Data Analysis: Chile's improving PPP pipeline

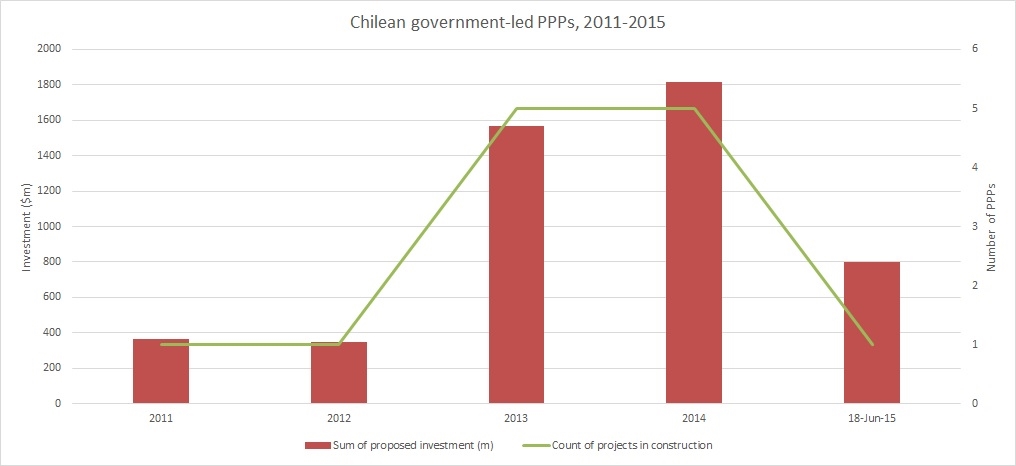

Chile's Ministry of Public Works (MOP) has slowly increased the number of PPPs awarded to the private sector over the last four-plus years, according to the IJGlobal database.

The MOP awarded just two major PPPs in 2011 and 2012 – the $360 million Autopista Concepción Cabrero and $340 million Ruta 5 Norte La Serena-Vallenar urban highways.

But in 2014, the MOP awarded five large-scale PPPs, with a total expected investment of more than $1.8 billion. These projects include the $210 million new Bio Bio bridge, the $1 billion first stretch of the Américo Vespucio Oriente highway, the $80 million Los Libertadores border complex, and two hospitals worth a combined $520 million.

Chile was a PPP trailblazer in Latin America, particularly in transportation infrastructure. Yet in recent years, the pace of procurement has lagged behind Andean neighbours Peru and Colombia despite the meagre percentage of Chilean roads paved – less than a quarter, according to President Michelle Bachelet.

Source: IJGlobal Database (ijglobal.com)

Chile, however, is on course to see an uptick in closed PPP investment in the near- to medium-term, according to IJGlobal data, which will in turn create opportunity for international lenders.

When Bachelet re-assumed the presidency in March 2014, she discontinued a hospital concession programme that her predecessor had launched. But Bachelet said that she would support the use of the concession model in other sectors. Bachelet's government subsequently announced a transport-heavy concession agenda worth $11 billion between 2014 and 2018.

Direct bid processes have also contributed to the increased pipeline of projects. In April 2013, OHL won the concession to develop the $210 million second terminal at the Chilean port of Valparaíso. Additionally, a number of non-public tenders have been launched for desalination facilities, including one issued by state-owned Codelco.

Chile's liquid local bank market - led by Corpbanca, Banco de Chile and BancoEstado - has managed to absorb most domestic infrastructure debt requirements recently. But with deal flow expected to pick up, and with Chile tendering larger-scale PPPs, international banks will also play a role in future financings.

Foreign banks are assembling for the roughly $600 million dual-tranche financing for the expansion of the Santiago airport, which MOP awarded in February 2015. The financing is expected to feature US dollar and Chilean peso facilities.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.