Data Analysis: GCC builds fewer new MWs

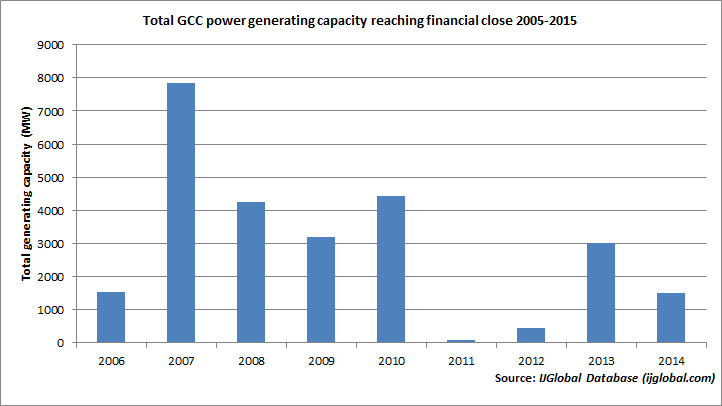

The demand for new power generating capacity in the Gulf Cooperation Council (GCC) is waning. The region - comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE - saw 1,500MW of power generating capacity close in 2014, down from a nine-year high of 7,835MW in 2007, according to IJGlobal data.

2015 may see a rebound in new capacity, but major new power projects remain rare.

Before a barren 2011 and 2012, investors, developers and advisers could rely on at least three major projects in the annual GCC pipeline.

But today, market opportunities have declined. In 2014, for instance, only one major power project reached financial close - the Mirfa independent water and power project (IWPP), which will add 1,500MW to Abu Dhabi’s total capacity when construction is completed.

Weaker-than-expected regional economic growth is one reason for the slowdown in development, with power demand growing slower than had been projected this decade. Also, the two active grantors from the last decade - Abu Dhabi Water and Electricity Authority and Saudi Electric Company (SEC) - have both reduced the scope of their ambitions. The former now has spare capacity, while the latter is increasingly dubious of the benefits of privately developed power plants.

Earlier this year, SEC dropped plans for private investment in the new Duba gas-fired and solar power plant, with its new chief executive thought to be unconvinced of the benefits of independent power production (IPP) programmes.

Both countries are also looking outside of conventional power projects to meet longer term demand. A nuclear programme is underway in Abu Dhabi, while Saudi Arabia is still in planning stages, although neither scheme is likely to add to the regional power capacity in the next few years.

No GCC power projects closed in the first half of 2015, but there should be around 3,000MW of new projects reaching financial close before the end of the year. Much of this new capacity, however, will be provided by a single project - the 2,400MW Facility D in Qatar.

Market participants now say that the near-term pipeline will resemble 2015, with one big project closing annually.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.