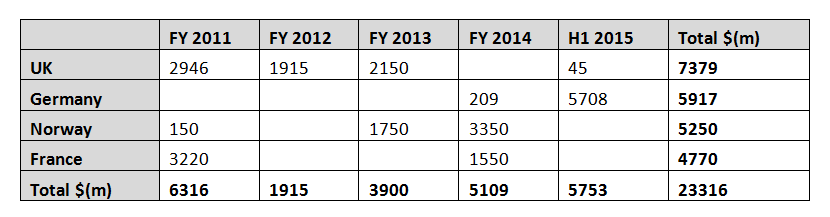

Closed European upstream M&A investment is up significantly from 2014. More than $5.7 billion of such deals has closed this year through 30 June 2015, up from about $5.1 billion in all of 2014, according to IJGlobal data.

The first half of 2015 has also already topped the average annual European upstream M&A investment volume from 2011 through 2014 – $4.31 billion. Most of the deals that have closed this year were agreed before the fall in oil and gas prices, which began in July 2014.

Germany and Norway have hosted multiple large acquisitions since 2014, including the two largest deals to sign prior to the fall in commodity prices – acquisitions by Det norske and LetterOne. Both Det norske’s $2.1 billion acquisition of Marathon Oil Norge and Wintershall’s $1.25 billion acquisition of partial stakes in five of Statoil’s North Sea oil and gas field and pipeline assets closed in Q4 2014.

Norway closed $3.35 billion in upstream M&A deals in 2014, up from $1.75 billion in 2013. No deals have closed in Norway in 2015 – yet. In Q2 2015 Hungarian firm MOL announced a planned acquisition of Ithaca Energy’s non-core Norwegian exploration assets for $60 million. It is expected to close this quarter.

Germany has similarly had one deal that bumped its closed M&A investment volumes – the Russian investment firm LetterOne’s acquisition of RWE Dea, which was announced in March 2014 but closed in Q1 2015, with a total value of more than $5.7 billion.

No M&A transactions have closed in the UK in 2014 and 2015 thus far. But the UK has a massive deal in the works – Royal Dutch Shell’s planned acquisition of BG Group, valuing the company at £47 billion. The deal was announced in April 2015, but reportedly won’t close before Q2 2016.

Upstream M&A activity is unlikely to see much further growth in the near-term. Owners are focused on holding on to assets until commodity prices improve, explained Steven Bryan, a partner at Hogan Lovells in London.

“There is a degree of weathering the storm at the moment, with lenders to these companies being reasonably patient to date granting covenant waivers or extensions, or in some cases restructuring the debt,” he said. “This has meant that the companies have been able to avoid distressed sales.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.